An increase in heavy sour crude imports and lower fuel oil consumption in cokers is expected to raise US Gulf petroleum coke sulphur content in the coming weeks, potentially widening the price spread between 4.5pc and 6.5pc sulphur coke.

US refiners are expecting a jump in medium and heavy sour crude supplies from Canada, Venezuela and the Opec+ group of countries in the near term. About 2mn-2.5mn b/d of this crude will be returning to the market in the autumn, according to US independent PBF Energy's chief executive Matthew Lucey.

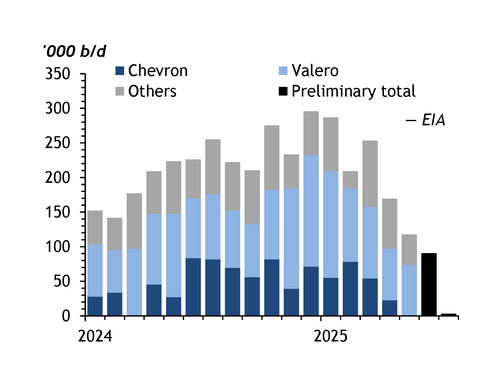

About 200,000 b/d of Venezuelan sour crude has been blocked from the US Gulf coast market since April, when Chevron stopped these shipments out of concern over the expiration of its sanctions waiver. Canadian wildfires took about 5mn bl of June supply off the market, Valero's chief operating officer Gary Simmons said. And an April spill on South Bow's 622,000 b/d Keystone pipeline, a major carrier of Canadian heavy crude to the US midcontinent and Gulf coast, reduced crude flows by 13pc in the second quarter and is still not back to full capacity.

As a result, after US Mars prices firmed, a number of US Gulf refineries that would typically produce 6.5pc sulphur fuel-grade coke have been producing closer to 5pc sulphur or less, as these coking units consume lighter feedstocks like WTI and high-sulphur fuel oil (HSFO) compared with their usual heavy sour crudes.

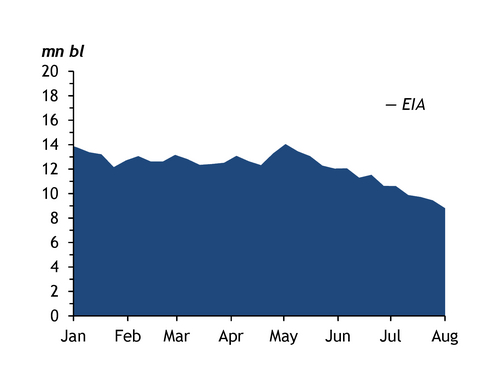

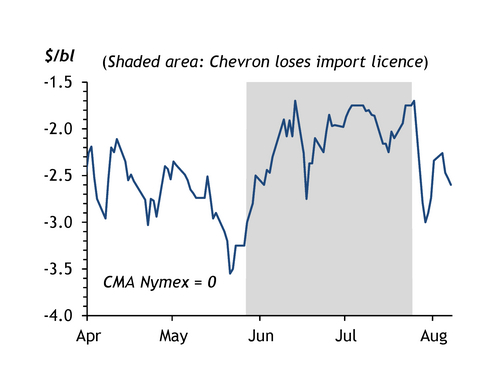

HSFO averaged less than a 70¢/bl premium to heavy Canadian crude on the Gulf coast in January-June, which encouraged coking units to consume more of this lighter feedstock. Because of this coker consumption, fuel oil inventories have tightened sharply on the Gulf coast since mid-June. As of the week ended 8 August, total US residual fuel oil inventories reached their third consecutive record low in the US Energy Information Administration's near 43-year historical database. This has raised the product's premium to WCS to more than $3/bl, which has likely caused refiners to reduce using this as a coker feed. US Gulf coast refiners have typically opted to run either HSFO or heavy sour crude depending on the width of this price spread.

Coking refiners are also likely to reduce consumption of lighter, sweeter crudes as differentials widen. Mars and low-TAN heavy sour Canadian crude at the Texas Gulf are on track to average multi-month lows against their benchmarks for September deliveries. Eight predominantly sour crude producers in Opec+ will raise their collective production target by 547,000 b/d in September, matching an increase in August. And Venezuelan crude is about to return to the Gulf, with Chevron-linked oil tankers already loading in Venezuela after President Donald Trump's administration reversed course on the decision to cancel its licence to operate there. One tanker is already carrying a cargo of Boscan crude from Bajo Grande and another Hamaca crude from the Jose terminal.

Although Venezuelan crude has historically produced coke with around 4.5pc sulphur as received or 5pc sulphur on a dry basis, market participants have said that this crude has now been making higher-sulphur coke at more than 5.5pc db. The reason for this is not entirely clear, but it could be related to Venezuela not having enough of the correct diluents, like US naphtha, that are required to keep this heavy crude flowing.

The expected shift in US Gulf cokers back to running Canadian, Venezuelan and Mideast Gulf heavy sour crudes will likely reduce the supply of mid-sulphur cokes with less than 5pc sulphur db and increase availability of closer to 6pc sulphur cokes that trade in the high-sulphur market. This is likely to increase the premium for the mid-sulphur grade from the historically low levels it has been hovering at since mid-June.

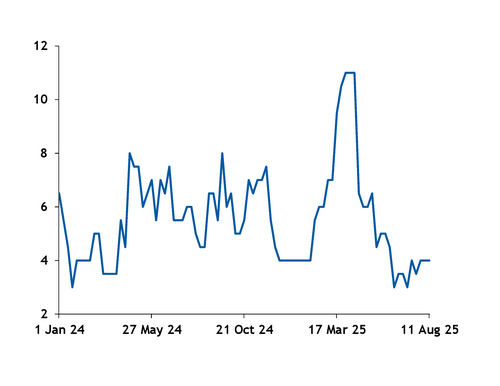

The premium for the Argus 4.5pc sulphur as received assessment to the 6.5pc sulphur assessment on an fob US Gulf basis averaged $3.69/t over the eight week period from mid-June to mid-August, 27pc narrower than the previous eight-week period and 35pc narrower than the same eight-week period in 2024.

This was also not a result of significantly lower outright pricing, with the 4.5pc assessment on 13 August at $69.50/t, compared with $65.50/t a year earlier. The US Gulf mid-sulphur premium made up only 5pc of the 4.5pc sulphur price on average over the past eight weeks, compared with 7pc and 8pc a month and year earlier.