Distributors have been spurred into bolstering supply security as the UK faces a growing LPG shortfall, write Waldemar Jaszczyk and Yasmin Zaman

The UK LPG market is facing tighter supply this winter after an unplanned closure of the 105,700 b/d Lindsey refinery comes amid already declining domestic output.

The refinery in eastern England ceased operations this month after its owner, UK-based energy firm Prax, declared itself insolvent in July. The facility has exported negligible volumes of LPG in recent years, according to Kpler, implying the majority of its LPG has been sold domestically. The nearby 221,000 b/d Humber refinery operated by the US' Phillips 66 could mitigate lost supply, but additional demand this winter will test an already stretched loading rack and cause longer queues, an industry executive says.

It is the second UK refinery shutdown in less than four months after Petroineos' 150,000 b/d Grangemouth plant stopped processing crude in April. The loss of product from Scotland's only refinery has already tightened supply in the north, market participants say. The UK has lost just under a quarter of its refining capacity since the start of this year, and the recent closures are part of a longer-term trend that includes the loss of the 180,000 b/d Coryton refinery in 2012 and the 130,000 b/d Milford Haven plant in 2014.

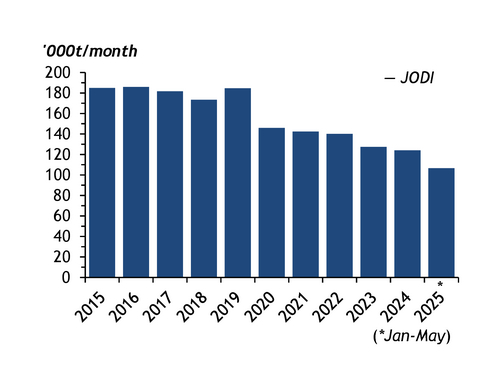

Refinery production of LPG fell by almost 15pc on the year to 106,000 t/month in January-May, data from the Joint Organisations Data Initiative show, which was partly owing to Grangemouth's gradual drop in run rates. That is less than half of the 216,500 t/month peak in output in 2011 when the UK's refineries provided almost 80pc of domestic supply. A lack of investment, technical issues caused by the ageing refineries and closures reduced this share to 60pc in 2024, while the latest closures are expected to bring it below 50pc this year, Argus Consulting data show.

Supply from the country's second main source of production, gas processing plants (GPPs), has simultaneously come under pressure from rising natural gas prices. Northwest European benchmark propane and natural gas prices have flipped from propane premiums to discounts this year. The cif Amsterdam-Rotterdam-Antwerp large cargo propane price stood at a $101.75/t discount to the Dutch TTF gas price in January-July, compared with a $79.50/t premium in 2024, encouraging upstream producers to leave unprocessed natural gas liquids in the gas stream. Forward curves for both are in contango into winter but the TTF's is steeper, probably capping the UK's GPP output, which Argus Consulting forecasts to decline by 13pc to 1.34mn t this year.

Teesside resort

The growing supply gap has prompted UK LPG distributors to invest in improving supply security. Flogas opened an LPG terminal at Teesside last year to provide up to 100,000 t/yr of North Sea LPG that was previously exported. The firm has also converted an LNG storage facility in Avonmouth in southwest England to a 34,500t LPG storage facility. Flogas plans to connect Avonmouth to Bristol port with a 6km pipeline, enabling it to receive imports on vessels carrying up to 20,000t. The first delivery is expected in the second half of 2027, director Ivan Trevor says.

Calor Gas' 30,000t storage terminal at Canvey Island on England's east coast is due to partially return from a long-term maintenance, boosting capacity to 8,000t from the current 8,000t. The sector is mulling the Lindsey assets' future, including the storage units, which could interest Phillips 66, market participants say.

The gains from Teesside, Avonmouth and Canvey will mitigate the impact from recent refinery closures, Trevor says. But these investments were intended to build supply resilience rather than dependency, and downstream logistics will be tested by longer truck deliveries. Much will depend on this winter's weather. The market has enough LPG but the system will need to rebalance, and there is likely to be short-term pain, an industry executive says.