The Norwegian Offshore Directorate's (NOD) forecast that 2027 production will be higher than this year and in line with 2026 despite heavy scheduled maintenance is probably the result of new fields coming on line and firm Troll production.

The NOD in mid-October forecast Norwegian output at 329.9mn m³/d in 2027, stable on 2026 despite the heavier works and above the NOD's projected 2025 output of 324.5mn m³/d.

Norwegian fields, including Snohvit, which delivers only to the 4.2mn t/yr Hammerfest LNG terminal, produced 324.4mn m³/d in January-August this year, the latest data show.

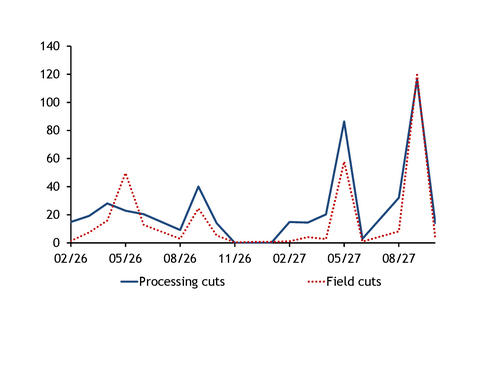

But Norwegian offshore operator system Gassco's works schedule shows that capacity cuts at Norwegian fields in 2027 will be heavier than those set for 2026 and the heaviest since 2023, when Norwegian capacity was reduced by 150mn m³/d in September. September is typically the month with the heaviest unavailability at Norwegian fields, with capacity cuts set at 119.6mn m³/d in September 2027, well above 25mn m³/d scheduled for September 2026 and actual cuts of 72mn m³/d in September this year (see future unavailability graph).

Norwegian works have remained relatively light over the past years, which may in part explain the heavy works in 2027.

Output from new fields in 2027 coupled with high Troll production rates may help offset the decline in production from maturing assets and heavy scheduled works. One new field is set to come on line in 2026 and 10 new fields in 2027, mainly through tie-backs to existing infrastructure, NOD data show (see upcoming fields table).

Troll to run at high capacity

Gassco lists Troll's technical capacity at 129.1mn m³/d in 2027, equal to 47.1bn m³/yr, suggesting that the field could consistently operate at a higher capacity than in 2025, supporting Norwegian output that year.

Troll produced 39.4bn m³ in October 2024-August 2025, while the field's technical capacity is listed at 124.2mn-131.5mn m³/d in the 2025-26 gas year, according to Gassco's maintenance schedule — equivalent to 45.3bn-48bn m³/yr. But this does not factor in lower availability during maintenance.

Troll is scheduled to be off line on 2-18 September 2027. This would be the longest complete outage at Troll since September 2023, when it was off line from 26 August–17 September. Troll produced only 32.3mn m³/d in September 2023, while output from Norwegian fields — excluding Snohvit — totalled 184mn m³/d, the lowest for any month since September 2019.

Troll has consistently operated at higher capacity since the 2023-24 gas year. The 2023-24 permit was revised up to 42.2bn m³, or 115.3mn m³/d — the highest ever — in August 2024, well above the quota of 38.5bn m³ for the 2022-23 gas year.

Although the production quotas for the previous and current gas years are not confirmed, documents seen by Argus imply that they are high.

Equinor's 2025-26 permit application for Troll also refers to a shifting focus from oil well technology to gas recovery optimisation and modelling, further signalling the potential for strong gas production.

This follows operator Equinor's announcement in May 2024 that it will invest just over 12bn kroner (€1.02bn) to develop gas infrastructure in the Troll West gas province. The first wells are scheduled to come on stream at the end of 2026, according to Equinor.

Investment in Norway's oil and gas sector continues at record levels and is mainly focused on production drilling at fields being developed and already on stream, rather than exploration.

Forward prices suggest an incentive for firms to maximise production over the next two years rather than deferring output. The TTF calendar 2026 market closed at a €2.33/MWh premium to the calendar 2027 price on Tuesday, while the TTF calendar year 2027-28 spread was wider at €2.69/MWh.

| Upcoming Norwegian fields | bn m³ | |||

| Field name | Location | Operations start | Infrastructure notes | Reserves |

| Irpa | Norwegian Sea | 2026 | Tie-back to Aasta Hansteen | 21.5 |

| Alve Nord | Norwegian Sea | 2027 | Tie-back to Skarv | 4.1 |

| Fenris | North Sea | 2027 | Tie-back to Valhall | 14.0 |

| Fulla | North sSea | 2027 | Part of the Yggdrasil area | 8.4 |

| Hugin | North Sea | 2027 | Part of the Yggdrasil area | 6.6 |

| Idun Nord | Norwegian Sea | 2027 | Tie-back to Skarv | 3.0 |

| Munin | North Sea | 2027 | Part of the Yggdrasil area | 21.3 |

| Symra | North Sea | 2027 | Tie-back to Ivar Aasen | 1.3 |

| Orn | Norwegian Sea | 2027 | Tie-back to Skarv | 8.0 |

| Bestla | North Sea | 2027 | Tie-back to Brage,transported through Karsto | 0.8 |

| Berling | Norwegian Sea | 2028 | Tie-back to Asgard | 4.5 |

| — NOD | ||||