With net zero-related subsidies under fire for stoking energy costs and demand still conspicuous by its absence, the industry faces another tough year, writes Chingis Idrissov

The UK's hydrogen ambitions face a critical test in 2026 after another year of missed policy deadlines, the collapse of flagship blue hydrogen projects, persistent cost challenges for renewable hydrogen and growing political uncertainty.

The UK is officially still aiming for 10GW of low-carbon hydrogen production capacity by 2030, but this goal has slipped further out of reach because of cancellations and delays, including for carbon capture and storage (CCS)-based projects.

Kellas Midstream and SSE Thermal paused their 1GW H2NorthEast CCS-based project in Teesside in September, citing policy uncertainty and market conditions. And in November, BP cancelled plans for its 1.2GW H2 Teesside project because of a land use conflict with a planned data centre and weak demand prospects.

Setbacks for CCS-based hydrogen came despite some progress for the UK's CCS plans more broadly, helped by clearer policy and funding support. The HyNet CCS project reached a final investment decision (FID), while the government launched a second CO2 storage licensing round and confirmed backing for the Viking and Acorn sites. Hydrogen projects were once prominent in the country's CCS plans, but are now set for a minor role at best, at least in the short to medium term.

Electrolytic hydrogen has hardly fared better. Following lengthy delays, 10 of 11 projects awarded subsidies under the government's first hydrogen allocation round (HAR1) had signed final agreements by the end of last year. But not all supported projects will be built. Scottish Power said in September that it would no longer pursue its two projects with subsidy agreements, and industry participants say more could fall through. So far, only GeoPura has finished building its site and is now ramping up output at HyMarnham. Octopus' Northfleet project is the only other plant to have reached FID.

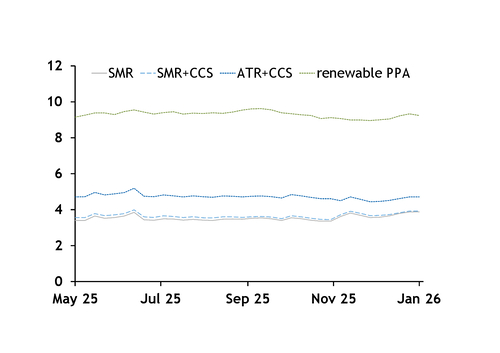

Final results from HAR2 are expected this quarter, also much later than planned. Supported capacity will probably remain far below the 875MW initially targeted. The 27 projects shortlisted in April have a combined capacity of just 765MW and industry participants expect this to be whittled down much further. They say developers will struggle to meet the government's expectations that strike prices will be significantly reduced from HAR1's £241/MWh as there is little scope to secure lower renewable power supply costs and there are mandates for renewable hydrogen use. All this does not bode well for HAR3, which is due to be launched later this year.

More uncertainty

The lack of certainty extends beyond production projects. London has yet to finalise its subsidy models for hydrogen transport (HTBM) and storage infrastructure. Gas network operator Cadent has paused planning for its HyNet North West hydrogen pipeline, citing uncertainty over the HTBM, which will not be finalised until spring.

Sluggish progress will have to be reflected in a revised hydrogen strategy, arguably with new targets, but the timeline for this has slipped as well. The government targeted autumn 2025 for the new release, but says it now expects the strategy to be published early this year.

The outlook for 2026 is further clouded by political uncertainty. The right-wing Reform UK party has taken the lead in recent polls, putting the Labour government on the defensive over its energy agenda. The government plans to increase clean energy investment by more than £30bn/yr over the next 10 years as part of its industrial strategy. But energy secretary Ed Miliband's Clean Power 2030 Action Plan and the net zero by 2050 goal are under mounting scrutiny as opponents frame net zero-related subsidies as drivers of higher energy costs.