Weaker margins and poor downstream consumption have weighed on propane demand, writes Efcharis Sgourou

Seasonal restocking demand in the northwest European large cargo propane market has been subdued over the first half of this month, with prompt spot bids for cargoes proving fewer and less aggressive than anticipated. This is because downstream buyers remain well supplied before peak winter season as record volumes of LPG arrive in the region from the US.

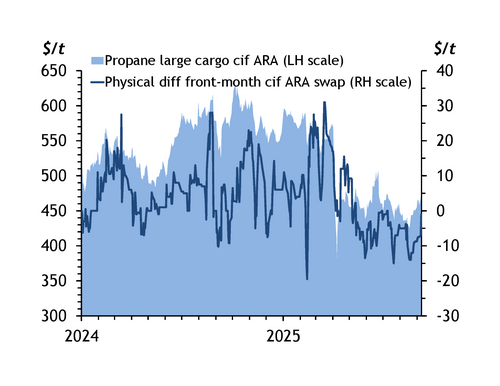

Large cargo propane prices have been stuck at $450-470/t cif Amsterdam-Rotterdam-Antwerp (ARA) during the first half of the month. More strikingly, despite sporadic summer rebounds, prices have failed to recover from pre-April levels when US president Donald Trump's "Liberation Day" trade tariffs triggered a collapse at the start of the second quarter. September prices have averaged $469/t, down by $85/t from $554/t a year earlier.

Some market participants had hoped that buying interest for restocking before the heating season would support values, but this has yet to materialise. Trading firm Gunvor was the only company to make persistent bids in the spot trading session for a 23,000t propane cargo for delivery in early October, at a discount of $3-7/t to September and October cif ARA paper.

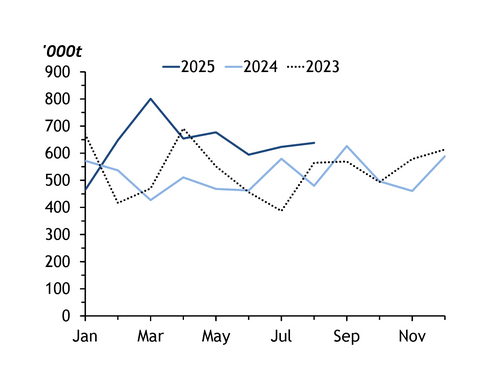

Northwest European imports of US LPG have risen this year with shipments standing at nearly 640,000t in August, compared with 480,000t a year earlier, despite it being the summer off-season, and hitting a record high of 801,000t in March, data from Kpler show. Imports from the US averaged 637,500 t/month in January-August, an increase of 26pc from 504,500 t/month a year earlier.

Propane's $80-90/t discount to naphtha in September has kept it the favoured feedstock for ethylene steam crackers, but demand from the sector has been subdued. Cracker shutdowns, weak margins and sluggish downstream consumption have reduced the scale and frequency of petrochemical sector buying.

Heating is the most important seasonal driver for European propane prices. A colder-than-average start to winter could still eat into plentiful stocks, allowing cif ARA values to push back above $500/t. But this is less likely than the market remaining well supplied given the trend of warmer winters. Petrochemical switching to LPG from naphtha is unlikely to provide much relief on its own.

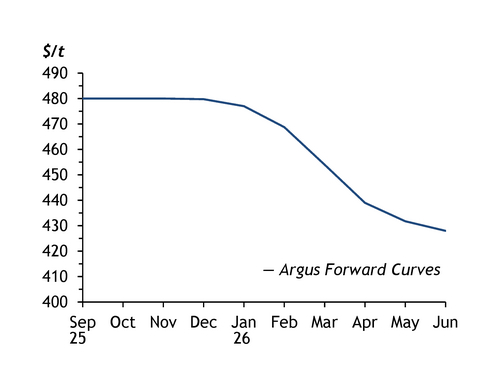

Propane swaps also hint at market stagnation, with cif ARA swaps for September and October oscillating between contango and backwardation since the start of this month. The fluctuations imply that there is no clear short-term outlook as the market tries to gauge whether incoming winter buying will be sufficient to tighten fundamentals. The rest of the cif ARA forward curve is essentially flat until January, with the differential between November and December at $0/t.

The heat is on

In contrast, the Asia-Pacific forward curve on Argus Far East Index (AFEI) swaps had September AFEI at nearly $12/t cheaper than December in mid-September, pointing to an expected rise in buying and also a widening front-month AFEI-cif ARA spread that would lift the former's premium to the low $80s/t from the high $60s/t by the end of the year. This should make the US arbitrage to Asia-Pacific more attractive than the equivalent to northwest Europe, potentially drawing volumes away from Europe and reducing the prospect of an oversupplied market over winter. But elevated US propane supplies could offset this impact, with inventories at 97.6mn bl (7.87mn t) by 5 September, 12pc above the five-year average.

For now, the European market is waiting for seasonal demand to see momentum. As colder weather moves in, heating demand will rise, supporting depressed prices. But only a few market participants expect them to climb to levels seen before April's fall. Instead, European propane prices look to be affected by ample supply, lacklustre consumption and a lingering drag from trade policy uncertainty.