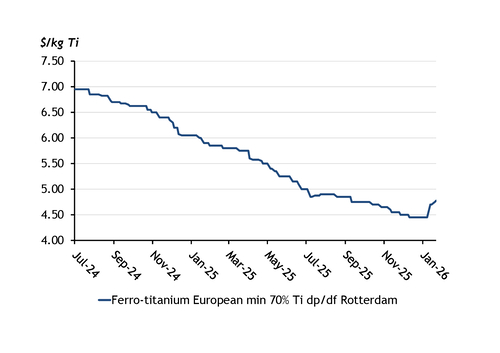

European ferro-titanium prices have increased by 7pc since 8 January, after producers hiked offers in response to a squeeze on scrap availability and some steel mills sought alternative supply sources to Latvian producer LLR-Ecotech in response to its Austrian parent company filing for insolvency.

Argus assessed European ferro-titanium prices at $4.65-4.90/kg Ti dp/df Rotterdam on 22 January, up by 7pc since 8 January and the highest since 11 September. The increase was supported by a number of factors but some market participants still question the sustainability of the rise based on broader weak demand fundamentals.

The market was in a sustained decline from June 2024 until earlier this month because of depressed demand from steel mills and falling scrap costs. Underlying demand has not materially changed. Overall demand this month has consisted of standard enquiries from trading firms, cored-wire producers and mills for spot first-quarter volumes. One mill also released a large enquiry on a long-term contract basis.

For prices to be sustained or rally further, there would need to be a significant increase in real consumption from mills, which in the broader pressured context of Europe's steel industry seems unlikely.

Austrian metal trading firm LL-Resources (LLR) filed for insolvency on 5 January because it was not able to utilise credit lines following the discontinuation of a factoring agreement. Its Latvian ferro-titanium producer subsidiary SIA LLR-Ecotech subsequently confirmed that its operations have not been affected by the insolvency.

But the announcement still triggered scrap suppliers and ferro-titanium producers to withhold or hike offers, while some steel mills moved to review alternative suppliers.

Reviewing and qualifying alternative producers allows steel mills and cored-wire producers to manage their risk in case of non-delivery. But unless LLR-Ecotech fails to deliver and declares force majeure, which has not happened, then those mills cannot renege on existing contracts. This means at least some of the enquiries currently in the market are hypothetical.

Producers have adopted varied stances in response. The prevailing approach has been a rise in offers to around $4.75-4.90/kg Ti, at which level Argus has confirmed multiple transactions. One producer has hiked its prices to $5.60/kg Ti, with a load reportedly closed at this level, but market participants broadly dispute the viability of prices above $5/kg Ti at this point. Other sellers are holding back from the spot market and instead prioritising their long-term commitments.

Argus assessed 90/6/4 titanium turnings at $1.70-1.90/kg ddp NWE on 22 January, up from $1.55-1.75/kg on 8 January. One ferro-titanium producer said that if turnings cross a $2/kg threshold, scrap sellers will enter the market after a long period of holding inventory in anticipation of higher prices. A separate ferro-titanium producer reported difficulty picking up turnings even at prices over $2/kg.

The squeeze on scrap is partly seasonal following inventory drawdowns in the fourth quarter and low generation rates during the Christmas and new year period. A fall in the dollar against the euro since 17 January has also factored into higher scrap costs.

Latvian imports of titanium scrap averaged 408 t/month in January-November, custom data show. If LLR-Ecotech stops buying scrap because it does not have sufficient cash flow or credit insurance then this would ease scrap supply, not tighten it. On the other hand, if LLR-Ecotech cannot produce and deliver ferro-titanium that would remove an average of around 477 t/month from the market.

But several sources pointed out this would not fundamentally change consumption and would just be a temporary reallocation of demand. This could sustain prices in the near term as other producers may not have spare production to serve additional customers.

Most European ferro-titanium producers are not operating at full capacity, but increasing output would require more raw materials. A flurry of further enquiries for titanium turnings and solids would drive up scrap prices further, which ferro-titanium producers would then factor into higher offers to prevent losses down the line.

The lag between purchasing, shipping, processing and melting scrap means that units purchased today would not be converted to ferro-titanium until one or two months time. If higher ferro-titanium prices do not hold, producers run the risk of incurring significant losses on higher-priced raw materials.