Singapore's residual fuel oil stocks have climbed toward the top of their six-year range as more Middle East and west African barrels could head east, and additional barrels could test its ability to absorb them.

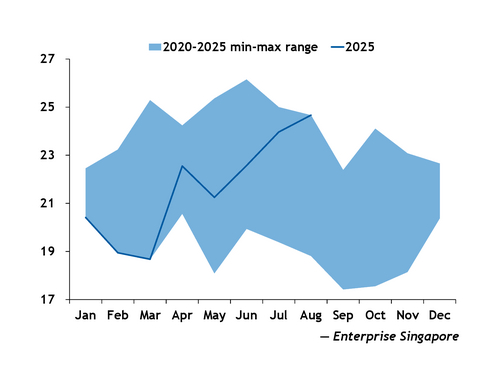

Singapore's residual fuel oil stocks in 2025 have stayed comfortably within the 2020-25 historical range, rebounding sharply from a weak first quarter and climbing steadily through summer to form the top of the six-year band by August (see chart). Singapore's fuel oil stocks were at 23mn t in the week ended 20 August, up by 9pc from the five-year average of around 21.1mn t from 2020-2024, according to the latest data from government agency Enterprise Singapore.

The continuation of Singapore's residual fuel oil overhang comes as the resumption of Venezuelan crude imports to the US is easing the US Gulf's reliance on high sulfur fuel oil (HSFO) as a refinery feedstock. As US fuel oil inventories recover from record lows, US Gulf refiners are expected to reduce competition for Middle East and west African cargoes, sending more of those barrels east. In addition, the market anticipates increased fuel oil supplies arriving in Singapore from sources like the Dangote refinery in Nigeria, which has sold multiple cargoes for August and September loading, contributing to a supply overhang.

A key factor in Singapore toward managing the glut is the re-emerging demand from Chinese independent refiners. These refiners are incentivised by higher tax rebates and lower fuel oil prices, leading to increased fuel oil imports.

Singapore's own bunker sales also matter: HSFO bunker demand rose by 10.3pc in July to 1.96mn t compared with the same period last year, the latest data from the Maritime and Port Authority of Singapore showed.

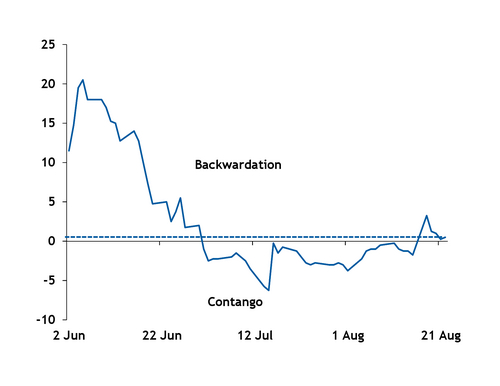

The HSFO market in Singapore showed a shift in its structure during August. In early- to mid-August, the HSFO time spread was primarily in contango. But it flipped into backwardation on 18 August (see chart), signaling easing of the Singapore HSFO residual fuel oil stocks. If this trend continues, Singapore could take in more Middle East and west African barrels without significant downward pressure on prices. But unless demand growth keeps pace, the additional inflows may still cap any upside in bunker margins into the fourth quarter.