UK biomass-fired power generation yesterday evening rose to its highest for any settlement period since December 2022, as units with contracts for difference (CfDs) started up for the first time in several months and the long-delayed 299MW MGT Teesside plant began operating under its CfD.

UK biomass-fired output rose to 2.37GW yesterday evening, the highest since December 2022 — when the day-ahead hourly price spiked to over £1,500/MWh and brought forward most generation capacity.

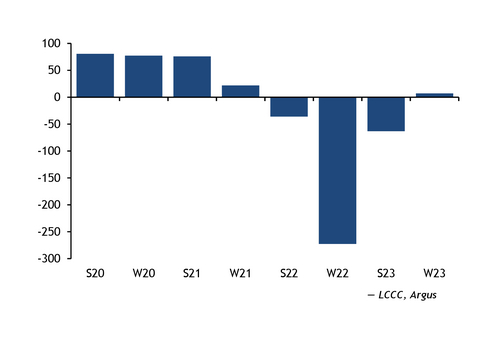

Biomass-fired units with CfDs have started up again as the base-load market reference price for the scheme will be around £128.75/MWh for winter 2023-24, Argus estimates, down from £207.07/MWh for summer 2023. Units had been paying back to the scheme when generating over the summer, making them unprofitable as delivery prices fell well below the reference price — with the N2EX day-ahead market delivering at £83.65/MWh over the season.

The 660MW unit 1 at UK utility Drax's biomass-fired plant started up on Sunday for the first time since July and generated throughout Monday, reaching capacity in the evening before reducing its output again today, BMRS data show. The unit has a strike price of £132.47/MWh for April 2023-March 2024, meaning that it will receive around £3.70/MWh from its CfD when it generates this winter.

The 405MW Lynemouth biomass-fired plant also started to ramp up yesterday afternoon for the first time since May, with generation as high as 130MW this morning from the 133MW unit 1 at the plant. The other two units at Lynemouth are expected to be available from 10-11 October, Remit notifications published today show, pushed back by one week from previous schedules.

Utility MGT Teesside's biomass-fired plant has generated consistently since Saturday, BMRS data show, with output as high as 230MW today — following its long-delayed commissioning runs restarting last month. The unit took up its CfD on 30 September, according to scheme operator LCCC, over five years after its initial target start date.

Lynemouth has a CfD strike price of £139.08/MWh for 2023-24 and will receive £10.30/MWh from the CfD scheme this winter, while the Teesside plant has a higher strike price of £165.97/MWh.

High wind squeezes biomass generation again

High wind output largely pushed biomass out of the mix again today and could continue to do so over much of the next week.

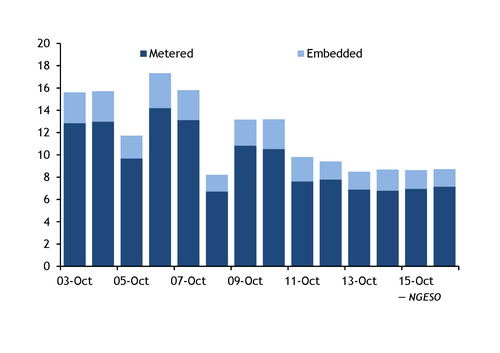

The N2EX day ahead cleared at £63.10/MWh for 3 October delivery and at £63.15/MWh for 4 October delivery — down from £75.27-94.01/MWh for the first two days of the month. Wind output is forecast to remain high for much of the next week, with combined metered and embedded generation expected at 13.6GW over 4-10 October, system operator National Grid ESO data show.

Continued low demand could make prompt power prices even more volatile with changes in wind forecasts and output this month — temperatures are expected to be above seasonal norms until at least 11 October, and significantly above this weekend.

But high UK renewable energy guarantees of origin (Rego) prices will support biomass-fired output, allowing plants to dispatch at lower power prices. Biomass Regos for compliance period 22 — April 2023-March 2024 generation — were assessed at £16.10/MWh on 28 September, up from £10/MWh just over a month earlier.

Biomass-fired availability will also increase next month once the 660MW unit 4 at Drax returns from an extended outage on 29 October. It is the second unit to undergo a major overhaul at the plant this year, with unit 2 off line in April-July. Drax's units 2-4 operate under the renewable obligation (RO) scheme rather than with CfDs, so have continued to generate over the last year.