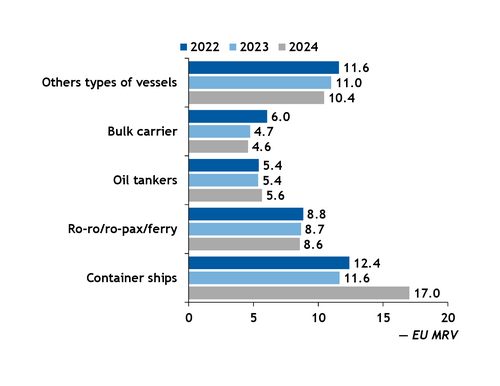

EU bunker demand in 2024 surged by 4.9mn t to 46.3mn t, up 12pc from the previous year, driven largely by longer container ship voyages as vessels avoided the Red Sea following Houthi attacks.

Container ship fuel consumption led the increase, rising by 5.4mn t to 17.0mn t in 2024, according to the latest data from the EU's Monitoring, Reporting and Verification (MRV) database. Many container lines rerouted around South Africa's Cape of Good Hope instead of using the Suez Canal, lengthening voyages, and increasing fuel burn. The MRV system tracks marine fuel demand for ships of 5,000 gross tons and above on all voyages involving EU or European Economic Area (EEA) ports. This includes full-voyage fuel consumption, even in international waters, as long as at least one port is within the EU or EEA.

MRV-tracked marine carbon dioxide (CO₂) emissions followed suit, rising 12pc to 143.2mn t in 2024. For the first time in 2024, the MRV also required reporting of two other greenhouse gases (GHG): methane (CH₄) and nitrous oxide (N₂O). Vessel operators reported 59,479t of CH₄ and 8,066t of N₂O, which translate to 1.7mn t and 2.1mn t of CO₂-equivalent emissions, respectively, based on their global warming potential of 28 and 265 times that of CO₂.

Of the 59,479t of CH₄ reported to the EU MRV in 2024, the majority, 36,615t, came from LNG carriers, which often use boil-off gas from their cargo as fuel. LNG has lower CO₂ emissions than conventional marine fuel, but LNG or dual-fuel LNG engines can result in methane slip, where unburned methane escapes through the engine exhaust. Another 14,432t of CH₄ came from roll on/roll off passenger vessels (ro-pax), roll on/roll off cargo vessels (ro-ro), and ferries, many of which also run on LNG or LNG dual-fuel engines.

MRV does not report different marine fuel types demand, just total demand. By comparison, Rotterdam, Europe's biggest bunkering port, reported 8.6mn t of conventional marine fuel sold in 2024, down 2.7pc from 2023. Biodiesel bunker blends reached 752,103t in 2024, holding steady. LNG and bio-LNG sales were up 52pc to 424,863t, and bio-methanol jumped up to 3,946t from less than 800t in 2023. Sustainable marine fuel demand grew ahead of the start of the FuelEU Maritime regulation in January 2025, which mandated 2pc in GHG emissions cut in 2025.