Romania may play a defining role in the regional gas market over the next decade by exploiting Black Sea resources and expanding its transmission infrastructure, gas grid operator Transgaz has said.

Transgaz faces "one of the biggest challenges" that any Romanian company has encountered in the past two decades, the firm said in its 2024-33 network development plan. The operator must develop transmission corridors "as soon as possible" to provide enough interconnectivity with other European markets and transmission capacity to exploit domestic Black Sea gas and other regional resources.

The operator is eyeing investments estimated at around €9bn, but it remains unclear how much will be built as only €736mn of those projects have reached a final investment decision (FID) or an advanced non-FID stage.

Market participants also said heavy state regulation has reduced wholesale trading activity in recent years, despite Romania's gas market being fully open for industrial and residential customers.

Production jump

Start-up of the Neptun Deep field in the Black Sea in autumn 2027 or earlier will roughly double Romanian gas production, which already meets around 70pc of annual demand.

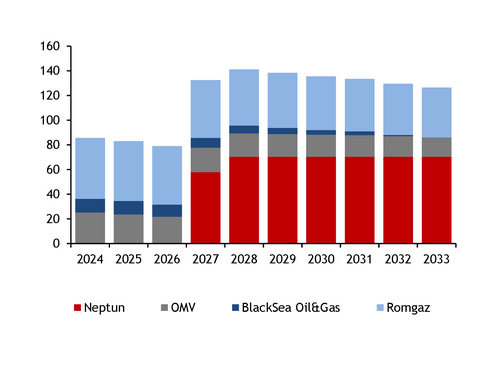

Romania aims to increase gas output to 18bn-20bn m³/yr by 2027, from 8bn-10bn m³/yr at present, by developing Neptun Deep, in which Romgaz and OMV Petrom share ownership (see Romanian output forecast graph).

First gas from the field will be extracted and transported through the Tuzla-Podisor pipeline from 2027, Transgaz said. The operator estimates that 8.16bn m³/yr from Neptun Deep gas will enter the Romanian grid by autumn 2027, although the country's energy ministry has said the field might come on line in January 2027 "or maybe even a little earlier". In any case, construction of the Tuzla-Podisor pipeline is "perfectly on schedule", the ministry has said.

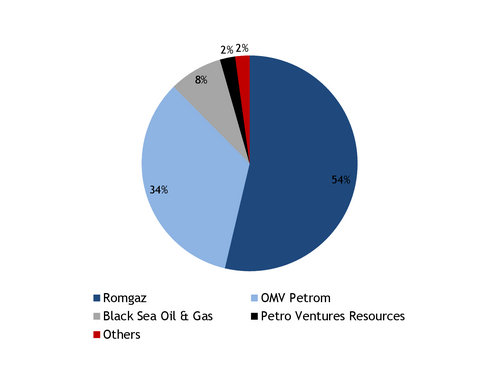

Romania has 13 gas producers. Romgaz accounted for 54pc of domestic production, OMV Petrom 34pc and Black Sea Oil and Gas below 8pc in 2024, while other firms made up less than 2pc each (see Romanian output graph).

Unclear demand outlook

Transgaz' grid plan presents an unclear view of near-term gas demand growth.

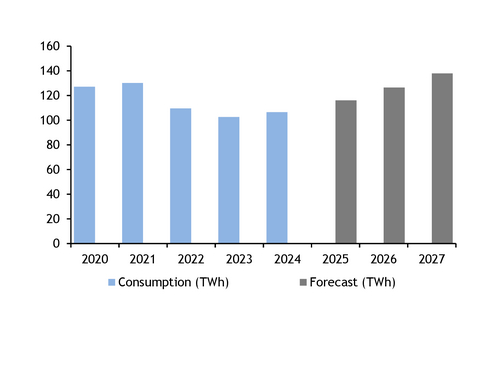

Romanian gas consumption has decreased in recent years, mainly driven by the closure of petrochemical plants. Gas consumption fell to 106.5TWh last year, from an average of 114TWh in 2021-23 and 132.4TWh in 2010-20, according to Transgaz (see consumption graph).

Romanian consumption may increase by about 10bn m³ in the next 3-4 years, as the 1.7GW Mintia plant, the 450MW Lernut plant and two co-generation facilities in Isalnita and Turceni are completed, boosting power-sector gas burn. The restart of the Azomures fertiliser plant and Piatra-Neamt chemical plant also add gas demand, while local areas being connected to the gas network will further lift demand, Transgaz said (see table).

But the operator's grid plan also foresees gas consumption growth of 1pc each year in 2025-27, driven by industrial users in the food, metallurgical and construction sectors.

Supply surplus

The energy ministry estimates that Neptun will increase Romania's production by 75-100pc, while domestic demand will rise by only 25pc, leaving a "margin of gas we will be able to export".

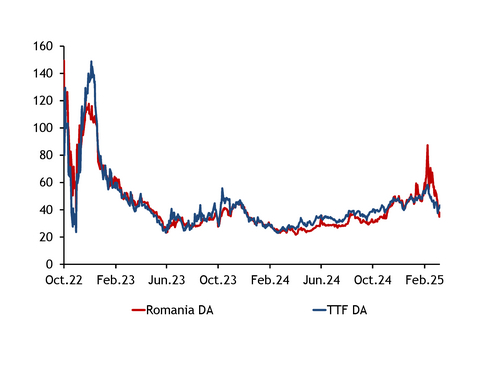

Romania is already a net exporter when demand is low and Romanian gas prices hold a discount to nearby markets. The Argus-assessed Romanian day-ahead price was €4.53/MWh below the Dutch TTF on average in April-October and held a discount of €0.78/MWh over the period in 2023 (see price graph).

Negotiations to sell Neptun output have begun. Romania and Hungary earlier this month signed a gas solidarity agreement aimed at strengthening energy security. Companies from the two countries are discussing negotiating an agreement, according to Hungarian foreign minister Peter Szijjarto. The Moldovan and Romanian energy ministries will discuss guaranteeing Moldovan access to gas purchases as soon as Neptun Deep begins production. And OMV Petrom plans to export output from Neptun Deep to an unnamed German firm.

| Gas usage projects | |

| Project | bn m³/yr |

| Mintia power plant | 2.5 |

| Isalnita CCGT | 0.8 |

| Turceni CCGT | 0.8 |

| Lernut CCGT | 1.0 |

| Azomures fertiliser plant | 1.2 |

| Piatra-Neamt chemical plant | 0.8 |

| Households segment | 3.0 |

| — Transgaz | |