Weather-adjusted demand on the UK's local distribution zone (LDZ) appears to have strengthened in October-November from a year earlier, although high energy bills will likely prevent a larger rebound.

UK LDZ demand averaged 125.9mn m³/d on 1 October-27 November, up from 117.5mn m³/d over the period last year. LDZ users consist of households and some commercial and industrial consumers. Minimum temperatures in London averaged 8.1°C, just below 8.2°C a year earlier.

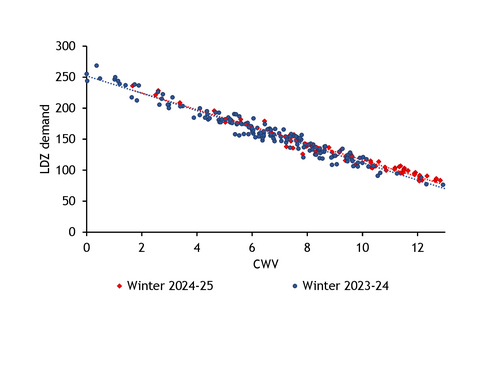

Slightly colder weather partly explains the rise in demand. But consumers have also been using slightly more gas relative to the weather than in winter 2023-24 (see trend lines graph).

This particularly applies for mild conditions. UK gas grid operator National Gas publishes a composite weather variable (CWV), a population-weighted index used for forecasting heating demand based on wind speeds and temperatures. The lower the CWV, the lower temperatures are, resulting in higher heating demand.

Daily LDZ demand has held in a range of 82.5mn-106.9mn m³/d on days when the CWV was in a range of 11-13 — corresponding to minimum temperatures in a range of 9-13°C — so far this winter. This was up from LDZ demand in a range of 76.4mn-94.7mn m³/d over the whole of last winter on days when the CWV was 11-13.

That said, there has been a much less pronounced difference in weather-adjusted LDZ demand on colder days, although there are few data points so far for this winter, complicating any comparison.

The data suggest that consumers have been more willing to turn on their heating so far this winter when the weather was still mild. But with colder weather this willingness is lower. This might be to save energy as gas prices are still generally high, compared with pre-2021 levels.

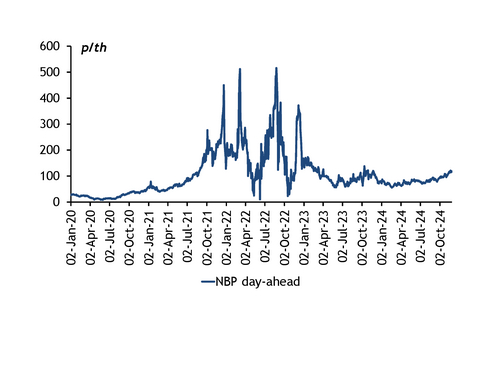

Argus assessed the NBP day-ahead market at an average of 104.32p/th on 1 October-27 November, only just below 104.72p/th a year earlier but nearly three times above the 37.8p/th in 2020 before prices spiked (see NBP graph).

Wholesale price changes do not immediately filter through to consumer prices, and are only one element of UK energy regulator Ofgem's quarterly price cap, based on the typical gas and power consumption for a household over a year.

The price cap was set at £1,717 for October-December for users paying by direct debit, £117 lower than a year earlier. The lower price cap may have prompted some users to increase their consumption.

The cap will rise to £1,738 in January-March next year.

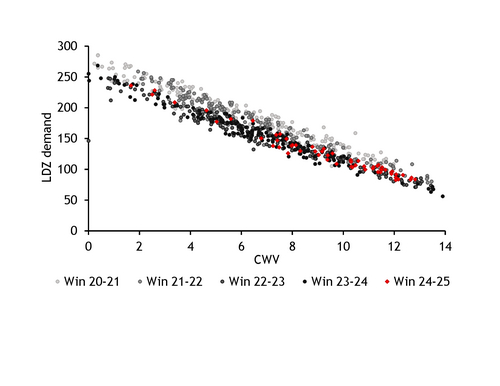

In any event, weather-adjusted LDZ demand remains far lower than in the pre-2022 period. The relationship between LDZ demand and the weather since 1 October has been close to the winters of 2023-24 and 2022-23 (see winter graph). Weather-adjusted LDZ demand was far higher in winters 2020-21 and 2021-22.