Australia's safeguard mechanism could see carbon unit surrenders reach as high as 13.4mn for the July 2024-June 2025 compliance year, up 4.2mn on the year, while issuance of safeguard mechanism credits (SMCs) is expected to remain strong at 7mn, according to preliminary data released today.

A total of 59 facilities out of 207 covered under the scheme that year may be eligible to earn up to 7mn SMCs, down by just 1.5mn from the final 8.5mn eligible for the July 2023-June 2024 year, the Climate Change Authority (CCA) said in its 2025 Annual Progress Report on 27 November.

The scheme applies to facilities emitting more than 100,000t of CO2 equivalent (CO2e) in a compliance year across several sectors. These facilities face a 4.9pc/yr baseline decline rate until 2029-30 and can earn SMCs if their reported scope 1 emissions fall below baselines. Conversely, they must surrender Australian Carbon Credit Units (ACCUs) or SMCs if emissions exceed the threshold.

The SMC figure for 2024-25 is higher than previously forecast, with Australia's Department of Climate Change, Energy, the Environment and Water (DCCEEW) having estimated 5.7mn for 2025 in its 2024 emissions projections.

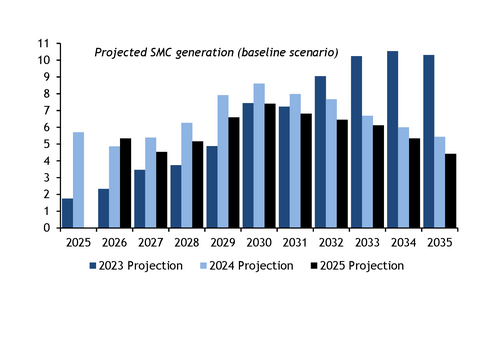

The DCCEEW has revised its SMC generation forecast for 2026 upward in its 2025 emissions projections released today, to 5.34mn from 4.86mn previously. However, forecasts for all subsequent years have been revised downwards — combined SMC issuance between 2026-35 is now expected at 58.17mn, down 8.63mn from the previous estimate (see chart).

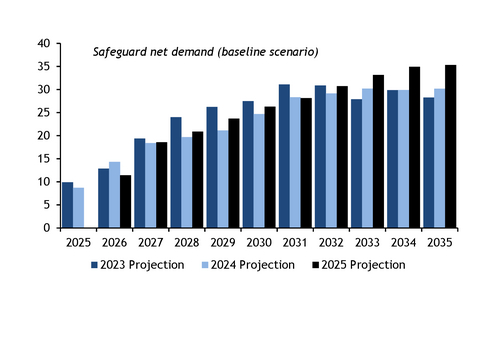

The DCCEEW also adjusted its net safeguard demand forecast. It now expects net demand for ACCUs and SMCs to reach 11.42mn in 2026, down from 14.33mn previously, while demand for most subsequent years is projected to mostly rise compared with earlier estimates (see chart).

Tighter baselines driving excess emissions

The CCA's 2025 Annual Progress Report shows that 140 facilities exceeded their baselines in 2024-25 by a combined 13.4mn t CO2e, compared with final numbers of 9.2mn t CO2e across 142 facilities for 2023-24.

This reflects the impact of reduced baselines and the time facilities need to transition to low-emissions technologies, the CCA said. The year-on-year decrease in SMC issuance eligibility also highlights tighter baselines, which make it harder for facilities to earn units without adopting low-emission technologies.

"This suggests that liable entities will need to surrender a higher amount of ACCUs and SMCs [compared with last year] to acquit their liabilities, and/or invoke other flexibility measures for managing liabilities under the scheme," it noted.

The use of flexibility mechanisms — including trade-exposed baseline-adjusted (Teba) arrangements and multi-year monitoring periods — will influence final requirements, likely resulting in surrenders below 13.4mn carbon units.

For comparison, emissions exceedances were initially estimated as high as 10.7mn t CO2e in the CCA's 2024 Annual Progress Report, but actual surrenders reached 8.44mn carbon units as of 31 March 2025, with five facilities failing to surrender around 800,000 units by that deadline. SMC eligibility for 2023-24 was also initially estimated at 9.2mn, but ended at around 8.5mn units, with 8.3mn issued so far, as there is no deadline for a safeguard facility to claim SMCs when eligible.

Overall, today's preliminary data indicates gross emissions across all facilities at 132.7mn t CO2e, down from 135.9mn t CO2e the previous year.

Net emissions are estimated at 119.6mn t CO2e, down sharply from 127.5mn t CO2e, indicating the CCA expects ACCU and SMC surrenders of around 13.1mn.

The 2.4pc decline in gross emissions was mainly due to some facilities falling below the 100,000t CO2e/yr coverage threshold, largely because of permanent closures, reduced production, and temporary shutdowns, the CCA added.