It remains unclear whether firms will still be able to ship gas directly to Germany from France at the Obergailbach interconnection point beyond the end of March.

France historically received Russian gas at Obergailbach that had transited Germany through the Megal pipeline. Physical reverse flows — to Germany from France — were made available only in October 2022, as Germany sought alternate supply options following the suspension of Russian flows to Europe through the Nord Stream and Yamal-Europe pipelines.

France odorises gas at the transmission system level rather than the distribution level, raising the sulphur content. In addition, "oxygen peaks" are on occasion recorded because of biomethane injections on the French side, grid operator GRT Gaz Deutschland has said.

German grid regulator Bnetza introduced regulation — called Volker — that allowed for these differences to be overcome. While there is no provision for a time limit to this regulation, the specifications on compensation claims for odorised gas are valid until 31 March, Bnetza previously told Argus.

GRT Gaz Deustchland has advocated for an extension, but the firm told Argus on Monday that it has yet to receive a response from Bnetza. Other options to continue exports without an extension to Volker are being explored, GRT Gaz Deutschland said. The German operator was unable to confirm whether exports at Obergailbach would continue beyond the end of March.

But the firm's French parent company and neighbouring grid operator GRT Gaz has expressed optimism at the likelihood of an extension to the agreement. "Until now we have reached deals on a rolling basis with our German neighbours and I think we will continue to do so," GRT Gaz's chief commercial operator Pierre Cotin said at a press conference in Paris on Tuesday.

Cotin cited issues with sulphur from odorisation and oxygen levels because of the injection of biomethane and LNG from certain sources, but said that "our German neighbours have seen that it is possible in an emergency [to accept odorised gas] but also in times of economic necessity".

A source told Argus that there are frequent renegotiations over French exports to Germany, and that these negotiations can often last until shortly before agreements are scheduled to expire. Other market participants involved in the French market told Argus that they were not worried about a potential end to French exports.

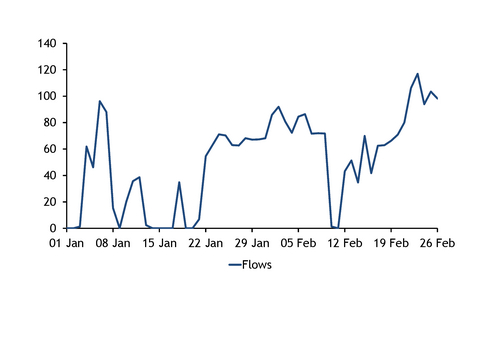

French exports to Germany at Obergailbach have been brisk in recent days, averaging 104 GWh/d on 22-26 February (see graph).