The potential for Europe's industrial gas use to rebound this winter is capped by an expected economic slowdown, lower energy costs abroad and some potential structural demand destruction.

EU statistics unit Eurostat estimated annual inflation in the euro area at 5.3pc in August, flat to July when it had been the lowest for any month since February last year. But despite lower inflation, EU GDP held unchanged in the second quarter from the first quarter. And the European Central Bank recently raised its key interest rates again to their highest since 2001, while Eurostat's economic sentiment indicator fell in August to its lowest since November 2020. These mixed indicators point towards a persistently weak and unpredictable outlook for industrial activity.

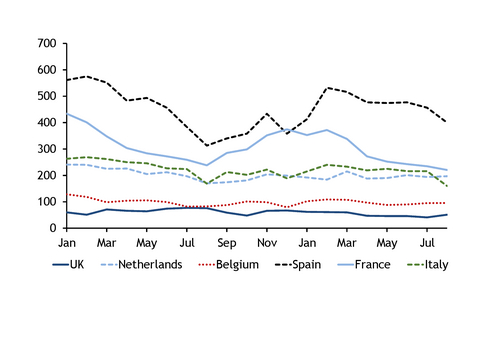

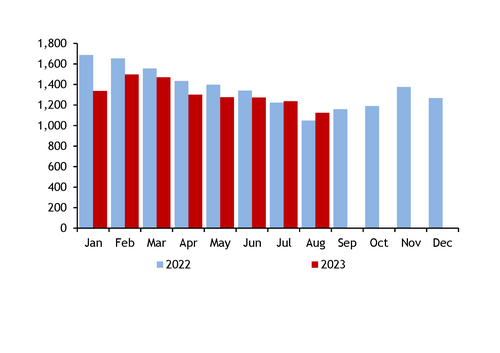

Industrial gas demand across the UK, France, Belgium, the Netherlands, Spain and Italy increased by roughly 7pc in August compared with a year earlier to a combined 1.12 TWh/d. But despite rising on the year, it was still the lowest for any month since August 2022 as industrial demand this year has declined each month since its peak in February. It was also still far below consumption of 1.58 TWh/d in August 2021. Counting only months after the start of the Russia-Ukraine war, combined industrial consumption across these countries averaged 1.28 TWh/d in March-August, slightly down from 1.33 TWh/d a year earlier. Germany is excluded as there is no breakdown between power and industrial demand.

Unstable outlook across various sectors

Production has been low across some key gas-intensive sectors this summer, despite a drop in gas and power prices, hinting at limited upside for this winter.

The production of ammonia, the key component in fertilisers and one of the most gas-intensive industries, has only partly recovered in recent months. Argus estimated European plant utilisation rates at 50-60pc of capacity in August, barely higher than a year earlier. Europe has an installed ammonia capacity of roughly 19.6mn t/yr, while plants tend to burn about 36mn Btu of gas to produce a tonne of ammonia. A 55pc utilisation rate implies gas consumption of roughly 9.5bn m³/yr, against 17.3bn m³/yr if sites operate at full capacity.

But the gas demand loss may be steeper than this estimation suggests, as some producers have opted to more fully use their most efficient plants and export some of this production to other parts of Europe, instead of producing ammonia locally in less efficient plants.

Imports of ammonia have been cheaper than domestic EU production for most of this year so far. This prompted UK producer CF Fertilisers to close its Billingham ammonia plant, with the facility to use imported ammonia instead.

Higher import prices in recent weeks following outages in key exporting countries could spur higher EU ammonia production, but continued gas price volatility has made producers wary of lifting output.

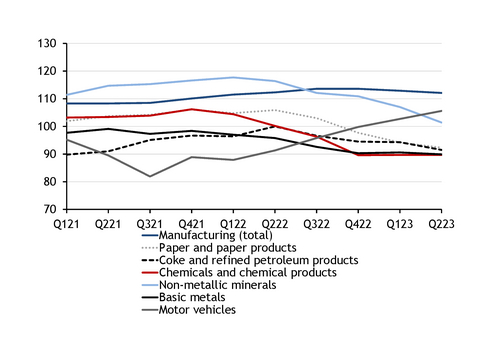

Output in the chemicals sector as a whole has continued lower so far this year (see manufacturing graph). Production in Germany, by far the bloc's largest producer, excluding pharmaceuticals, was down by 16.5pc on the year in January-June, national chemical industry association VCI said. VCI expects production to decline by 8pc this year as a whole.

Weak downstream demand and lower production costs abroad have weighed on output in the steel industry, too. EU steel production was down by 10.3pc in January-July from a year earlier and even further below historical averages.

Continued strong imports, along with an economic slowdown discouraging investment in construction, which accounts for the majority of steel demand, suggest limited scope for a near-term recovery in EU steel demand. And some blast furnaces are to be closed in Germany and Austria for relining, following on from a recent plant idling in Hungary.

Meanwhile, the manufacture of refined petroleum products slipped in the second quarter to its lowest since the first quarter of 2021 and was particularly low in Germany and France.

The only uptick has been in motor vehicles manufacturing, in which second-quarter output was at its highest since the third quarter of 2019 as chip shortages have eased.

Demand reduction vs destruction

The potential for industrial demand to rebound depends on the extent to which gas demand has been cut permanently or only temporarily.

"Belief in Germany as a location [for industry] is disappearing," VCI's president said, as "a cluster risk from bad location factors robs us of confidence". Nearly a third of German industrial companies now are planning or enacting the relocation of capacities abroad or the reduction of their production domestically — double that of the previous year.

Energy efficiency gains and the roll-out of renewables also will result in some permanent demand loss, with many EU financial support grants contingent on firms improving energy efficiency. The installation of LPG systems that enable industrial users to switch between gas and LPG accelerated significantly last year, which could make industrial gas demand more price-responsive this winter, although logistical bottlenecks would limit any significant increase in LPG demand.