Thermal and metallurgical coal exports from Australia's 102mn t/yr Gladstone port rebounded in October from a more than five-year-low in September on record shipments to Taiwan and firmer buying by Indian consumers.

Gladstone shipped 5.25mn t in October, up from 4.33mn t of coal in September but below 5.29mn t in October 2021, according to Gladstone Ports (GPC) data. Year-to-date shipments are still 9pc behind January-October shipments in 2021 and the monthly average is 15pc below the pre-Covid-19 pandemic levels set in 2019.

Coal mining regions that supply Gladstone had above average rainfall in October, including some localised flooding that closed roads and caused access issues for some mining firms. The wet season officially starts in Queensland in November. But the third La Nina weather pattern in a row bought unseasonal heavy rainfall in October that fell on already saturated ground.

Taiwan took 1.13mn t of coal from Gladstone in October, according to the GPC data. This is a record volume and almost double the high for the past decade of 589,817t set in October 2016. Gladstone has shipped on average 390,000 t/month to Taiwan during January-October, up from 310,000 t/month in 2021 and 180,000 t/month in 2019.

Gladstone coal shipments to India returned above 1mn t for the first month since June, although January-October exports are still 37pc behind where they were in the same period of 2021.

The Netherlands, Belgium and Turkey all took shipments from Gladstone in October, as did South Africa. This was the first shipment of Gladstone coal to Belgium since 2016, as trade flows continue to adjust to Russia's invasion of Ukraine and associated trade embargoes.

There were 30 vessels queued off the port on 7 November, down from 31 on 6 October but above the average of around 20. The rising threat of industrial action at mine sites and infrastructure across Australia could disrupt loadings at Gladstone, although none has yet been notified that directly relates to the port.

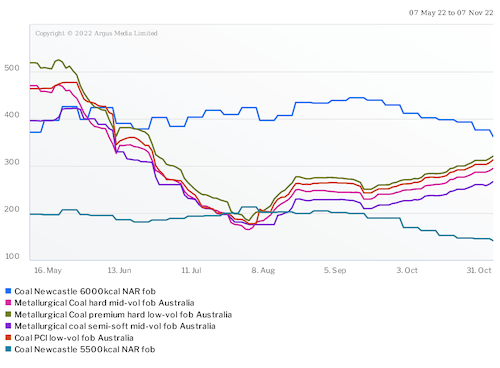

Argus last assessed high-grade 6,000 kcal/kg NAR thermal coal at $362.25/t fob Newcastle on 4 November, down from $411.87/t on 30 September and from a peak of $444.59/t fob on 9 September. It assessed the premium hard low-volatile metallurgical coal price at $320.80/t fob Australia on 4 November, up from $273.25/t on 5 October and from $203/t on 5 August but down from $664/t on 15 March.

| Gladstone coal shipments | (mn t) | |||||

| Japan | India | South Korea | Taiwan | Vietnam | Total | |

| Oct '22 | 1.37 | 1.08 | 1.02 | 1.13 | 0.07 | 5.25 |

| Sep '22 | 1.76 | 0.70 | 0.70 | 0.48 | 0.12 | 4.33 |

| Oct '21 | 1.43 | 2.17 | 0.62 | 0.21 | 0.16 | 5.29 |

| YTD 2022 | 16.83 | 10.28 | 11.79 | 3.92 | 2.84 | 51.49 |

| YTD 2021 | 17.80 | 16.31 | 11.46 | 3.30 | 2.04 | 57.49 |

| Source: GPC | ||||||

| Total includes all destinations not just those listed | ||||||