If a global LPG supply shortfall does emerge alternatives including renewable LPG and DME could plug any gap, writes Peter Wilton

Global LPG supply is on course to continue expanding over the next 10 years in line with growing natural gas production, despite the push to move away from fossil fuels and develop renewable alternatives, delegates heard at LPG Week in Rome over 13-17 November. But a supply shortfall could start to emerge after this that will need to plugged by alternatives such as renewable LPG and DME.

Global supplies are forecast to exceed 400mn t by 2030, US-based consultancy NGLStrategy's Emma Lamb said at the event. This is around 17pc higher than the 344mn t in 2022 and a projection of 397mn t by 2030, according to Argus. The majority of this additional supply will come from natural gas processing rather than from refining, given the expected increase in natural gas demand and rationalisation of the refining sector, Lamb said. The US will continue to spearhead this natural gas — and in turn natural gas liquids (NGLs) — expansion until 2026-27 before it plateaus, at which point the Middle East will drive growth in line with new gas processing projects in Iran, Saudi Arabia and Qatar, she said.

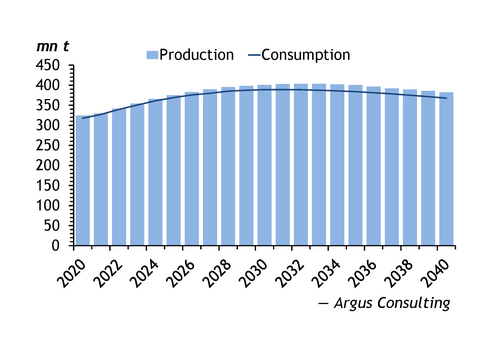

The 2030 to 2050 period is more uncertain in terms of the global LPG supply outlook. When estimating global supplies over the longer term, the intensifying legislation to limit global temperature increases to 1.7 °C by 2050 must be considered, New York-listed S&P Global's vice-president of LPG and NGL insights, Darry Rogers, told attendees. This includes a radical shift in the industry under the firm's "green rules" scenario, in which global LPG supply peaks at 359mn t in 2024 before falling to 241mn t by 2050 as the energy transition accelerates. Under a base case scenario, supply peaks at nearly 400mn t by 2030 then falls to 375mn t by 2050.

In the event of a base case outlook for demand but a green rules scenario for supply, it would leave a 134mn t shortfall, according to Rogers. Some of this demand from the petrochemical sector can be replaced with crude or naphtha, and some will be decarbonised, but this would still leave a 95mn t gap in supply for "hard-to-decarbonise demand, namely residential and commercial", he said. The conclusion is that the chasm would need to be filled with renewable liquid gases by 2050.

Just how large a gap that is can be drawn from Argus' estimates for bioLPG and renewable DME production of just over 250,000t in 2022, sharply higher than the 75,000t in 2016 but still a fraction of the almost 100mn t/yr potentially needed. Yet Argus forecasts this output to rise tenfold to 2.5mn t/yr by 2030, and if such sharp growth can continue over the next 20 years then the target could be feasible, not least as new production routes and feedstock sources are likely to emerge.

Global LPG demand stood at around 342mn t in 2022, up by 3.5pc on the year, supported by growing petrochemical sector use in China and as a replacement for natural gas in refineries, Argus' vice-president of LPG, David Appleton, told delegates. But a mild 2022-23 winter in many of the large heating markets tempered growth, and high LPG prices driven by buoyant underlying crude also resulted in waning demand in more price-sensitive economies, Appleton said. Moving into this year, the wider energy complex is still stuck in a high-price environment that will continue to bolster LPG production given it is a by-product, he said.

Continental drift

Europe is the exception to this trend. Norwegian LPG output from gas processing is falling steeply and in turn exports, which were previously around 600,000 t/month, are now closer to half that. This is partly because of natural field decline but more significantly because of the rejection of NGLs in the natural gas stream as European gas prices surged. European refinery output is also waning because of rationalisation, while less LPG is available as refiners consume more LPG as a fuel in place of gas. But imports from the US have more than offset these losses, rising to 500,000 t/month from 100,000-500,000 t/month in previous years.