Regional Greenhouse Gas Initiative (RGGI) allowances have mostly recovered since plunging immediately after the member states finished their third program review as summer power demand looms larger in the market.

While the completion of the long-running third program review led to a brief bout of bearishness in the 10-state northeast US power plant CO2 compliance market, it also brought much-needed closure. The process had been a large source of uncertainty in the market due to numerous delays since its start in February 2021, as well as because of the lack of updates as the review dragged on — particularly during its last few months.

Allowance prices dove by nearly 9pc on 3 July, the day the states announced the end of the review along with their planned changes to the market, with Argus assessing December 2025 allowances at $21.45/short ton (st). The market has since risen by nearly 6pc, putting the December 2025 allowances at $22.72/st on Wednesday.

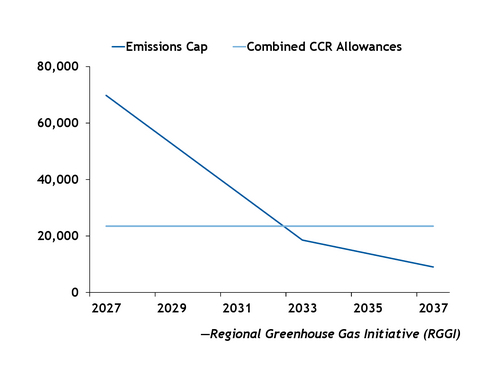

At the time market participants viewed the changes, which will be implemented in 2027, as bearish despite a more-stringent emissions cap that declines to just over 9mn st in 2037. Participants noted the lack of new steps to reduce the allowance bank and the decision to add a second cost containment reserve (CCR). The two collectively will hold about 23.5mn allowances each year that can be released if auctions exceed certain price thresholds. Starting from 2033, the number of CCR allowances will exceed the annual emissions cap.

Allowances fell further on 7 July, down to $21.17/st, but then began to rebound, going as high as $23.63/st on 28 July. These gains can be largely attributed to summer power demand. Higher temperatures in the northeast spurred expectations for more emissions, boosting demand for allowances.

This rather swift recovery suggests that the effects of program review were already baked into the market, since the final changes are nearly identical to the most recent proposal released by member states in September 2024, according to Justin Johnson, the RGGI representative for the International Emissions Trading Association.

With great power comes great costs

Projected electricity demand has grown significantly, fed in large part by data center growth and broader electrification initiatives, making concerns about rising electricity costs and affordability a major variable in the overall calculus of climate policy, and RGGI is no exception.

Policymakers in the northeast have had to balance addressing rising power demand and electricity costs with achieving state climate goals — while also contending with a federal administration that has been unfriendly towards climate initiatives.

As a result, various stakeholders view the latest changes to RGGI as a compromise, while those concerns likely contributed to the length of the review process.

"If this is the way to get consensus then I can't really complain too much," said Paola Tamayo, a senior policy and data analyst at the Acadia Center, a non-profit clean energy research group.

The conversations around demand growth and data centers are relatively new to RGGI. During the early years of the program, concerns about falling allowance prices loomed larger. This led to the creation of an emissions containment reserve (ECR) that will withhold allowances from the market in an attempt buoy prices, said William Shobe, a professor at the University of Virginia who studies emission market and auction design. The ECR will be replaced with a price floor in 2027.

"The problem now is that the cap could become so binding that the price could get really, really high," which could result in some member states deciding to leave RGGI, Shobe said.

Calling the final changes a "balancing act", Johnson said that the addition of a second CCR gives RGGI "a couple of speed bumps" to prevent allowances prices from going up "too fast too quickly."

The CCRs could dilute the new CO2 caps, but only when auction prices cross their respective thresholds. The trigger prices for the two CCRs will increase by 7pc/year, reaching as high as $38.36/st and $57.53/st by 2037.

In addition, member states may have accounted for increased uncertainty with regards to the resource mix for the region, said Jamie Dickerson, senior director of climate and clean energy programs at the Acadia Center, citing, for example, recent roadblocks to offshore wind development.

As a result, the size of the combined CCRs relative to the emissions cap is "partly a reflection of that sort of medium-term uncertainty around what resources will be available" and which resources will be left to buy allowances, Dickerson said.

Ultimately, the program changes strengthen "the cap [by] making sure that it doesn't fall afoul of political limits," Shobe said. "If more states withdrew, there's no cap."

Back to the future

Member states are now looking towards kickstarting a fourth review in 2028. They intend to evaluate the effects of the latest program changes and focus on issues such as clean energy deployment and the pace of electricity load growth.

There will likely be renewed discussions regarding the emissions cap — something that has always been in past program reviews — as well as the CCRs, according to Johnson.

In addition, interim climate goals — which, for many states, are approaching in 2030 — could be a large driver of conversations. Member states likely will take a fresh look at the "evolution of the power mix, where technology costs are, [and] where the policy landscape" is at the federal level, Dickerson said.

Other issues, such as offsets use, which the states are eliminating in 2027, and carbon capture technologies could be part of the discussions.

But before the fourth program review begins, member states must promulgate regulations that will implement the latest changes in 2027, with some states, such as New Hampshire and Maryland, requiring legislative approval to do so.