Political focus on the EU emissions trading system (ETS) has intensified noticeably in the past two weeks, weighing on prices, as leaders and policymakers consider how the scheme's approaching review can be used to address its implications for industrial competitiveness in the bloc.

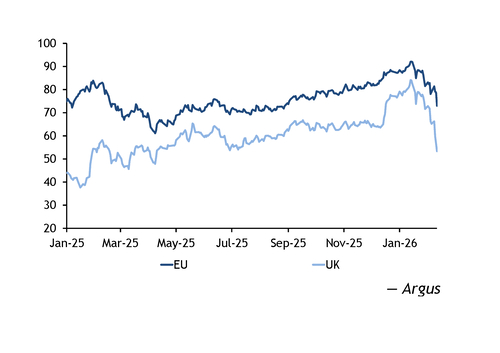

The benchmark front-year EU ETS contract dropped by almost 6pc on the day on 5 February, in reaction to media reports suggesting that the European Commission was planning to weaken the system.

EU officials were quick to express "surprise" at a "mix-up" in reports on the possible extension of free allowance allocation beyond 2034, emphasising that the trajectory and ways of aiding industrial decarbonisation will be part of the EU ETS review, legislative proposals for which are expected to be published by the European Commission early in the third quarter.

The EU ETS is increasingly under scrutiny as politicians look to address the high costs local industries are facing, threatening its competitiveness on the world stage. Emissions prices in reality only contribute a portion of such rising costs, which are driven by numerous factors feeding into higher energy costs and uncertain market outlooks. The global macroeconomic prospects are constantly exposed to geopolitical risks such as the Russia-Ukraine conflict — which has had a large impact on natural gas supply, or US tariff threats.

But as the EU ETS is a political instrument, set to undergo a major review later this year, it is seen as a much easier opening to address costs than wider energy markets, which are at the whim of wider economical and political factors.

Discussions came to a head as industrials and politicians gathered in Belgium for the European Industry Summit on 11 February — where industry seized the opportunity to lobby for adjustments to the system — and an informal EU leaders' summit the following day.

"After 20 years in the ETS we might have gone in the wrong direction," said Marco Mensink, director general of chemical industry association Cefic, which organised the summit.

German chancellor Friedrich Merz — whose CDU party is staunchly pro-business — weighed in on the matter, stating that "this system is not the system to generate new revenues".

"We should be very open to revise it or at least to postpone" the ETS, he said, without specifying what such a revision or postponement would entail.

He softened his comments the next day at the end of the leaders' summit, terming the ETS as an "effective instrument" in need of frequent revision to make sure it continues to work effectively.

But carbon prices had already fallen in reaction to his initial statement, dropping another 7pc in all on 12 February to stand at their lowest levels since August.

And comments by other EU leaders following the summit reinforced a general push to reform the system, even if details on how to do so were scant.

French president Emmanuel Macron said he wants "concrete" solutions from the European Commission in March to reduce the ETS price burden. Belgian prime minister Bart De Wever urged "intelligent" adaptations to industry's "too high" CO2 costs. And Czech prime minister Andrej Babis reiterated his position that ETS allowances are "destroying" his country's industry.

Commission president Ursula von der Leyen, who also attended the meeting, defended the ETS's "clear benefits", and pointed to its market stability reserve as an option to "modulate" the price. She had at the industry summit the previous day already emphasised that member states invest less than 5pc of ETS revenues in industrial decarbonisation, saying that "this will be a core focus of the upcoming reform of our ETS this summer."

A review of the system is not a surprise — it has been written into the EU ETS's governing directive since 2023. But lack of visibility on which changes member states will push for has left participants with an uncertain outlook.

"The events of the last two days have amply demonstrated that confidence requires political as well as regulatory stability," the International Emissions Trading Association said. "The EU ETS must remain protected from ad hoc political interventions that risk undermining investor confidence and weakening Europe's decarbonisation pathway."

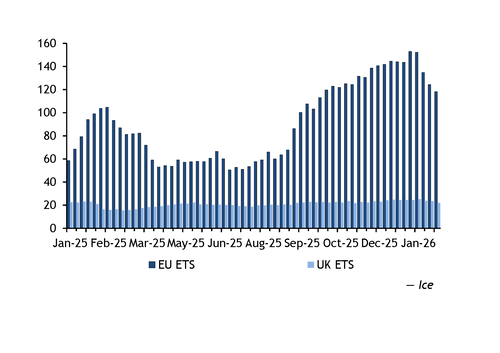

The still significant long position held by speculative participants leaves prices open to extensive downside risk. Investment funds held an outright long position of 118.3mn allowances in the EU ETS at the Intercontinental Exchange (Ice) in the week ending 6 February, commitment of traders data published by the platform on Wednesday show.

UK ETS tumbles

Despite not being at the centre of political discussions, allowances under the UK ETS have seen even larger losses this week as wider uncertainty surrounding the tenure of prime minister Keir Starmer prompted some participants to close out positions in the market. The benchmark front-year contract declined by 19pc cumulatively over the past three sessions.

Similarly to the EU ETS, investment funds have built up a substantial outright long position of 22.1mn permits in the UK ETS at the Ice, posing downside risk. And price moves tend to be exaggerated in the UK ETS compared with the EU ETS because of the former market's relative lack of liquidity.