US firms seeking to balance sharper swings in supply and demand may be driving a revival in storage, writes Julian Hast

Increasing volatility in US natural gas markets is spurring renewed interest in underground storage projects, after more than a decade in which US storage capacity has grown little, even though the gas market has expanded rapidly.

Market participants see growing value in gas storage, particularly as several new LNG export terminals are preparing to enter service on the US Gulf coast, raising the risk that the regional market will be suddenly flooded with supply if hurricanes or unplanned maintenance force the terminals off line. Gas and power utilities need to secure larger volumes of dispatchable generation fuel, as greater penetration of intermittent renewable power supply in the electric grid forces natural gas-fired power plants to ramp up and down more often. "I think there was a recognition [in about 2022] that something's got to change," privately held storage operator Enstor chief executive Paul Bieniawski says. Enstor's 34bn ft³ (960mn m³) Mississippi Hub gas storage expansion was approved by federal regulators in March. "What we are seeing is a renaissance for storage."

Underground gas storage projects comprising a combined 262bn ft³ of capacity have been proposed in the US in recent years, consultancy East Daley Analytics analyst Zack Krause says. If all come to fruition, the country's capacity would increase by nearly 6pc. US storage capacity has held broadly flat at 4.7 trillion ft³ since 2015, after rising by 574bn ft³ in 2008-14, data from US agency the EIA show.

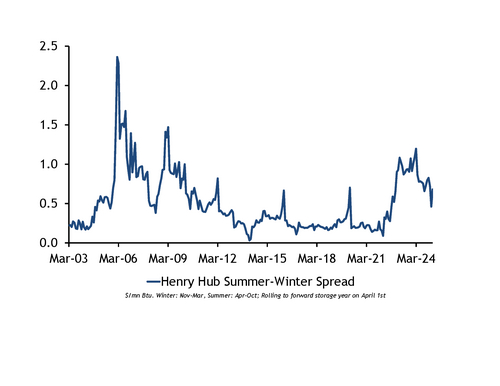

Storage capacity growth slowed in the wake of the shale revolution, when advancements in horizontal drilling and hydraulic fracturing unlocked massive reserves of gas previously regarded as being uneconomic to produce. The resulting flood of newly accessible gas weighed heavily on seasonal spreads in US gas prices, which typically underpin the investment thesis for building storage. The implied front summer-winter spread in Nymex futures for delivery at the Henry Hub, assuming injections in April-October and withdrawals in November-March, averaged 88¢/mn Btu in 2005-10, when the bulk of the latest round of capacity additions was sanctioned,Enstor data show. But this differential was just 25¢/mn Btu in 2013-21, before climbing again to 90¢/mn Btu in 2023-24.

Spread the word

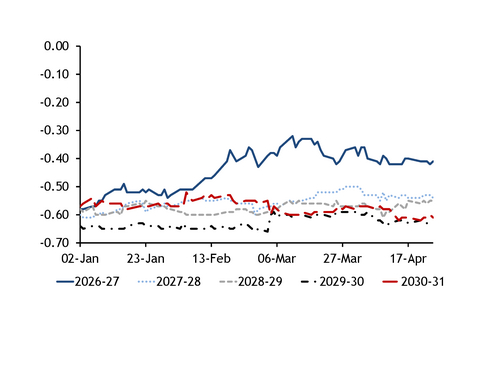

Such spreads may be profitable enough to incentivise expansion projects at existing storage facilities, which make up the bulk of capacity additions under development at present. But they are still not wide enough to spur development of new or greenfield storage sites. And near-curve storage spreads have tightened in recent months, although corresponding spreads for following storage years are wider.

Yet increasing volatility in the Gulf coast gas market is fuelling LNG exporters' and power utilities' growing need to be able to "control their own destiny", US pipeline operator Williams senior vice-president Chad Teply tells Argus. The firm boasts the largest gas storage portfolio on the US Gulf coast and acquired 115bn ft³ of capacity in Louisiana and Mississippi from an affiliate of trading firm Hartree Partners in early 2024. Williams is open to further acquisitions, but expanding its own storage facilities is a priority, Teply says.

Gas storage start-up NeuVentus' recently approved 96bn ft³ greenfield Texas Reliability Underground Hub is seeking to attract new customers such as LNG exporters and utilities willing to pay a premium for insurance purposes, which should allow the project to get "over the greenfield hump", NeuVentus co-founder and chief executive Sam Porter tells Argus. Projects like those by NeuVentus are also attractive to commodity trading firms looking to exploit price volatility, such as Geneva-based trading firm Mercuria, which invested in the Louisiana greenfield storage project of NeuVentus' competitor, Black Bayou, in June last year.