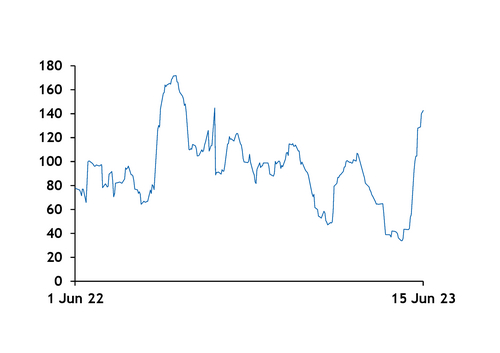

EDITORIAL: Gas prices resumed an upward trend in recent weeks, after declining for months

A combination of supply squeezes has spurred European gas price volatility to its highest in nearly eight months, just as firms were starting to anticipate a late-summer supply surplus.

The Argus TTF front-month volatility index — an annualised historic measure of price variation over time — has climbed to its highest since September last year, when Gazprom announced the indefinite closure of the Nord Stream pipeline. And higher volatility has filtered through to longer-dated contracts.

The rally began in early June, after an arbitrage between European and Asian prices for a couple of weeks remained wide enough to incentivise Atlantic basin LNG cargoes to take the longer route to Asia. The open arbitrage spurred firms to unwind hedges at the TTF and send cargoes to Asia instead, at a time when maintenance at the US' Sabine Pass tightened the LNG market. European prices had already climbed high enough to close the arbitrage before Shell announced a lengthy shutdown at its Nyhamna processing plant in Norway, which is set to stay off line for 24 days longer than previously expected, removing roughly 1.2bn m³ of supply, Argus estimates. The plant's restart date remains uncertain, further fuelling forward price volatility.

The TTF front-month market changed hands at close to €50/MWh at its peak on 15 June, before shedding some value later in the week. Traders put the price hike down to rumours of the confirmed closure of the Groningen field on 1 October, although the Dutch government said in January that all four conditions set out for the field's closure had been met and has opposed calls for the field to stay on line for longer. A final decision is expected later this month, the government told Argus.

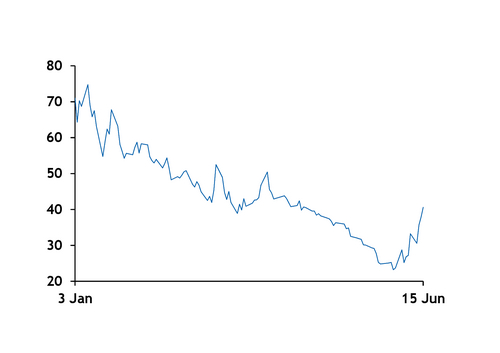

A ‘gamma squeeze'?

The price movements were undoubtedly triggered by shifts in market fundamentals, but their scale suggests they may have been driven by activity in the options market, market participants say — a so-called "gamma squeeze".

Traders betting that gas prices will fall will often buy call options as a stop-loss measure for their short positions on the underlying commodity. But when demand for these call options is high, the counterparties writing the options may move to buy more of the underlying commodity to cover their exposure to the potential exercise of these options. But by buying the underlying commodity, they lift its price, potentially high enough for the strike prices in some of these call options to be reached, which in turn leads to firms exercising the options and forcing counterparts to secure more volumes. And this process is amplified if the fundamentals of the market tighten at the same time.

Firms had mostly taken short positions in the market until late May, traders say, as the downward trend in prices was perceived to be lasting longer because gas demand remained less responsive to lower prices than in the past. This may be the result of a combination of structural factors, such as the build-up in renewable generation capacity and efficiency measures in residential demand. But it may also signal a shift in consumer behaviour, probably a legacy of last year's energy crisis. The extent of this shift is still difficult to gauge.