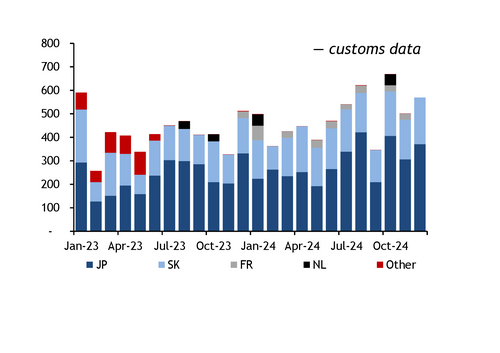

Vietnam's wood pellet exports reached an all-time high in 2024 on stronger power sector demand particularly from Japan and South Korea.

The southeast Asian country exported 502,000t of wood pellets in November 2024, up by 53pc from a year earlier, customs data show.

Overall exports in January-November jumped to 5.3mn t, which is already above exports for any full previous year, and significantly higher than 4.5mn t during the same period in 2023.

Exports to Japan rose sharply in November-December (see chart) supported by the start up of several biomass power plants in Japan in December — as the 50MW-Niigata Higashikou and the 75MW Chofu power plants both started operations in the month. Mirrored data — from Japan's and South Korea's import data — were used for January-April and June 2023 and December 2024, because of lack of actual data, — and Vietnamese customs data were used for the other months for this analysis.

Vietnam remains the top supplier of wood pellets to South Korea, and exports to this destination have risen steadily in 2024, as the northeast Asian country looked to diversify to make up for slower receipts from other exporting markets such as Russia and Malaysia.

Exports to France jump

Some 27,000t were exported to France in November 2024, from zero a year earlier. Vietnam has steadily increased its exports to France, probably delivered to overseas French territories where utility Albioma has ramped up its pellets consumption as it converted power plants from coal to biomass firing. The 108MW Bois-Rouge power plant and the 122MW Le Gol facility, located on Reunion, in the Indian Ocean, phased out coal completely since March 2023 and February 2024, respectively.

Albioma uses feedstock from locally sourced biomass and imported wood pellets. Albioma also plans to fully convert its 102MW Le Moule power plant in Guadeloupe to biomass by the end of 2025, after an agreement with the French state to extend its power sales contract to 2047. It will secure bagasse, forest wood and prunings locally as well as import wood pellets from sources including its own 200,000 t/yr pellet plant in Quebec, Canada, to feed Le Moule.

Further on Vietnamese exports to Europe, it has also ramped up shipments to the Netherlands over the past two years, although it did not export to this country in November.

Record high exports in 2024

Exports are likely to have exceeded 5.8mn t for all of 2024 based on December import data by Japan and South Korea — Vietnam's largest destinations. The sharp increase for all of 2024 was supported primarily by stronger exports to Japan — due to rise by 690,000t on the year — and South Korea — expected to increase by 286,000t on the year. Deliveries to France also grew strongly (see table).

Exports to Japan will continue to increase throughout 2025, as major outages from last year are expected to end and as new biomass-fired capacity in the northeast Asian country will bolster consumption and the need for Vietnamese pellets. Japanese buyers will also seek to replace a big chunk of cancelled term contractual volumes with US supplier Enviva with pellets from Vietnam.

Shipments to South Korea may also increase throughout 2025, provided that Vietnamese pellets maintain competitiveness over other origins, as South Korean power demand is expected to increase by 10-15pc on the year in 2025. This is a short-term impact on the market from (changes)[https://direct.argusmedia.com/newsandanalysis/article/2645856] in South Korea's Renewable Energy Certificate (REC) state support mechanism for biomass-fired generation since late 2024.

| Vietnam wood pellet exports | t | |||

| Destination | Nov-24 | Nov-23 | 2024* | 2023 |

| Japan | 306 | 204 | 3,484 | 2,794 |

| South Korea | 169 | 123 | 1,999 | 1,713 |

| France | 27 | 0 | 260 | 28 |

| Netherlands | 0 | 0 | 96 | 63 |

| Other | 0 | 0 | 6 | 416 |

| Total | 502 | 327 | 5,844 | 5,014 |

| *Mirror data for Japan and South Korea for Jan-Apr and Jun 2023 and Dec 2024 | ||||

| — customs data | ||||