Canada is eyeing an ambitious drive to extend its gas exports reach beyond the US, write Shaun Polczer and Brett Holmes

The commissioning of LNG Canada opens up a diversification phase for the country's gas industry, which in the past has relied entirely on pipeline exports to the US and comes at a time when the government is looking to cut red tape to advance major energy projects.

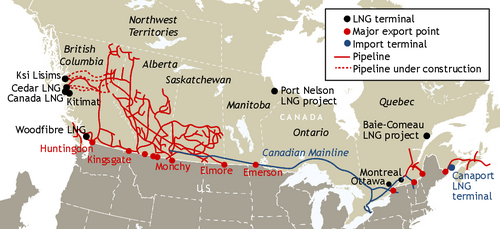

The 14mn t/yr LNG Canada export terminal started operations earlier this month, leading to a number of planned LNG export projects on the country's west coast. These include two smaller facilities — the 2.1mn t/yr Woodfibre LNG and 3.3mn t/yr Cedar LNG terminals — that already reached a final investment decision (FID) and are expected to be commissioned in 2027 and 2028, respectively, potentially followed by two larger projects with a combined capacity of 33.2mn t/yr — the 12mn t/yr Ksi Lisims LNG and 21.2mn t/yr Kitimat LNG terminals, which still await an FID and might not reach the market this decade.

Canada may now be gearing up to support more ambitious projects in the eastern part of the country, in a bid to support a further diversification of Canadian gas exports beyond the US. Quebec premier Francois Legault has confirmed that his team has discussed with developers a proposed LNG export project in Baie-Comeau — a project that could be considered in the national interest, according to federal energy minister Tim Hodgson. And the Canada Energy Regulator has granted federal authorisation for a modern deepwater port and LNG export project on Hudson Bay. The project is being developed by NeeStaNan, a 100pc First Nation initiative majority-owned by Fox Lake Cree Nation, and would be located in Port Nelson in northern Manitoba.

Under prime minister Mark Carney's proposed infrastructure fast-track initiative, or Bill C-5, projects deemed to be in the "national interest" — including pipelines, railways and ports — would be accelerated to counter rising protectionism in the US and open new corridors to global markets, specifically Europe.

Long-distance pipeline options for the delivery of feedgas supply to the planned Port Nelson project are still subject to a feasibility study. But projects to move energy flows to Canada's east are once again being contemplated — oil-rich Alberta's premier, Danielle Smith, signed an initial agreement this month with Ontario premier Doug Ford to consider the construction of more oil and gas pipelines between the two provinces.

Leap of faith

Carney has pushed Bill C-5 through parliament to spark investment and project development by promising faster approval times while circumventing onerous rules made by previous Liberal-led governments. Oil and gas firms see this as a positive step, but with the law comes familiar ambiguity.

To be considered for the new "national interest projects" list, a project should strengthen Canada's autonomy, provide economic benefits, have a high likelihood of completion, be in the interest of indigenous groups and contribute to meeting Canada's climate change objectives. How well a project satisfies these requirements will be at the discretion of Carney's cabinet and requires a leap of faith for supporters and opponents to trust the new process.

Developers can expect a tighter two-year time limit for a federal decision, but how quickly the government navigates indigenous and environmental aspects remains to be seen. Such a consultation was seen as crucial under former prime minister Justin Trudeau, and Carney plans to strike a balance between these aspects and economic development. "Bill C-5 doesn't reform Canada's burdensome regulatory system, which is preventing needed investment," think-tank the Fraser Institute says. "It simply lets politicians decide who gets around it."