US utilities received slightly less Illinois basin coal last year than in 2022, despite lower electricity demand and competition from reduced natural gas prices.

Last year, 46 US power plants received 60.1mn short tons (54.5mn metric tonnes) of Illinois basin coal, according to an Argus analysis of US Energy Information Administration (EIA) data. Receipts were 3.8pc lower than in 2022, when 62.5mn st of Illinois basin coal arrived at 53 plants.

Intake at some other plants dropped sharply. Deliveries fell in part because milder weather helped curb electric power coal consumption, while several plants were retired, permanently removing some demand from the market.

AES' Petersburg plant in Indiana took 2.2mn st of Illinois basin coal last year, down by 1.9mn st or 47pc from 2022. AES retired its 415MW Unit 2 in June 2023. AES plans to convert the remaining two coal units at Petersburg to natural gas over the next few years.

Illinois basin coal shipments to East Kentucky Power Cooperative's Spurlock plant dropped by 19pc to 2mn st. And Seminole Electric Cooperative's power plant in Florida took only 2.1mn st, down by 18pc from 2022. The plant is retiring this year.

The decreases in deliveries were felt across the basin. Some producers sent coal for export, but lower US demand and power plant retirements tamped down some production.

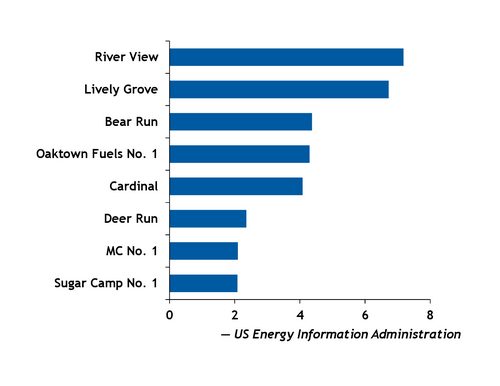

Alliance Resource Partners' River View mine in western Kentucky remained the top supplier to domestic utilities, even though shipments fell by 4.1pc compared with 2022. Utilities received a combined 8.7mn st of coal from River View, down by 376,874st in 2022.

Deliveries from Alliance's Gibson South mine in Indiana fell by 39pc to 2.2mn st last year.

Deliveries from Peabody Energy's Bear Run mine in Indiana declined more significantly — by 1.9mn st — to 6.1mn st in 2023.

Deliveries ticked up at some of the nation's largest consumers last year, in part because of improved rail service. Railroad performance plummeted in 2022, delaying coal shipments at a time when generators were favoring coal consumption to offset higher-priced natural gas. But market conditions were the reverse last year, with improved rail service and significantly lower natural gas prices. Better railroad performance in 2023 also resulted in utilities taking scheduled shipments as well as some coal that was delayed in 2022. Many US power plants ended 2023 with above-average stockpiles.

Among the power plants that received more Illinois basin coal was Kentucky Utilities' Ghent station, which took 2.6mn st of Illinois basin coal in 2023, up by 53pc from the prior year, EIA data show. Shipments to Southern Company subsidiary Georgia Power's Bowen plant rose by 31pc to 3.2mn st from 2.5mn st in 2022.

Deliveries from some Illinois basin mines also rose. Shipments from Foresight Energy's MC No 1 mine, also known as Sugar Camp, in Illinois, to utility-scale US power plants rose to 5.6mn st, up by 11pc compared with 2022. Hallador Energy's Oaktown Fuels No. 1 mine increased shipments by 7.9pc to 6.5mn st.

Deliveries from Prairie State Generating Co.'s Lively Grove mine in Illinois and Alliance's Cardinal mine rose by 2.7pc and 7pc, respectively to 6.7mn st and 4.5mn st.

US aluminum producer Alcoa's Liberty mine, which had been idle since 2019, shipped 684,505st to domestic utilities last year.

| Largest US utility recipients of Illinois basin coal | mn st | |

| Plant name | 2023 | Change vs 2022 |

| Prairie State | 6.7 | 2.7% |

| Gibson | 4.5 | 4.2% |

| Mill Creek | 3.6 | 7.4% |

| Bowen | 3.2 | 31% |

| Clifty Creek | 3.0 | 9.5% |

| Trimble County | 2.6 | -5.4% |

| Ghent | 2.6 | 53% |

| Cayuga | 2.4 | 18% |

| Warrick | 2.3 | -7.6% |

| Petersburg | 2.2 | -47% |

| — US Energy Information Administration | ||