Low capacity bookings and high variable costs weighed on the UK's gas exports in the fourth quarter of 2023 and could keep exports muted for the rest of the gas year.

UK NBP prompt prices held at historically wide discounts to continental markets for much of 2022 and again in spring last year. Reductions to Russian flows meant that the continent had to import at maximum capacity at other import points, including on the Belgium-UK Interconnector and Netherlands-UK BBL. The UK's large import capacity allowed it to cover its own needs while also importing LNG to be regasified and moved through the interconnectors. NBP discounts to the TTF were typically wide enough that they far exceeded the cost of exporting along the interconnectors, ensuring that the UK exported at close to maximum capacity in this period.

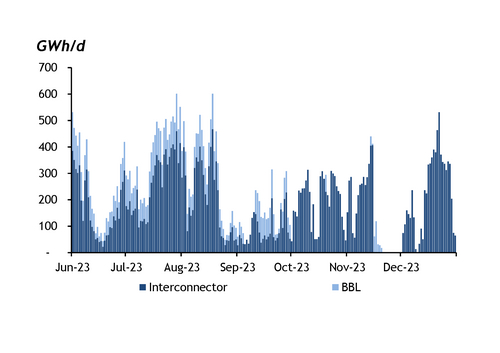

But from roughly the beginning of June last year, NBP-TTF everyday basis markets narrowed to the point that shippers' costs were much more comparable to the differential. Flows began to vary more day to day, rather than remaining at maximum almost all the time. Lower demand, higher inventories in storage and increased LNG import capacity on the continent meant that European countries no longer needed to keep imports at maximum capacity.

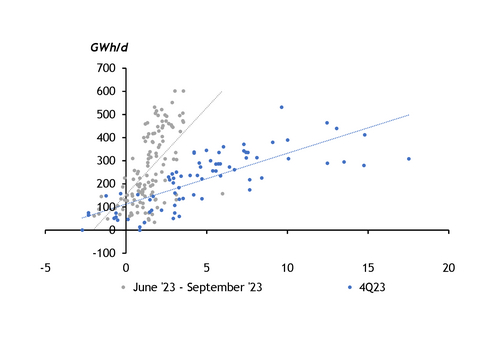

There was a relatively close linear relationship between the NBP-TTF everyday basis and flows in June-September. Small increases in the UK's discount could quickly push up exports to near maximum capacity, excluding the second half of November, when maintenance halted Interconnector flows (see flows vs differentials graph).

Shippers had booked more than 800 GWh/d of capacity to flow towards the continent for June-September. This meant that they could treat the cost of capacity as sunk, and take into account only variable costs to flow.

But firms reserved only 338 GWh/d on the Interconnector towards Belgium for the fourth quarter of 2023, and made no long-term bookings on the BBL towards the Netherlands. This put an effective ceiling on exports, which exceeded booked capacity only on the small number of days when cross-Channel differentials were wide enough to justify buying expensive day-ahead capacity.

On top of this, variable costs to flow increased sharply on 1 October, as commodity charges to exit the UK grid and flow on the two pipelines increased.

The commodity charge payable for exiting the UK grid increased to 1.56p/th on 1 October from 1.01p/th in the previous gas year.

And the operators of the Interconnector and BBL each changed their formula for calculating commodity charges from 1 October, increasing costs. Commodity charges averaged 0.84p/th on the Interconnector and 1p/th on the BBL in October-December, up from 0.34p/th and 0.77p/th, respectively, in June-September.

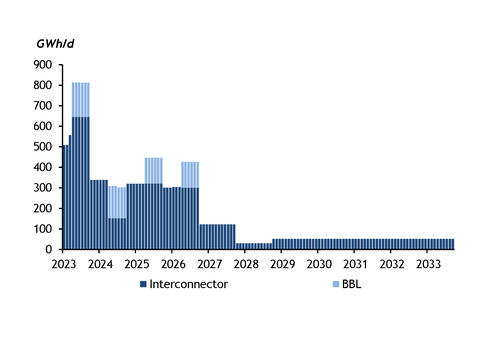

Cross-Channel flows could remain muted in the second half of winter. NBP contracts for delivery from February to September were assessed at small discounts to the TTF on Monday, too small to cover likely variable costs, which could remain in line with those in the fourth quarter of 2023 over the remainder of this gas year. And shippers have booked only 303-338 GWh/d of capacity towards the continent across the two pipelines for the first nine months of this year, while the narrow basis markets provide no incentive for further capacity uptake.

UK commodity charge drop on horizon

National Gas' commodity charge appears set to fall sharply from October, which could bring back some of the incentive for flows even with narrow basis markets.

Ofgem will set the commodity charge for the 2024-25 gas year in July. The charge has varied significantly in recent years because of mismatches between the period in which its level is fixed and the period in which revenue is collected, combined with high and volatile expenses for shrinkage gas.

Under the old methodology for calculating the charge, it would have been negative for the 2024-25 gas year. But Ofgem in November approved a modification to the gas code to prevent negative commodity charges, and National Gas has deferred recognition of £100mn of revenue by a year to reduce the volatility of the charge.

But the commodity charge could still fall by almost two-thirds to 0.37p/th, or to 0.47p/th if a modification to the calculation methodology currently being considered goes ahead.

At the same time, flows could continue to be limited, except at wide basis markets, by the low quantity of booked capacity. Booked capacity towards the continent holds roughly steady for the coming three years, with jumps in the summers of 2025 and 2026, before falling away (see booked capacity graph).