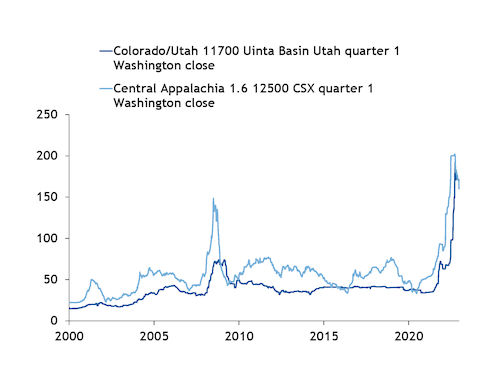

Prices for some Utah coals have recently flirted with exceeding Central Appalachian coal prices for the first time in at least two years, reflecting very tight supply conditions for western bituminous coal and mixed signals from export markets.

Central Appalachian coal has typically been assessed higher than Utah coal but that changed last week as well as during the week ended on 18 November. Western bituminous Utah coal was last higher than the CSX 12,500 Btu/lb coal between 13 March-10 July 2020. That trend also recurred from 30 October 2015 to 24 July 2016.

Last week, Argus assessed first-quarter shipments of 11,700 Btu/lb Utah coal at $171/short ton as the contract neared its end as the prompt quarter coal. In contrast, Central Appalachian coal fell by $11/st to $160/st over the same period. And during the week ended on 18 November, the prompt quarter Utah coal was also assessed higher than the CSX coal.

This autumn, CSX coal prices fell for four consecutive weeks starting in late October as natural gas prices declined. Prices went unchanged for nearly a month, only slightly increasing in mid-December for the second quarter of 2023 through the calendar year 2024.

But last week, CSX coal prices fell by $11/st across the curve, making its largest decline in months. During the same period, the weekly average of prompt two-month 6,000 kcal/kg coal deliveries to northwest Europe fell below $200/metric tonne for the first time in six weeks.

This sharp decrease in CSX-origin coal prices is likely related to the falling metallurgical prices as well as export demand. Metallurgical coal being sold into thermal markets may be increasing supply and affecting prices.

In the west, export demand for Utah coal has supported higher prices. Coal prices in Asia remain elevated; Argus assessed the fob Newcastle, Australia, NAR 6,000 kcal/kg coal — a reference for western bituminous export prices — at $404.45/t on 23 December, up from $175.50/t on 1 January.

Elevated prices for western bituminous coal in the US may linger into 2023 amid scarce supply. Production out of Colorado and Utah mines slowed down last quarter compared to the same period a year earlier, according to US Mine Safety and Health Administration (MSHA) estimates. And an overall domestic supply of western bituminous coal has tightened even further because of a fire at American Consolidated Natural Resources' Lila Canyon mine in Utah.

The mine, which typically supplies about a quarter of coal to Utah power plants, has been burning since 20 September. The coal producer needs to remotely pump in seals to close off that section of the mine, and once the area is sealed, inspectors will go underground to assess the area, MSHA said.