Higher payments for LPG cylinder distributors could help bring the total received from the government to $1.3bn by the end of 2026, write Gabriel Lara and Matt Scotland

Brazilian LPG distributors and retailers will receive about 174mn reals ($32.5mn) more than initially expected from the Brazilian government to meet higher demand for the Gas do Povo — or People's Gas — subsidy programme.

The Brazilian mines and energy ministry increased the listed price to be paid to distributors of 13kg gas cylinders that will be given to millions of Brazilians by approximately 2.6pc following intense pressure from LPG distributors' union Sindigas. The average price of a gas cylinder in the country is now R103.93 compared with R101.26 set in October.

The price update addresses some of the sector's concerns over profitability. But the scheme is still on course to affect LPG distributors operating in more remote regions of the country, especially those in north Brazil, distributors say.

The People's Gas scheme came into effect on 24 November despite the proposal still working its way through congress. A final draft of the plan was due to be issued on 25 November but has been delayed owing to disruptions to the congressional agenda as a result of the UN's Cop 30 climate summit, which was held in Belem, Brazil, last month, the commission tasked with producing it says. But it is not expected to affect the initial roll-out of the programme. The government estimates it will have distributed the first 1mn LPG cylinders under the scheme by the end of 2025 and 65mn by the end of 2026. If this target is met, the sector should receive about R6.75bn.

The price update has increased the price paid to distributors for gas cylinders delivered mainly in the southern, northern and northeastern regions of Brazil, where logistics costs are higher. Prices are 6pc higher than initially established in the south, 4.6pc higher in the north and 1.58pc higher in the northeast.

The new pricing also includes monthly price updates that take into account international market conditions, and provides for an extraordinary update in cases of global LPG market supply or demand shocks.

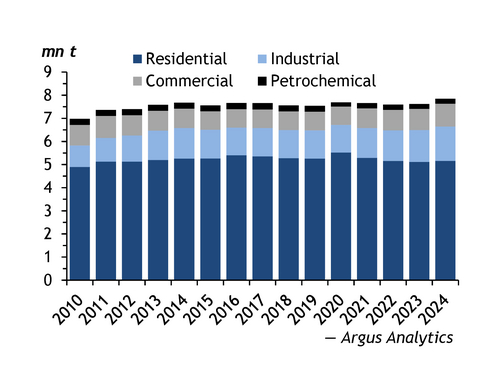

The subsidy scheme is likely to increase Brazil's LPG consumption next year, which will in turn necessitate greater imports, delegates heard at the World Liquid Gas Association's Liquid Gas Week in Rio de Janeiro in September. The programme will increase LPG sales by 5-8pc, Sindigas president Sergio Bandeira de Mello said on the sidelines of the event. Consumption stood at about 7.6mn t in 2024, Sindigas data show. But industry participants noted several regulatory concerns, including the ability to refill 13kg cylinders remotely and in small increments.

Perverse incentive

"If anybody can use anybody's cylinder, you run the risk of bringing organised crime to the distribution chain," de Mello said at the event. Allowing the purchase of fractional amounts of LPG additionally introduces higher costs for market participants, Carlos Ragazzo, a law professor at think-tank Fundacao Getulio Vargas, said. This encourages participants to look for ways to reduce costs. "There's a huge incentive… to not act correctly," he said.

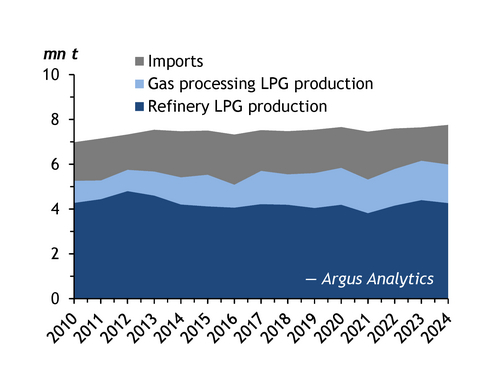

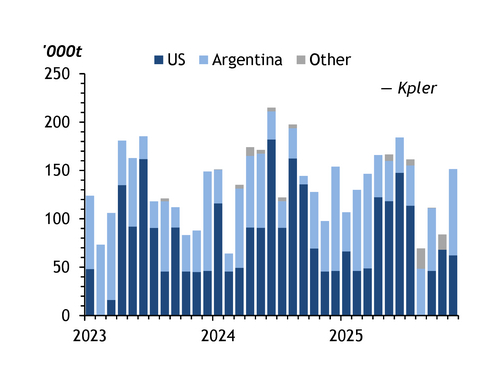

Brazil's seaborne LPG imports stood at close to 1.5mn t in January-November, down by 7.7pc on the year, according to Kpler, despite demand edging up by 1.6pc to early 6.5mn t, Sindigas data show. This may be partly owing to state-owned Petrobras boosting output in Rio de Janeiro from a new gas processing unit that opened in May and can produce about 730,000 t/yr.

Delegates at Liquid Gas Week said growing demand from the People's Gas scheme would lift imports mainly from the US. But arrivals from the US fell by 26pc to 800,000t in January-November, while imports from Argentina grew by 28pc to 629,000t. The recent shift to Argentinian supply comes as Argentina's LPG production and exports surge as it develops its vast Vaca Muerta shale formation.