Brazilian gasoline importers are bracing for a continued decline in foreign cargoes next year amid persistent headwinds for local demand and increased competition from domestic players.

Domestic gasoline demand in 2024 is poised to continue a decline that started in August after state-controlled Petrobras increased wholesale gasoline prices, while hydrous ethanol availability increased significantly with the start of the sugarcane crop season in April. In Brazil E27 gasoline and hydrous ethanol compete at the pump to supply the country's flex-fuel car fleet.

Rising gasoline prices and lowerhydrous ethanol pricesaccelerated gasoline demand destruction in the fourth quarter, with retail sales falling 4.5pc in annual comparison in October to 3.7bn l (775,740 b/d), according to oil regulator ANP. Data for November is yet to be released.

The shrinking domestic gasoline market is helping Brazil become more self-sufficient as state-controlled Petrobras increased refinerythroughputs to a nine-year high in the third quarter of 95.8pc of nameplate capacity. Brazil became a net exporter of gasoline in November for the first time since 2021, as Petrobras increased shipments to the US Atlantic Coast amid a saturated domestic market.

Differentials at a record low

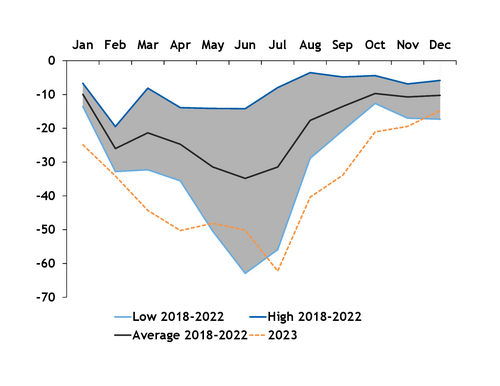

Unfavorable economics for gasoline imports occurred amid record discounts to Nymex futures for foreign gasoline delivered to Brazil. Cargoes of imported gasoline on a dap basis reached their lowest monthly average between July and November 2023 (See chart) pressured by a global supply glut for gasoline components and naphtha.

Europe stood out this year as Brazil's largest supplier from January to November with almost 50pc of all imports. The continent eclipsed the US as Brazil's traditional supplier as European refineries grapple with the fallout of a rapid switch from Russian heavy sour crude oil to lighter feedstock in the aftermath of Russia's invasion of Ukraine. The fast crude slate change aggravated a historic mismatch in Europe's oil products supply and demand characterized by a diesel structural short and the need to find outlets for its surplus gasoline and naphtha.

Brazil is poised to remain a destination of choice for European refineries as some flows into African countries — a large taker of European light and low-octane components — should slowdown. Bans in countries like Belgium and the Netherlands for exports of low-quality gasoline are going to be a barrier for imports from Africa.

The push to E30

Brazilian domestic refiners like Petrobras and independent refineries are also watching closely government pledges to increase the maximum content of anhydrous ethanol from 27.5pc to 30pc.

The biofuel blend increase, on top of cutting Brazil's demand for gasoline by 940mn l, would damage the economics of domestic cracked, high-octane gasoline while improving arbitrage opportunities for importers of paraffinic, low octane finished gasoline and blending components.

Parrafinic naphthas — a byproduct of natural gas processing — respond especially well to ethanol's oxygenating effect, which allows for significant octane gains when the ethanol content in gasoline is raised. Meanwhile, Brazil's refiners feel they would be at a disadvantage if they direct their large supply of high-value cracked gasoline components from the countries complex refineries to compete with importers of cheaper, low-octane product.

ANP currently sets the research octane number (ron) and motor octane number (mon) range of E27 at 82/93 in 2020.

By Amance Boutin