Northeast Asian countries are facing higher than usual LNG inventories post-winter, resulting in lower-than-expected demand for summer stockpiling despite softer spot LNG prices.

Inventory levels at most northeast Asian utilities have been maintained at above-average levels. Most utilities bought aggressively from the spot market in advance for this year's winter as they experienced tight LNG supplies in the 2021-22 winter season. Utilities in the region expressed confidence that they would have sufficient LNG inventories for the winter even if the weather was colder than expected. But the relatively normal winter weather resulted in weaker power and LNG demand, so most exited winter with high inventories.

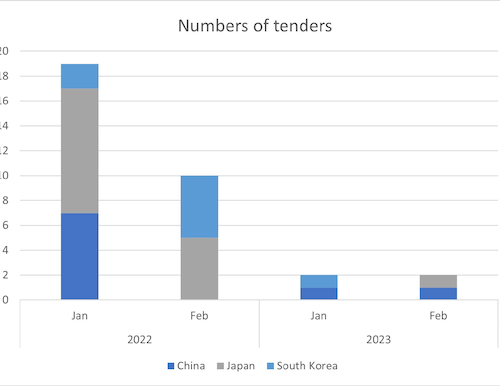

Prompt demand from Japan, China and South Korea continued to be weak, with the number of tenders issued over January-February this year being less than half the number during the same period in 2022.

Japan's major importer Jera has been selling cargoes either through cargo swaps or bilaterally. Other Japanese utilities have turned to cargo swaps to manage high inventories.

Japan's main utilities held 2.4mn t of LNG stocks as of 26 February, which was higher by 42pc from 1.69mn t at the end of February 2022 and higher by 24pc against 1.93mn t, the average of end-February stocks during 2018-2022.

South Koreans state-owned importer Kogas' aggressive purchases of spot cargoes in the run-up to the 2022-2023 winter season may have resulted in tanktop situations, market participants said. Chinese national oil companies were mainly in the market for portfolio optimisations.

Key importer Chinese state-owned CNOOC recently issued a tender to purchase at least 12 cargoes for delivery over June 2023-June 2024. The tender was awarded at 1-9¢/mn Btu and 10-15¢/mn Btu premium to a northeast Asian spot LNG price for summer and winter cargoes, respectively. CNOOC may have bought another eight cargoes bilaterally after the conclusion of the tender.

Outside of northeast Asia, state-controlled Singapore LNG (SLNG) has sold about three cargoes this week, including one for March delivery and possibly two for April deliveries. The firm may have been compelled to sell its cargoes as it could be facing high inventories, similar to what utilities in northeast Asia are facing. In a somewhat unprecedented move, the firm purchased spot cargoes at relatively high prices at least twice last year, likely as a buffer against potential LNG supply shortfalls. This need was made more urgent by the fact that the country will be receiving less pipeline gas from Indonesia's south Sumatra.

Most northeast Asian utilities have held back on summer restocking plans despite the dip in spot prices. But spot prices may have recently bottomed out as of late last week, hence making the possibility of restocking even more unlikely.

The front half month ANEA price, the Argus assessment for spot LNG delivered to northeast Asia, was assessed at $14.23/mn Btu on 3 March, half that of from two months earlier at $29.92/mn Btu, and higher by 3¢/mn Btu from 24 February.

But utilities in the region may still have to restock for the upcoming summer season, with market participants suggesting that buying interest may gain momentum for May deliveries onwards.