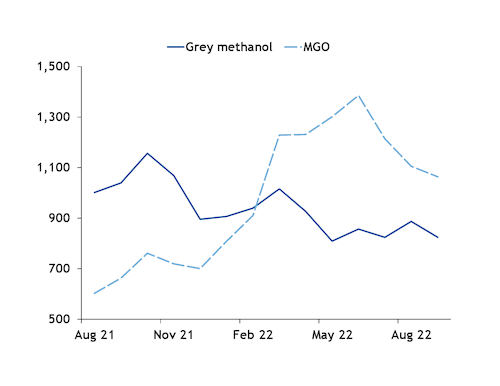

The US Gulf coast's methanol discount to 0.1pc sulphur marine gasoil (MGO) could drive up interest in newbuild vessels with methanol-burning capabilities, as these ships could provide a natural hedge against volatile MGO prices.

Methanol prices in the US Gulf coast dipped to a $529/t discount to MGO in July. The discount has since narrowed to $239/t in September but remains wide enough to draw interest, considering gasoil's price volatility.

EU sanctions will ban all imports of Russian diesel from February next year, requiring Europe to replace 750,000 b/d of supply, or roughly a tenth of consumption. Buyers will have little bargaining power as their options will be heavily restricted and stocks are very low. In August, middle distillate inventories, predominantly diesel, fell to the lowest in 14 years in the EU 15 and Norway, Euroilstock data show. US distillate demand so far this year has been down by 2pc from the same period in 2021, according to US Energy Information Administration data. But US distillate inventories have fallen by 20pc as exports climbed by 26pc. The EU ban could drive US distillate exports even higher, which could prop up US Gulf distillate prices, including MGO, a type of distillate fuel.

By comparison, prices of methanol have remained relatively steady with normal production and steady to soft demand. Methanol producers such as Methanex also tend to have long-term agreements to procure methanol feedstocks at fixed prices or based on a formula linked to methanol prices above a certain level, shielding them from natural-gas price volatility.

In addition to methanol likely remaining at a discount to MGO, methanol also has an advantage in lower emissions from combustion.

Vessels are required to burn marine fuels with 0.1pc sulphur maximum content in designated emission control areas (ECAs), and methanol does not contain sulphur. Designated ECAs include US territorial waters, Canadian territorial waters, the North Sea, the Baltic Sea, the English Channel, the Yangtze River, the Xi Jiang River, the coastal area around the China's Hainan province and South Korea's ports of Incheon, Pyeongtaek-Dangjin, Yeosu-Gwangyang, Busan and Ulsan.

Conventional grey methanol, which is made from natural gas or coal, emits 6.6pc less CO2 emissions from combustion than very low-sulphur fuel oil (VLSFO). But marine fuel sales and consumption are not yet subject to CO2 restrictions, fees or taxes. The EU has two proposals. One proposal would add 100pc of marine emissions to the European emissions trading system (ETS) starting in 2024. An earlier proposal called for adding 20pc of emissions to the ETS from 2023, gradually increasing to 100pc from 2026.

The International Maritime Organization (IMO) is requiring that vessels reduce their CO2 emissions by 40pc by 2030. The IMO is currently only concerned with emissions from combustion, but it is mulling whether to regulate full lifecycle emissions. For ship owners considering investing in methanol-burning vessels, bio-methanol and e-methanol could provide high lifecycle CO2 reductions than grey methanol, once they become financially feasible.