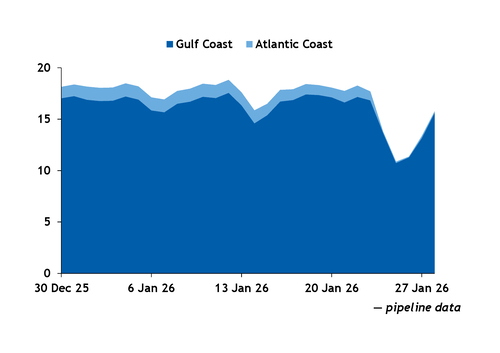

Flows of natural gas to LNG export facilities on the US Gulf coast continued to recover today with milder weather and lower regional gas prices, but flows to the two terminals on the Atlantic coast were still reduced, interstate pipeline data show.

Overall feedgas nominations climbed to 15.8bn ft³ on 28 January, up from a one-year low of 10.9bn ft³ on 25 January. The preliminary flows are 2.1bn ft³ below the 30-day average through 23 January, when the storm began affecting export nominations. Flows remain subdued to Cheniere's 33mn t/yr Sabine Pass terminal in Louisiana and the 4mn t/yr Elba Island and 5.75mn t/yr Cove Point terminals on the Atlantic coast, though nominations can fluctuate later in the day.

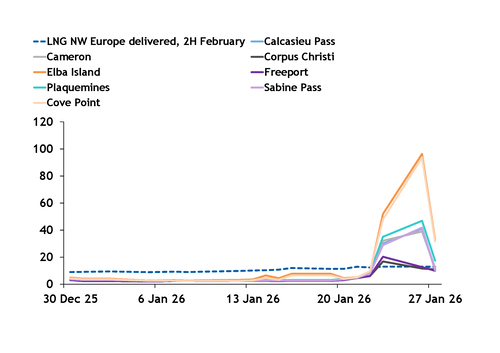

The return to normal ranges coincides with falling day-ahead gas prices at key regional hubs that tie into the Gulf coast export facilities. Those spot prices had risen above the value of LNG delivered to northwest Europe in the second half of February, which incentivized customers from LNG facilities with the flexibility to do so to send their feedgas toward the domestic market.

Feedgas costs to Cove Point and Elba Island have declined from record highs but stood at $31.70/mn Btu and $33.15/mn Btu, respectively, on 27 January. Both were well above delivered LNG prices in Europe in the second half of February, which were $12.88/mn Btu on the same day. A forecast for colder-than-normal weather on the US Atlantic coast through 1 February may continue to offer price support.

Both Cove Point and Elba Island are utilizing their regasification capacity to import LNG. BP's 174,000m³ BW Enn Snow Lotus LNG carrier delivered a cargo from Trinidad and Tobago to Cove Point on 26 January, and Shell's same-sized Paris Knutsen is set to deliver a shipment to Elba Island on 28 January, Kpler data show.