Ukraine's 2025-26 winter crop marketing year (July-June) has got off to a slow start, compared with a year earlier, because harvests of wheat, barley and rapeseed are lagging those of the previous season.

Overall exports also fell on the month in July because of lower shipments of corn towards the end of the 2024-25 corn season (October-September).

Ukraine exported 2.9mn t of grains, oilseeds and oilseed products in July, down from 3.1mn t in June and 4.9mn t a year earlier.

Shipments from the deep-sea ports of Pivdennyi, Odesa and Chornomorsk fell to 2.5mn t last month, from 2.6mn t in June. This represented about 85pc of Ukraine's total agricultural exports, in line with the 85pc share a month earlier.

At the same time, agricultural exports from Ukraine's Danube river ports continued to stagnate, declining to 109,700t in July, from 116,400t in June. Their share of overall agricultural exports stayed at 4pc.

Grains

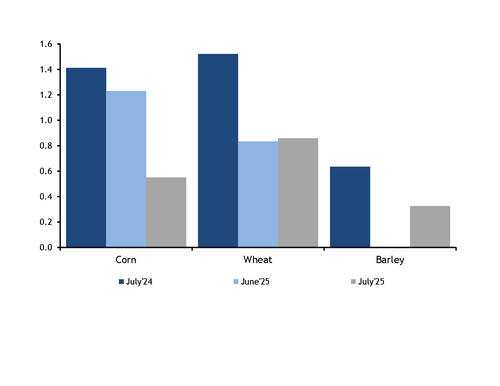

Ukraine exported 1.7mn t of grains in July, down from 2.1mn t in June and well below the 3.6mn t exported a year earlier (see chart).

Wheat exports amounted to 858,500t in the first month of 2025-26 (July-June), slightly up from 833,100t in June, but significantly down from 1.5mn t a year earlier. Egypt was the largest buyer of Ukrainian wheat, followed by Spain and Indonesia, according to customs export declarations.

Barley exports totalled 324,700t in July, just over half of the 634,700t exported a year earlier. China was the main destination for Ukrainian barley in the first month of 2025-26.

Ukraine's 2025 winter crop harvest continued to lag last year's pace because of unfavourable weather. Data from the agriculture ministry show that as of 31 July, only 11.4mn t of wheat and 3.6mn t of barley had been threshed from 3.1mn hectares (ha) and 1mn ha, respectively. This compares with 19.4mn t of wheat and 4.8mn t of barley collected from 4.5mn ha and 1.3mn ha, respectively, on 1 August 2024.

As for corn, exports declined to 550,200t, from 1.2mn t in June and 1.4mn t a year earlier. Turkey remained the largest recipient of Ukrainian corn in July, receiving 192,500t. Italy and the Netherlands were the next two largest destinations. Notably, 48,500t of corn was also exported to South Korea.

Ukraine's corn exports since the start of the 2024-25 marketing year (October-September) have reached 19.6mn t. Argus forecasts Ukraine's 2024-25 corn exports at 20.5mn t, below the latest US Department of Agriculture's projection of 22mn t.

Oilseeds

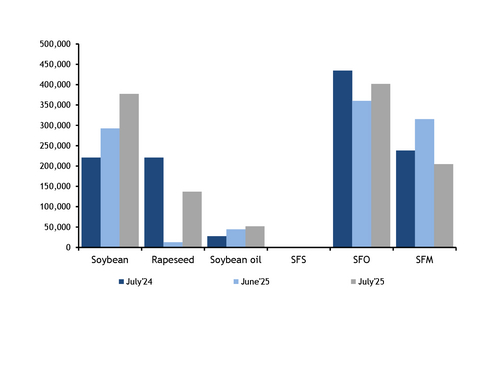

Ukraine exported 1.2mn t of oilseeds, vegetable oils and meals in July, up from 1mn t in June but below 1.3mn t a year earlier.

Rapeseed exports amounted to 136,800t in the first month of the 2025-26 marketing year (July-June), down sharply from 411,200t a year earlier (see chart).

Similar to wheat and barley, Ukrainian farmers had threshed only 1.8mn t of rapeseed from 781,900ha as of 31 July, compared with 3.2mn t from 1.1mn ha on 1 August 2024.

Ukrainian soybean exports remained strong in July, increasing to 377,500t from 292,500t in June and 220,600t a year earlier. The Netherlands was the largest buyer, followed by Turkey and Egypt.

Sunflower oil exports rose to 401,700t, from 360,400t in June, but were down from 434,800t a year earlier. India was the main destination, followed by Spain and the Netherlands.

Exports of sunflower meal fell to 204,700t in July, down from 315,100t in June and 238,100t a year earlier. China was the largest buyer, followed by Poland and Italy.