India was the largest importer of US-origin PVC in November 2023, as the subcontinent becomes more dependent on US supply to satisfy growing demand.

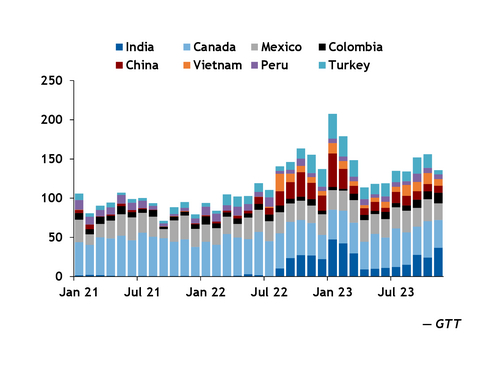

India imported a total of 36,830t from the US in November, according to recent data from Global Trade Tracker (GTT). This is the third time on record that India was the largest importer of US-origin PVC, with all three instances occurring since January 2023. This does not match total US-origin PVC exports to India of 47,383t in January 2023, a record high, or 42,329t in February 2023, but it does remain one of the highest totals on record. Prior to August 2022, India rarely imported more than 10,000t/month of PVC from the US.

US PVC producers began relying more on exports in the final quarter of 2023 as domestic demand reached its seasonal low point. US exporters are becoming increasingly dependent on India as a key outlet for PVC, as the country is one of the few in the world to show steady demand growth for the resin. This growth is mainly driven by local government incentives aimed at boosting agricultural and construction activity in India, with both sectors remaining heavily reliant on the use of PVC pipes for water transportation and irrigation.

Other key export destinations, like Europe and Canada, are currently wrestling against a combination of high interest rates and reduced consumer spending, which continues to dampen PVC demand into a series of construction applications. PVC markets in Latin America are also navigating broadly weaker economic performance, while East Asian markets remain increasingly flooded by Chinese PVC as the country brings on additional capacity while also dealing with an unstable domestic housing market.

Higher US PVC exports into India during the second half of 2023 were further supported by ongoing investigations on residual VCM (RVCM) content in PVC imports into India. The ongoing investigation is aimed at potentially limiting PVC imports into India with an RVCM content higher than 2ppm, commonly found in carbide-based PVC specifications. The carbide-based PVC production process, which uses feedstock acetylene instead of feedstock ethylene, remains China's largest PVC production route. These investigations have kept Indian buyers reluctant to source carbide-based PVC from China, with US exporters likely viewing this as an opportunity to export more PVC cargoes in order to replace carbide-based PVC supply.

Trouble afoot in the Red Sea

But there are concerns over the potential continuation of this trend in the short-term, mainly due to a combination of lower water levels in the Panama Canal and a security crisis along the Red Sea.

US exporters are heavily reliant on the Suez Canal and the Red Sea in order to export polymers to south Asia. Current attacks on vessels in the area are driving up freight costs from the US. These rising costs are becoming increasingly difficult to digest among Indian buyers, resulting in fewer US PVC shipments into India so far in January.

Recent US PVC shipments to the Gulf Cooperation Council (GCC) and south Asia were mainly diverted towards South Africa's Cape of Good Hope as a result of the attacks along the Red Sea, but this route sees higher freight costs and longer lead times, which could create further reluctance to purchase these cargoes from Indian buyers.