The Global LPG Partnership (GLPGP) is a UN-backed non-profit organisation formed in 2012 to support developing countries scale up access to LPG for clean cooking. Elizabeth Muchiri is the organisation's director for east Africa, based in Nairobi, Kenya, and has participated in a variety of state-backed projects in Kenya and across the region. Argus' Yasmin Zaman spoke with Muchiri to discuss the Kenyan market and plans to establish Kenya as an important African LPG hub:

What is the status of Kenya's LPG market expansion?

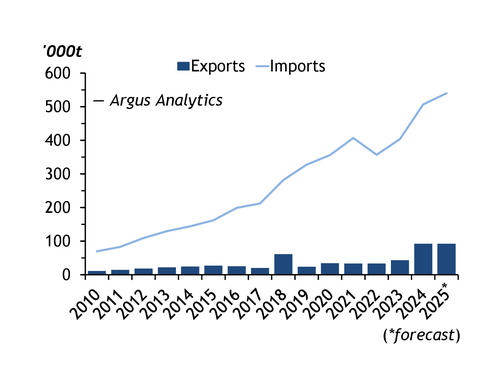

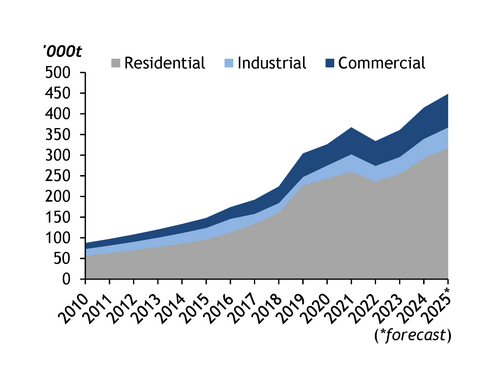

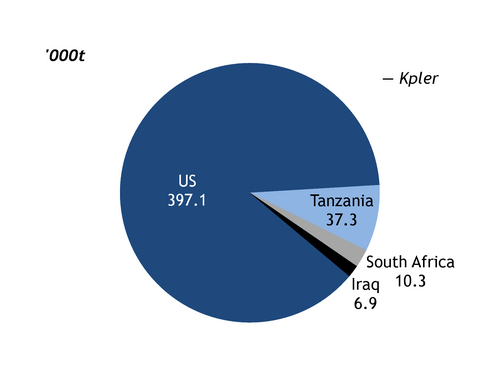

Kenya's LPG market has made notable progress over the past few years, although per capita consumption remains below the government's ambitions. Current levels are around 7 kg/yr compared with a target of 15 kg/yr. Demand has risen steadily, to 415,000t in 2024 from 326,000t in 2020, with fluctuations along the way in 2021 and 2022. When these totals are divided by population, the per capita figure shows slow but consistent growth, suggesting that LPG is gradually gaining ground as a mainstream household fuel. Nairobi dominates the market, consuming an estimated 60pc of volumes, while Mombasa and other regions lag behind. Unfortunately, no reliable data exist on the urban–rural split, although adoption is clearly concentrated in cities. The government has set a 2028 target for universal clean cooking access, with LPG expected to account for half. Compared with its neighbours, Kenya leads — Tanzania's per capita use is around 3 kg/yr and Uganda's is less than 1 kg/yr.

How does Kenya's LPG market differ from others in the region?

Kenya's LPG market is the most advanced in east Africa and one of the most complex. Unlike neighbouring countries, where consumer bases are still small, Kenya has seen widespread entry of private players, with around 80 marketers operating in the sector. This fragmentation is in stark contrast to the situation just a few years ago, when the market was dominated by five key firms, when the government created a mandatory cylinder exchange pool. The exchange system allowed consumers to buy a refill of any available cylinder by exchanging the empty cylinder at the retail outlet. The regulations allowed branded cylinders to be exchanged among the marketers, with each marketer still refilling and marketing [their] own cylinders. But the system weakened as more companies entered, with some marketers failing to give the cylinders to the owners and illegally refilling them instead. The mandatory exchange ended in 2019, but the practice continues in the market, impacting investment and raising safety concerns. Despite this challenge, Kenya's scale and demand have made it the regional leader, whereas countries such as Tanzania and Uganda are only beginning to see meaningful adoption.

What have been the main successes and challenges in the past two years?

The past two years have brought both innovation and frustration for Kenya's LPG sector. On the positive side, the most visible success has been the rise of autogas. Thousands of vehicles, particularly in Nairobi, have been converted to run on LPG, and new autogas-only filling stations are emerging alongside traditional petrol stations. Industry estimates suggest as many as 15,000 vehicles may already be using the fuel, although official figures are hard to come by. Importantly, this growth has been entirely market-driven, with no government incentives. Another notable success has been the widespread growth of pay-as-you-cook LPG, which started in low-income areas of Nairobi and has now moved to peri-urban areas of other towns.

The biggest challenge is the continuation of the mutual cylinder exchange system, which encourages illegal refilling. Illegal refilling deters investment in new cylinders, as marketers are unwilling to increase cylinders only for others to refill. Although domestic LPG use has risen, much of the overall growth in 2024 has been driven by autogas rather than household consumption. Competition from electric vehicles is also beginning to reshape the energy transition landscape.

Have supportive government policies such as tax cuts made a difference?

Policy changes have been a key factor in shaping Kenya's LPG market, especially the removal of VAT on LPG, which has helped stabilise prices and improve affordability. The VAT history has been turbulent — [LPG] was first zero-rated in 2005, reinstated at 16pc in 2013, then scrapped again in 2016. In 2022, VAT on LPG was reintroduced at 8pc, but lasted only that year. A proposal to bring it back was eventually dropped. This consistency has lowered costs for households, particularly low-income earners, and provided certainty for marketers. In addition, the government's efforts to distribute cylinders to vulnerable households have broadened access and encouraged new users to adopt LPG. While these measures have not been sufficient to meet the government's targets, they have laid important groundwork for further growth. The combination of fiscal support and consumer-focused initiatives has improved affordability, but challenges remain around sustainability, long-term refill uptake, and the ability of new users to continue using LPG regularly.

What more can be done to expand use into rural areas?

Rural adoption of LPG in Kenya has been growing, largely thanks to the entry of multiple marketers and the availability of smaller, affordable cylinders. The 6kg cylinder, typically sold with a screw-type burner and tripod, has become a popular option for low-income households. This package has made LPG accessible in regions where affordability and transportability are major barriers. But pricing remains highly fragmented, with retail prices ranging from 190 shillings/kg [$1.47/kg] to KSh230/kg, depending on the seller. With no price controls, both branded companies and informal operators compete on the open market, which can confuse consumers and raise safety concerns. Expanding adoption further will require stabilising supply chains, extending safe distribution networks into rural areas, and building trust through consumer education. Greater enforcement against illegal operators could also help protect households and foster investment in the sector.

Why did the Mwananchi project fail to deliver on expectations?

The Mwananchi Gas Project, launched in 2016, aimed to distribute 6kg cylinders to low-income households but has struggled to achieve its intended impact. Records indicate that just 5,444 out of 161,448 cylinders were refilled within the first year. Still, the project has clearly not scaled as planned. Recently, the government signalled that the scheme may be revived through a public-private partnership, with the private sector expected to take a stronger operational role.

What role could Kenya's plan to increase LPG usage in schools play?

The LPG schools programme represents an important step in Kenya's clean cooking strategy, aiming to reduce reliance on firewood and charcoal in public schools. By introducing bulk LPG systems, the scheme not only improves the health and safety of school kitchens but also helps tackle deforestation. But implementation has been slower than anticipated, largely because of the financing and logistical demands of installation. Each school must undergo a safety audit, site verification, and design process all while daily operations continue. This makes conversion to LPG a gradual process. Although the government has taken ownership of the programme, private-sector firms were already piloting similar initiatives and many continue to support schools in their transition. The challenge remains the pace of funding and execution, but the long-term benefits make it a critical part of Kenya's clean energy push.