Much lower spot LNG prices have so far likely spurred Argentina energy firm Enarsa to award more LNG cargoes in tenders earlier in the year compared with 2022, with the country securing supply much more in advance.

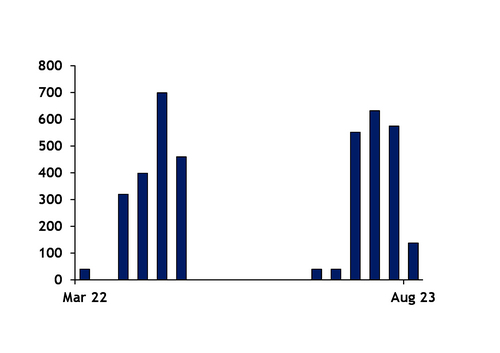

Enarsa has bought 1.97mn t of LNG across 44 LNG cargoes for delivery across March-August so far this year compared with about 850,000t in 18 cargoes for delivery in March-July 2022 by late April last year, Enarsa data show. The firm has bought 32 partial cargoes for delivery to its Escobar import terminal — about a 70pc share of all purchased supply — and 12 standard-sized cargoes for Bahia Blanca compared with 11 cargoes for Escobar by this time last year and seven for Bahia Blanca. Argentina has already bought slightly more LNG for this year than all of the supply secured for last year, when Enarsa continued to tender for cargoes through to June.

Lower pipeline imports from Bolivia in the first quarter of this year may have further pushed Argentina to seek spot LNG. The country received a about 404,300t of pipeline gas in January-March, down from 579,530t a year earlier, customs data show.

Argentina is set to receive a floating storage and regasification unit (FSRU) to operate at Bahia Blanca, which could arrive before the end of this month, given that deliveries to Bahia Blanca are slated to start in May. The 138,000m³ Excelsior FSRU is declaring arrival at Bahia Blanca on 1 May.

Domestic gas production has grown in recent months, and plans to ramp up debottlenecking at the country's Vaca Muerta field, as well as commissioning the new President Nestor Kirchner pipeline in June, may have prompted Argentina to concentrate LNG deliveries earlier in its austral winter. The Argentinian government forecasts upstream output to be at 144mn m³/d this year compared with 132mn m³/d in 2022 and 124mn m³/d in 2021, data from the energy secretariat show. Based on these projections, the average output this year could exceed the 2022 monthly peak of 141mn m³/d in August, which was the highest since 144mn m³/d in August 2019.

LNG prices holding at much lower levels in recent months than in 2022 may have prompted Enarsa to secure more cargoes sooner in the year, with the company paying about 45pc less for its LNG by the same time last year. The company has paid an average of $18.36/mn Btu for its LNG compared with $33.95/mn Btu for its supply bought by this time last year. And all cargoes were awarded on fixed-price basis, when last year about 56pc of cargoes were awarded at a fixed-price with other supply linked to the US' Henry Hub or Brent crude oil.