French power prices for next year have fallen further below connected markets on continued strong nuclear availability, renewables additions and stagnant demand.

The French calendar 2026 was assessed at an all-time low of €55.40/MWh on 24 October. And on Monday morning it traded even lower at €54.37-54.81/MWh.

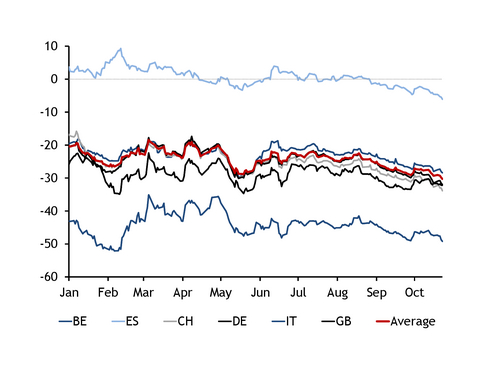

The front year was already well below all neighbours on 24 October and has likely fallen further on Monday. Its average discount to France's six interconnected markets averaged €30.29/MWh on 24 October, the widest since assessments began, with discounts ranging from €6.10/MWh for Spain to €49.20/MWh for Italy. Individual discounts to Spain, Germany and Switzerland reached record lows, although discounts to Belgium, Italy and the UK have been wider on individual days previously.

France's discount to its four northwest European neighbours have typically held in a relatively tight band. The four markets have in common that gas is generally their marginal fuel, to a greater extent for the UK than for others, explaining its typically higher price and wider discount.

Meanwhile, France's discount to Italy has held much higher than to any other neighbour. Italy has relatively low renewables capacity, compared with the other neighbours, boosting its price.

Spain started the year below France, as its large renewables capacity means its price is set in many hours by zero-marginal cost renewables, or by hydro reservoir plants whose price is determined by their water value, rather than gas as in all of France's other neighbours.

Unlike neighbours where either gas or zero-marginal cost renewables are the marginal generator most of the time, France's nuclear and hydro fleets set the price in most hours.

EdF's nuclear fleet has a fuel cost of roughly €8/MWh, according to energy regulator Cre. Its true marginal cost is likely higher than this, as frequent cycling of its plants accelerates wear and tear and could increase operating costs and reduce their ultimate lifespan. But in any case this is well below gas-marginal costs. France's combined cycle gas turbine fleet sits mostly unused in the summer, and in winter comes on line only in high-demand periods. October 2024-March 2025 output held below 500MW in 47pc of hours, roughly the output accounted for by must-run plants that do not set the marginal price.

But the nuclear fleet's average cost is likely far higher than its marginal cost, with energy regulator Cre estimating it at €60.30/MWh in 2026-28. The operator's output is concentrated in high-price periods, allowing it to extract more value than the outright price would imply. But extended periods of prices well below the average cost of nuclear generation could still weigh on EdF's ability to finance its planned investments over the coming decades, while keeping its indebtedness in check.

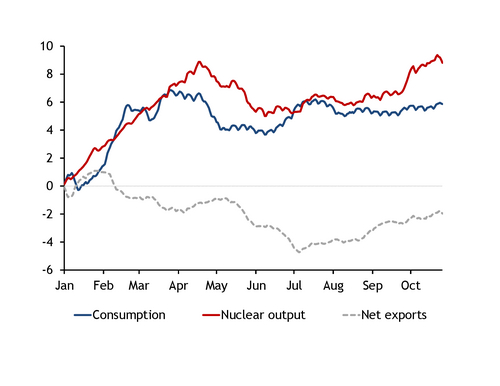

Nuclear supply next year could be in a similar range to this year. Unavailability across EdF's fleet is scheduled at 11.5GW, compared with 12.4GW for 2025 at this point last year.

Meanwhile, ongoing renewables additions mean some supply growth is likely baked in for the coming years. Solar additions held strong at 1.5GW in the third quarter and the rapid rate of additions could continue, despite a reduction in subsidy this year, as many projects in the pipeline registered before the subsidy was reduced.

As delivery is only two months away, short-term weather forecasts can begin affecting the front year, as conditions in the coming weeks will affect hydro and gas storage levels, and fuel levels in reactors, which have a limited stock before their next refuelling halt. Temperatures in Paris are forecast to hold 1-2°C above average in the first 10 days of November, while precipitation in the hydro-rich Alps is seen at roughly twice the seasonal norm.

On the demand side, France's consumption is roughly flat on the year, discounting weather effects. Consumption has totalled 344TWh so far this year, up on 338TWh at this point in 2024. But most of this surplus was incurred in February, when cold weather boosted demand, and it has since then held at a roughly 4-7TWh surplus year on year.

Increases in demand from data centres remains one of the elements that could tighten balances in the coming years. But estimates of current demand span a wide range, from 4-12TWh/yr, suggesting little certainty over the amount by which demand could increase.

Meanwhile, no interconnection projects to more expensive markets are scheduled to come on line until 2028, when France will gain an interconnection to Ireland with the 700MW Celtic Link. And upgrades to transmission infrastructure to Belgium and Germany are planned only from 2029-32.

The front year price of roughly €55/MWh is below the likely final average spot of 2025, which based on past spot prices and forward contracts could settle near €61/MWh. But higher gas prices boosted electricity at the beginning of 2025. The French Peg everyday price could average roughly €36/MWh across the year, compared with its front year assessment of €30.22/MWh on 24 October.