The cost of using the 85mn t/yr Queensland coal export port of Dalrymple Bay Coal Terminal (DBCT) has increased by 29pc for the 2022-23 financial year ending on 30 June compared with 2020-21 under new lighter regulatory framework.

Dalrymple Bay Infrastructure (DBI), which operates DBCT, has agreed with coal mining customers to raise the terminal infrastructure charge by 23pc to A$3.02/t ($1.89/t) for 2021-22 and to A$3.18/t for 2022-23, up from A$2.46/t in 2020-21. The new tariffs replace a mandated tariff model overseen by the Queensland Competition Authority that had been in place for at least five years.

DBI has increased coal handling costs for some of the more marginal coal producers in Queensland's central Bowen basin, which have also been subject to increased royalty costs since the Queensland government raised them on 1 July.

Under the new 2022-23 tariffs, DBCT's coal handling charges are higher than the RG Tanna terminals at Gladstone and those at Adani-operated Abbot Point terminal near the town of Bowen, but much lower than the Wiggins Island Coal Export Terminal (Wicet) at Gladstone. DBCT's proximity to mines in the central Bowen basin still makes it the cheaper option for many mining firms once rail costs are included.

DBI will increase its tariffs beyond 2022-23 in line with inflation and has maintained its take-or-pay structure where users must pay the tariff even if they do not send coal through the port, including under force majeure. The cost will be borne across the other coal exporters, if a consumer defaults on its payments.

DBI expects to receive A$61mn in back payments related to the tariff increases from 1 July 2021. Metallurgical coal made up 81pc of its exports last year, while thermal coal made up the rest, according to DBI.

DBCT shipped just 54.2mn t of coal in 2021, down from 66.7mn t in 2019, despite a strong price environment particularly in the second half of this year. Shipments fell even further this year, with January-September exports down by 5pc as compared with the year-earlier period, following a particularly weak July that DBI said was a result of India replacing Australian coal with Russian.

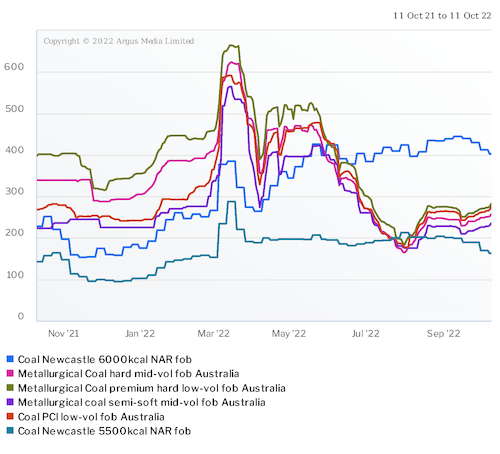

Argus last assessed the premium hard low-volatile coking coal price at $282.40/t fob Australia on 10 October, up from a recent high of $184/t on 2 August, but down from $525.25/t on 19 May.

The other major Queensland coal port of Hay Point, which is adjacent to DBCT, is owned and operated by coking coal joint venture BHP Mitsubishi Alliance and reserved for its use.