Australia's New South Wales (NSW) state government has vowed not to increase coal royalties before June 2024, although it is pushing ahead with plans to require coal producers to reserve 7-10pc of their output for domestic use at a price cap of A$125/t ($87/t).

NSW deputy premier Paul Toole told coal producers on 8 February that his government will not follow neighbouring state Queensland in increasing coal royalty rates while the domestic reservation and price cap remain in place. These policies are due to run until June 2024 but a state election on 25 March this year could render these promises valueless.

The Liberal NSW government has been in power since March 2011 and the opposition Labor party is currently ahead in the polls. The Labor party is in power in Queensland and it imposed upper tiers of royalty payments from 1 July 2022 that included a top level of 40pc on coal valued over A$300/t.

NSW mining firms oppose the introduction of the coal reservation policy and price cap, with the government promise not to increase royalties designed to appease the sector in an election year. NSW royalties are 8.2pc of the value of open-cut mined coal, 7.2pc of underground coal and 6.2pc of deep underground coal.

NSW royalties are expected to contribute 5.7pc of state government revenues in the 2022-23 fiscal year to 30 June, according to the half-year budget review released on 7 June. Most of the A$6bn in revenue from mining that the government expects to receive in 2022-23 comes from coal, with record-high prices providing an important windfall at a time when Australian governments are battling inflation and handing out cost of living payments.

Coal is a politically sensitive topic in NSW with its economic contribution and job creation weighing against community concerns about climate change, environmental degradation and the elevated profits that energy firms are reporting.

NSW produces around 200mn t/yr of saleable coal and exports around 175mn t/yr. But three years of above average rainfall has seen production and exports fall, with the key port of Newcastle shipping 136mn t of coal in 2022 compared with 156.33mn t in 2021 and a peak of 165.14mn t in 2019.

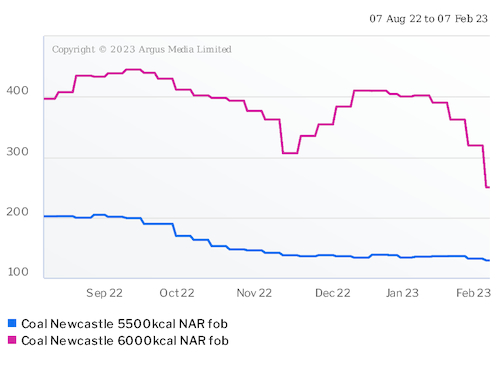

Argus last assessed high-grade 6,000 kcal/kg NAR thermal coal at $249.79/t fob Newcastle on 3 February, down from $402.02/t on 6 January and from a peak of $444.59/t on 9 September. It assessed lower grade 5,500 kcal/kg NAR coal at $128.93/t fob Newcastle on 3 February, down from $134.71/t on 6 January and from $137.53/t on 25 November.