California, a long-time leader in US environmental policy, is backtracking on some regulations in the face of a stark reality — two major refineries in the state are planning to close within a year.

State officials have softened their tone — and their proposals — since US refiner Valero in April informed the California Energy Commission (CEC) that it would shut or repurpose its 145,000 b/d Benicia refinery in California. The shutdown, and the planned closure of Phillips 66's Los Angeles refinery by the end of this year, will cause the state to lose 17pc of its refining capacity.

This put California in the unusual position of finding ways to stop more refiners from leaving during what it calls the "mid-transition period" as the state manages its strategy to phase out petroleum-based fuels by 2045.

The CEC has shelved the implementation of some regulations long opposed by refiners and is even recommending ways to stabilise the state's crude production.

State regulators have recommended pausing the implementation of a refining margin cap with penalties for operators in the state — one of the most controversial measures approved by the state legislature and championed by Democratic governor Gavin Newsom, a potential US presidential candidate. The refiner margin cap was part of a multi-year legislative effort by Newsom to mitigate price volatility in the state after gasoline prices climbed to record highs in 2022.

The CEC has also delayed a vote on rules that would have required refiners to submit resupply plans to the state at least 120 days before any planned maintenance in September and October that would cause California-specification gasoline production to decline by 20,000 b/d for at least 21 days, or a total of more than 450,000 bl.

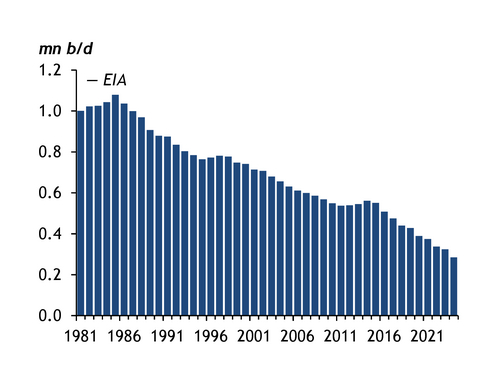

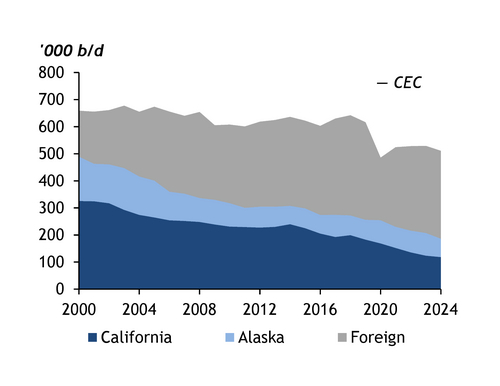

And state regulators are looking at ways to stabilise California crude production to help supply in-state refiners. Crude output in the state dropped to 285,000 b/d in 2024 from above 1mn b/d in the mid-1980s, according to the US Energy Information Administration. California production accounted for about 23pc of crude used by state refineries in 2024, down from 62pc in 1985, according to CEC data. The decline in crude output is largely caused by litigation related to the California Environmental Quality Act (CEQA) that stalled production permitting in Kern County, the CEC said in a 27 June letter to Newsom outlining possible solutions to stop refinery closures during the energy transition.

Newsom is working with state legislators on a bill meant to stabilize the state's petroleum market, in part by expediting permitting of new oil and gas wells.

Kern laws

The CEC recommended that the legislature consider statutory changes that would declare that an environmental review of a Kern County zoning ordinance is compliant with the CEQA. This change would allow "a more appropriate amount of extraction" in Kern County that is needed to stabilise output, the CEC said.

Crude output should be targeted in existing established and densely developed oil fields and outside of Health Protection Zones surrounding homes, schools and other areas where new permitting is prohibited by law, the agency said.

And state lawmakers are also considering ways to help refiners, including a "one-stop shop" process for co-ordinating refinery permits for air quality, water quality, hazardous waste permits, approvals and authorisations. The bill would also allow western US states to jointly develop a regional gasoline specification. California, Arizona and Nevada each mandate distinct gasoline specification requirements to manage smog and other air pollution. This has isolated them from more broadly produced gasoline grades. Since the 1980s, 29 refineries in California have been shut or integrated with other refineries that eventually closed or converted to renewable fuels production, according to CEC data.