Spanish LNG demand has been more volatile so far this winter. Although Spain has increased its reliance on LNG over the past two years, more renewable generation has weighed on the country's power-sector gas demand.

Muted demand from Spain, largely led by weak gas-fired generation over the past two months, has left the country with unusually high LNG inventories. The country's stocks were at 2.8mn m³ of LNG early today, well above the three-year average of 2.2mn m³ for the date. Stocks breached 3mn m³ on 21 November for the first time since 20 October 2022.

And sendout could remain muted were weather-adjusted regasification to remain in line with so far this winter.

Overnight lows in Madrid were forecast on Friday at 2.9°C on 24 November-8 December. Assuming weather-adjusted regasification were in line with the norm in October 2011-October 2021, sendout would be expected to average 486 GWh/d over the period. This would be below actual regasification earlier this winter of 570 GWh/d on 1 October-23 November. Were weather-adjusted sendout in line with the norm on 1 November 2021-23 November 2023, regasification would be expected to climb to 771 GWh/d over the period.

But assuming that weather-adjusted sendout were in line with the norm on 1 October-23 November, sendout would be expected to average 685 GWh/d on 24 November-8 December, as strong renewable generation has limited the call on Spanish regasification facilities over the last two months.

Power-sector gas demand has averaged 227 GWh/d on 1 October-23 November, the lowest for the period since 2018, apart from 2020, as high renewable generation has limited the call on gas-fired assets. Wind generation of 10GW on 1-23 November is on track to set a new record for the month, while hydro-generation of 4.8GW for the period would be the highest for the whole month since November 2020.

LNG holds larger share of Spanish gas mix

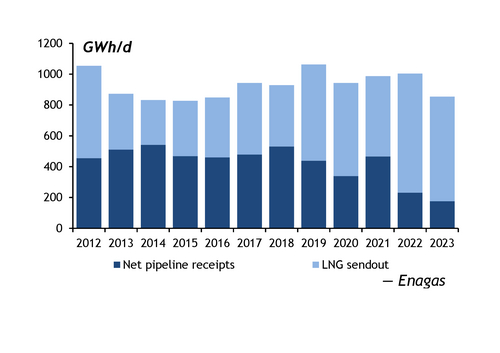

Spanish sendout has risen over the past two years, since flows from Algeria halted along the GME pipeline.

Regasification in 2022 was the highest for any year since 2010 as aggregate pipeline imports stepped down to their lowest since at least 2012 (see pipeline vs sendout graph).

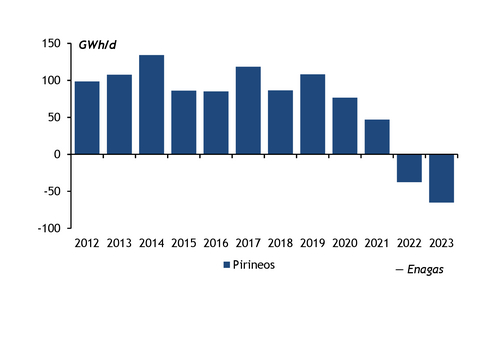

The increase in sendout was partly to accommodate a broader reorganisation of European pipeline flows from west to east. Net flows at the Pirineos interconnection point pointed towards France in 2022 for the first time on record (see Pirineos graph).

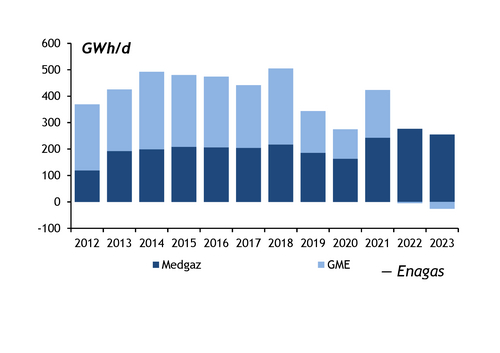

But sendout was also boosted by a slowdown in Algerian receipts. Net pipeline imports of 277 GWh/d in 2022 were the second-lowest of any year in the previous decade, just 2 GWh/d below 2020, when the Covid-19 pandemic led to much reduced consumption and led offtakers of Algerian supply to seek to renegotiate offtake contracts with Sonatrach (see Algerian graph). Algerian pipeline imports are on track to fall to their lowest in at least the past decade at 255 GWh/d on 1 January-23 November.