SAF mandates will drive demand for the fuel and help reduce aviation sector emissions, but consumers are likely to take a hit, writes Olivia Young

Sustainable aviation fuel (SAF) makes up a tiny amount of the 7mn b/d jet fuel market but is about to expand rapidly as environmental mandates take effect.

Jet fuel is the fastest-growing oil product this year, accounting for 30pc of total oil demand growth, IEA projections show. The rebound in jet fuel consumption from Covid lockdowns is not entirely complete, thanks in part to airline efficiency measures. But air traffic volumes have reached new highs and the aviation industry's decarbonisation objectives are under increasing scrutiny.

Airlines can cut carbon emissions in several ways, including by boosting fuel efficiency. But the greater use of SAF will "provide about 65pc of the mitigation needed for airlines to achieve net zero carbon emissions by 2050", the director-general of the International Air Transport Association (Iata), Willie Walsh, says.

The airline industry consumed 10,000 b/d of SAF last year, just 0.2pc of all aviation fuel use, Iata estimates. But that volume could treble this year, Iata says. Norway, Sweden and France already have SAF mandates in place. And while demand elsewhere is voluntary, some airports such as London's Heathrow are implementing their own initiatives to boost SAF uptake.

An EU-wide SAF mandate — called ReFuelEU — comes into effect next year, replacing national obligations. Under the mandate, fuel suppliers will need to include 2pc SAF in their jet fuel deliveries in 2025, rising to 6pc in 2030, 20pc in 2035, 34pc in 2040, 42pc in 2045 and 70pc in 2050. Jet fuel demand in the EU was around 950,000 b/d last year, Energy Institute data show, meaning that SAF requirements next year could be nearly 20,000 b/d.

A UK SAF mandate is also expected to come into effect next year, pending parliamentary approval. The obligation would be on suppliers to deliver a 2pc share of SAF in 2025 — equivalent to 5,000 b/d of aviation fuel — increasing to 10pc in 2030, 15pc in 2035 and 22pc in 2040.

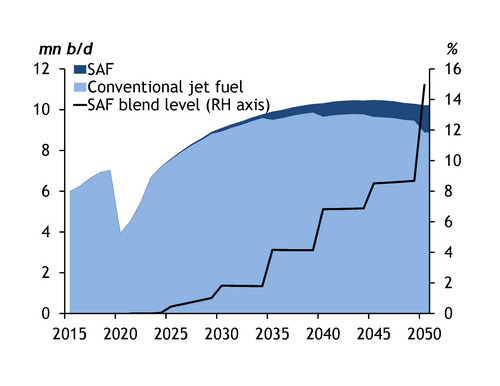

In the longer term, EU and UK mandates could push SAF consumption in Europe to nearly 20pc of total aviation fuel consumption by 2035 and 60pc by 2050, figures from Argus Consulting show. Globally, SAF will make up nearly 4pc of total jet fuel consumption globally by 2035, and 12.5pc by 2050 (see graph).

Less frequent fliers

The direct replacement of fossil fuel-based jet fuel by SAF is only one dimension of the effect that SAF expansion will have on the aviation industry and conventional jet fuel demand. "The cost of decarbonisation means that flying will become more expensive for consumers," airlines conglomerate IAG tells Argus.

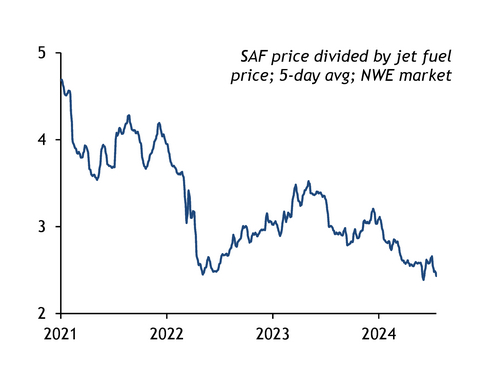

SAF prices have been nearly three times higher, on average, than those for oil-derived jet fuel in northwest Europe this year, although the ratio has fallen from the earliest days of the assessed market (see graph). Relative prices are likely to fall further as output grows and suppliers apply economies of scale and invest more in production technology. But SAF will remain at a significant premium to conventional jet fuel. Airlines are already suggesting that they will pass on extra SAF procurement costs to passengers through higher ticket prices.

Lufthansa Group will introduce an "environmental cost surcharge" of €1-72 for flights from 2025 to cover the extra costs under the ReFuelEU SAF mandate and other EU emissions schemes. The charge will apply to flights departing the EU, UK, Norway and Switzerland. Other airlines are likely to follow suit.

The competitiveness of specific cargo hubs could also take a hit. Cargo airlines are likely to shift towards hubs that do not have stringent SAF mandates, potentially benefiting Istanbul or Doha, at the expense of hubs in the EU, market participants say.