UK LNG sendout last week dipped to its lowest level since October 2023, likely on muted demand and steady pipeline imports, and could remain subdued later this month.

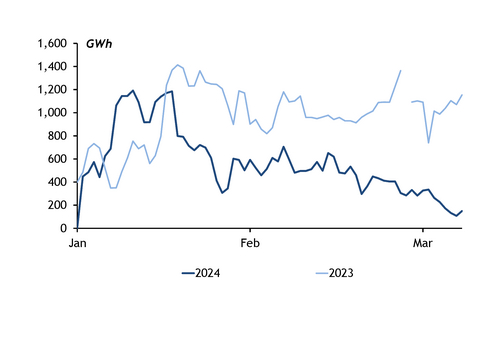

UK sendout dropped to 108GWh on 9 March from 332GWh on 1 March, and was the lowest of any day since 1 October last year. Sendout recovered slightly over the weekend, rising to 150GWh on 10 March, but was still well below 2023 levels (see graph).

Gas consumption on 9 March was 177mn m³, significantly down on the 278mn m³ consumed on the same day a year earlier.

Low sendout is likely a reflection of this muted demand, coupled with continuous imports along the country's two interconnector pipelines since 1 March — the highest number of consecutive importing days since 2022. The UK NBP's balance-of-March contract has held at a premium to the corresponding Dutch TTF contract since 4 March, which has offered some incentive for UK-bound flows.

Wind power generation has also been high, averaging 13.6GW on 9 March — over double the 6.6GW average daily generation during the first week of March.

Sendout to remain muted

Regasification could remain muted over the coming week, as milder temperatures and stronger wind generation could weigh on gas demand, and only a few LNG carriers have declared for arrival at UK terminals.

Minimum temperatures in London were forecast today to hold around 3.7°C above the seasonal average until 21 March, which could curtail heating demand. And the UK's wind generation over 13-21 March was set to average 10.6GW — above the average of 8.8GW for March since 2020, National Grid data show. This could reduce the call on some gas-fired generation.

And although stocks have held at 69-77pc since the start of March, recent LNG imports have been slow. The UK has imported five cargoes so far this month, compared to 13 full loadings at this point in March 2023. There are five vessels declaring for arrival at UK terminals, according to shiptracking data from Kpler.

The inter-basin arbitrage for US loadings was open for most of February, when some March cargoes would have been secured, which is likely to have pulled some cargoes away from Europe and towards Asia. This could continue to weigh on imports for the rest of this month, considering that the UK has little supply tied to long-term des contracts.