European carmakers' plans to delay CO2 targets, according to a recent report by clean energy think-tank Transport and Environment (T&E), will "effectively kill the dreams" of a local electric vehicle (EV) supply chain, as market participants reported to Argus this week.

"There would be damaging consequences from the EU stepping back from its goals," advocacy group E-Mobility secretary general Chris Heron told Argus.

"We are already seeing all of this discussion [to delay CO2 targets] is having a chilling effect on investment. A relaxation [of CO2 targets] will effectively kill the dreams of a European battery value chain," research group Circular Energy Storage wrote in a recent newsletter

In response to the T&E report, a spokesperson from Europe's largest carmaker Volkswagen Group told Argus that the 2025 CO2 targets still represent a "particularly significant challenge".

"The European Commission should review whether the conditions for achieving the CO2 fleet targets are in place during the upcoming review, which should be brought forward… Every euro invested in possible penalties would be a poorly invested euro," spokesperson Christopher Hauss said.

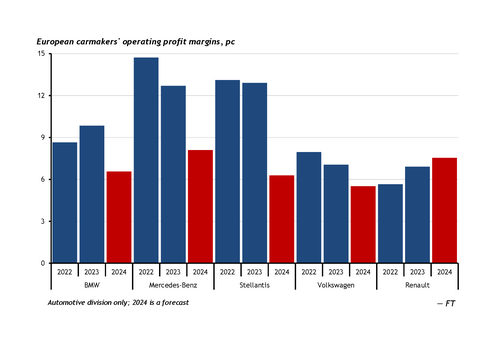

Hauss also conceded that battery EVs (BEVs) offer smaller margins, suggesting that, given the "challenge" of the targets, the group has considered delaying its BEV ambitions. "The more full BEVs you sell this diminishes your margin, across the industry carmakers have diminished results."

Hauss reiterated that the VW Group announced in March 2023, that the firm is investing €120bn into electrification and digitalisation, as well as €60bn into internal combustion engine (ICE) technology.

Infrastructure and lobbying weighs on BEV progress

Other sources question whether European carmakers' lobbying tactics distract from the vital need to invest in electrification, as the market share of Chinese-branded EVs in the EU and UK continues to rise.

"The power of the vehicle manufacturing regulatory compliance lobby hasn't changed… lobby, threaten, negotiate but always be ready to comply," Japanese carmaker Nissan former chief operating officer Andy Palmer told Argus.

"To be fair to the OEMs, the pain needs to be shared. Charging infrastructure needs to be accelerated to allow batteries to be right sized… it's about fixing planning permissions and grid connections," Palmer added.

Last year, 21 of the 27 EU member states were on track to meet public charging infrastructure targets, but next year this is due to fall to just two countries — Bulgaria and the Czech Republic, according to a report by T&E last year.

Despite this, Europe's existing charging networks are not saturated by EVs, Herron added, suggesting that BEV sales must continue to increase to spur further charging installations.

"Charging stations can accept 5-7 more vehicles today, but charging investments need predictability," he added.

And market participants have also implored carmakers to shift to smaller, more affordable BEVs to support charging investments, despite them offering weaker profit margins than ICE sports utility vehicles (SUVs) (see graph).

"German OEMs missed a trick when they went for big margin EV SUVs when what the world wanted was electric Ford Fiestas," campaign group FairCharge founder Quentin Willson told Argus. "Legacy auto needs to change its behaviours and build EVs with global relevance and go for volume rather than high margins that incur steep depreciation for consumers."

Sales performance so far strong on CO2 targets

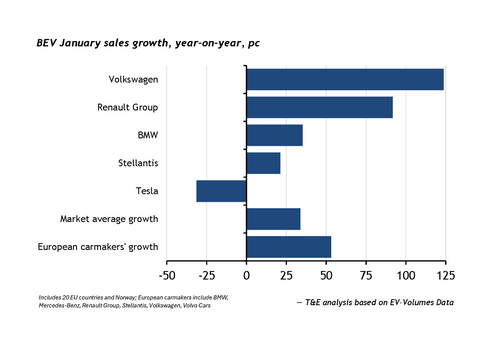

BEV sales in the EU + European Free Trade Association (EFTA) and the UK rose by 37.3pc last month (see graph), data from industry group European Automobile Manufacturers Association (ACEA) show today, after the commission's CO2 targets came into force.

Sales from European carmakers specifically rose by more than 50pc on the year (see graph), highlighting the carmakers' ability to match targets, with BEV sales potentially withheld.

"There's a variety of options for avoiding the full brunt of any potential fines, including pooling and selling existing BEV stocks," Heron said, regarding the reported fines.

"The only leverage [to increase BEV sales] would be to reduce pricing, this hasn't happened on 31 December, I couldn't think of another way to hold back sales," VW Group's Hauss said in response.

The commission also released its "Clean Industrial Deal" action plan today, a follow-up to the earlier Green New Deal, with plans to activate more investment in clean-tech but also a decision to delay the proposing of an EU 2040 climate target.

The news today is a backtrack on last February's announcement, which recommended a 90pc reduction of net greenhouse gas emissions by 2040, compared with 1990 levels.