High Swiss hydropower stocks at the end of 2023 and substantial snowfall already this year may limit Swiss imports this quarter, while solid snowpack could support exports in the second quarter.

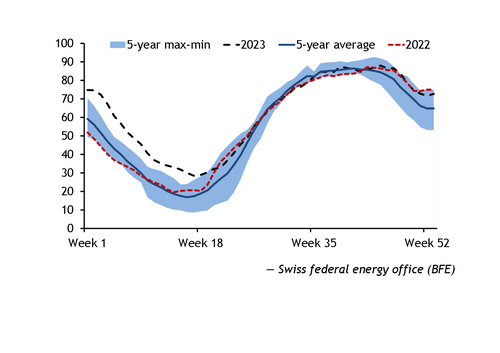

Total hydropower generation in the final quarter of 2023 averaged 2.3GW, up by 700MW on the year, supported by higher reservoir generation. It nearly doubled on the year to average 1.3GW, supporting the final-quarter increase. And hydro stocks fell below 2022 levels in late November last year.

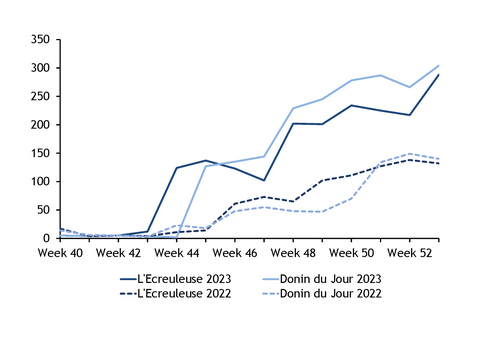

But stocks ended week 52 at more than 13 percentage points above the long-term average — the highest in seven months — filled to 72.2pc of capacity. Snowpack at the L'Ecreuleuse measuring station in canton Valais was 288cm on 4 January — up from 132cm in 2022 — and already above the maximum recorded in the first quarter of 2023. A total of 143cm of snow fell over the past seven days, and strong snowpack levels in canton Valais — home to about half of Swiss hydropower reserves — may boost Swiss hydropower generation in the second quarter once snowmelt begins, which could support exports.

Switzerland was a net exporter of nearly 300MW in the fourth quarter of last year, the first time for that quarter in four years, up from a net import position of more than 1.1GW in 2022. But high hydropower stocks may limit French imports this quarter despite French nuclear availability being forecast to increase by an average of 10.6GW on the quarter, and French hydropower stocks ended last year at high capacity.

Switzerland imported an average of 2.8GW — or about 67pc of total imports — from France in December. In the same period, Swiss demand fell by an average of 500MW on the year, with higher-than-average temperatures weighing on consumption. And minimum temperatures between 4 January and mid-February are forecast at about 1°C above seasonal norms, which will probably limit demand.

Italian hydropower stocks were above the long-term average in week 51, but their accelerating rate of decline has reduced their surplus, while snowpack remains below seasonal norms. This may limit Italian hydropower generation in the first and second quarters, probably lifting demand for Swiss imports.

The Jao cross-border capacity (CBC) auction for January between Switzerland and Italy settled at an €11.17/MWh implied Italian premium, in line with the average Italian premium for the front-month power product, which stood at €10.77/MWh from 18-20 December during the auction.

High snow levels in canton Valais also could weigh on net imports from France in the second quarter, with nuclear unavailability set to rise by 4.1GW, which will tighten supply and weigh on exports. But this may be offset by lower French electricity demand.

And several gigawatts of German dispatchable capacity will go off line at the end of this quarter as the replacement power plant availability act expires and the lignite reserve reactivation scheme ends, tightening German electricity supply and supporting Swiss exports northwards. The Jao CBC January auction for Switzerland and Germany cleared at a €10.91/MWh implied Swiss premium, while the average Swiss power contract premium for the front month stood at €11.04/MWh from 15-19 December during the auction window.

Swiss solar generation has risen every year since 2020, accounting for nearly 13pc of total generation in the second quarter of last year, up from 9.2pc over the equivalent period in 2022. The Swiss federal council amended the energy act last June, to accelerate approval procedures for renewable and grid expansion projects, while the latest solar photovoltaic tender was oversubscribed. This could boost solar additions and support exports in the second quarter of this year.