Combined Finnish and Baltic gas consumption was down by 9pc on the year in 2025, with demand lower in all four countries.

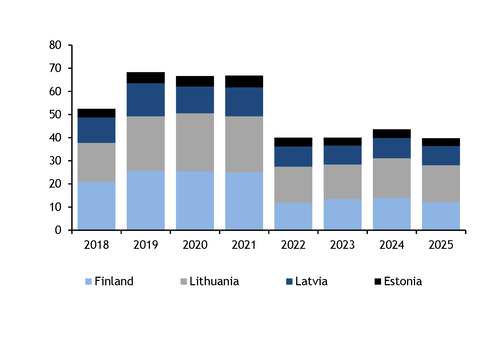

Consumption across Lithuania, Latvia, Estonia and Finland totalled 39.7TWh in 2025, down from 43.6TWh in 2024 and continuing its downward trend that began in 2022 in response to the energy crisis (see combined consumption graph, data and download). Gas demand in the region is down by 41pc since 2021 or by 27TWh.

The region is now almost entirely dependent on LNG imports, with only limited volumes of pipeline gas delivered from Poland. Combine sendout from the Inkoo, Hamina and Klaipeda LNG terminals totalled 40.2TWh last year, down from 43.4TWh in 2024 and substantially above 32.4TWh in 2022, when the region still received some Russian pipeline deliveries.

Russian pipeline flows stopped in 2022, while Russian LNG was last received in July 2024. Russia's Gazprom suspended deliveries to Finland's largest gas importer, Gasum in May 2022, following the refusal to transition to payments in roubles. And Lithuania was the first EU country that halted Russian supply in April 2022, in response to Moscow's war in Ukraine. That said, some volumes of Russian gas continue to go through Lithuania as transit volumes to meet the needs of Russia's Kaliningrad.

The Latvian Incukalns is the only storage facility in the region, with a technical capacity of 24.9TWh. Stocks totalled 10.5TWh on 12 January, a 4.7TWh year-on-year deficit, according to GIE transparency platform data. The available infrastructure was used also for deliveries to the region including Ukraine. Ukrainian private-sector firm DTEK received its first cargo at Klaipeda for delivery to Ukraine, and other central and eastern European markets in November. Lithuania was a net exporter to Poland of 4.4TWh in 2025, up from 1.1TWh a year before.

Users move away from gas

Milder weather — combined with European climate policy and rising environmental levies — encouraged users to reduce gas consumption.

Milder weather in the region may have weighed on gas needs, as minimum temperatures averaged 2.7°C in 2025 in Helsinki,Tallinn, Riga and Vilnius, up from 2.5°C a year earlier.

The EU emissions trading system (ETS) daily index averaged €74.92/t of CO₂ equivalent (CO₂e) in 2025 and stood at €89.46/t on 12 January, sharply above the €66.44/t CO₂e average in 2024.

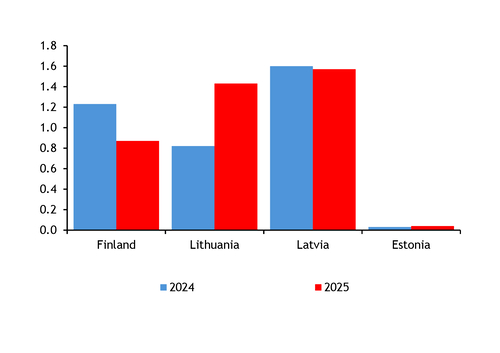

Gas-fired generation still plays a limited role in the region, but its share in the power mix edged up on the year to 11pc from 10pc in 2024. Combined gas-fired output across the three Baltic states rose to 3.04TWh in 2025 from 2.45TWh a year earlier, while Finnish gas-fired generation fell to 870GWh from 1.23TWh, according to data from Fraunhofer ISE (see gas-fired power graph).

Baltic countries had a 68pc share of renewables in their generation mix in 2025, while Finland had a 55pc share. And the European Commission approved a €2.3bn financial scheme to support Finland's transition to net zero emissions. The scheme includes support for investment renewable energy production, and has been provided as a tax credit. This is likely to weigh on gas demand from industrial users, which may be required to reduce fossil fuel use to access the financial support.

Lithuania's largest gas consumer, fertilizer producer Achema, restarted one ammonia unit at its Jonava plant in August, supporting regional industrial gas demand. The site operates two ammonia units, each capable of consuming up to 21 GWh/d. But Achema faces the same pressures as the wider European fertilizer sector, including low-cost imports, high environmental levies and uneven competition. The company has posted losses for the past two years and suspended ammonia production for three months this year on the back of high gas prices and weak margins.