Norwegian upstream independent BlueNord expects output from Denmark's largest oil and gas field Tyra to decline sharply after 2025, and is pushing for further measures to counteract the decline in Danish hydrocarbon production.

BlueNord expects output from Tyra to decline swiftly after peaking in 2025, according to an investor update published by the firm last week. Production at Tyra restarted in late March after the field had been off line since 2019 for refurbishment, shutting in several other fields tied into the Tyra processing and export hub. The field's operator, TotalEnergies, on Monday announced that a compressor issue will delay ramp-up to full production by at least two months. TotalEnergies expects technical capacity of 8.1mn m³/d of gas to be reached in the fourth quarter, having previously expected to reach this in August.

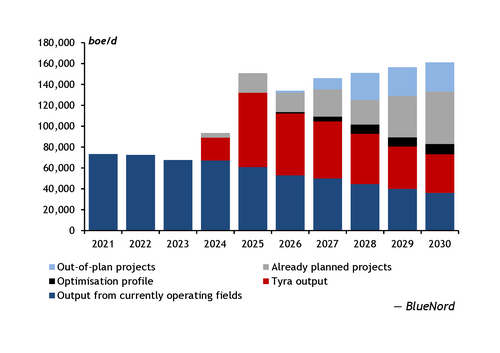

BlueNord expects its share in Tyra hydrocarbon production to average 26,200 b/d of oil equivalent (boe/d) in 2025, according to the investor update. And as BlueNord has a 36.8pc share in the Danish Underground Consortium (DUC) which owns the Tyra hub, total Tyra output could be about 72,000 boe/d in 2025. BlueNord expects output to step down by almost 20pc to about 59,200 boe/d in 2026, followed by a further decline, with expected output falling to 37,000 boe/d in 2030 (see graph). BlueNord has announced plans for an "optimisation profile" for DUC production, which only will only slightly mitigate this decline.

Total Danish production expected to decline

Production from other fields not connected to the Tyra complex is similarly in long-term decline, which BlueNord intends to offset with new projects.

Output from Danish fields excluding Tyra has fallen by roughly 7pc/yr since 2020, according to figures from BlueNord. BlueNord production reflects total Danish output as the DUC controls most Danish gas production. Production from the Syd Arne, Siri, Nini and Cecilie fields, which are not owned by the DUC, was about 378,300 m³/d of gas in 2023, about 11pc of total Danish gas production that year (see data and download). The DUC accounted for 95pc of total Danish gas production in 2018, the last full year when Tyra was on line.

But the DUC is planning to "maximise economic recovery" from it assets, with several projects such as infill wells and new developments planned. The DUC intends to drill at least seven infill wells in 2024-26, out of which up to four would be oil wells at the Halfdan field and one gas near-field exploration well.

And a total of 21 new wells will be drilled in developments at Halfdan North, Adda and Valdemar Bo South, according to BlueNord. Furthermore, three new developments could start production in 2026-29 from unmanned platforms tied back to DUC infrastructure, BlueNord said. But this would depend on the final investment decisions of the individual projects, which the firm expects to take in 2023-27. And the longer-term plans also contains some currently unsanctioned developments.

Danish gas output is still expected to peak in 2025, even including planned projects, as the maturation of existing fields may not easily be offset by the drilling of new wells.

But BlueNord also lists so-called "out-of plan projects", which may boost production later this decade. Last week's investor update shows substantially more out-of-plan projects than the annual report published in April, with the potential to lift total production above 2025 levels later this decade. That said, BlueNord still gave its expected minimum total plateau production in 2030 as 40,000 boe/d, down from the peak in 2025 at 55,000 boe/d.