The Spanish spot index is set to deliver significantly below forward expectations in February owing to high wind generation during and following Storm Kristin, while heavy rainfall over the period has weighed heavily on March.

The Spanish spot index averaged €12.66/MWh for delivery over 1-20 February, down sharply from an average of €116.88/MWh across the same period last year. The spot is on track to average about €18.85/MWh across the full month, based on its weighted average over 1-20 February as well as the latest assessments and trades for the weekend and week 9. This is well below the February contract's expiry at €50.55/MWh.

Very high wind generation has weighed on the February spot index. As of today, wind output has averaged 11.2GW in Spain, up by about 123pc on the year and substantially higher than the 6.6GW average over the past three years. But looking forward, wind output over the remainder of February is expected to return closer to the norm, with average output of 6.9GW over the next eight days, according to data from global trade and analytics firm Kpler.

Wind output has been particularly high owing to extreme weather conditions in February, especially at the beginning of the month when Storm Kristin brought extreme conditions to Spain and Portugal.

The storm also brought exceptionally high rainfall, with hydro stocks in Spain recording three of their five highest ever week-on-week increases in the past three weeks.

Despite the strong rise in hydro stocks, this has had little impact on output so far this month, with generation essentially equal to the level over the same period last year. But the extreme rise in hydro reserves in Spain has weighed strongly on the front-month contract. Since the storm hit Spain, March has shed €13.75/MWh, and is €21.65/MWh below where the equivalent contact was at this time last year.

The record-breaking hydro stocks are particularly consequential for March, which has recorded the highest average output from the technology of any month in Spain in the past three years. Snowpack is also at record highs for the season, indicating that large volumes will continue to reach Spain's Ebro basin reservoirs when Pyrenean snowmelt begins, typically in mid-April.

Gas-fired output has dropped in February, also contributing to low spot prices in Spain. Generation from combined-cycle gas turbines has dropped by about a quarter on the year to an average of just 3.6GW. This is also down by about 30pc from the 5.1GW average for the equivalent period of February over the past three years.

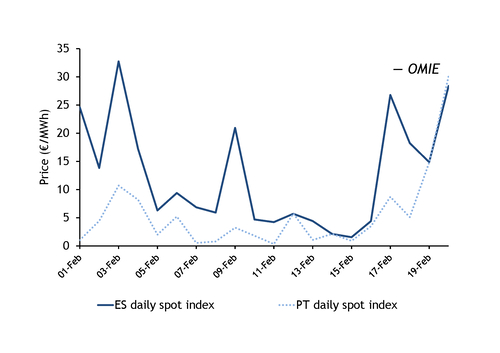

February has also been marked by a significant divergence in Spanish and Portuguese spot prices. The Portuguese spot has cleared below the Spanish almost every day so far in February, and often by a sizeable margin. On average, there has been a daily price differential of €7.31/MWh between the two spot indexes, overwhelmingly with Spain at a premium. Across the same period of 2025, the average price differential was just €0.13/MWh, with the two spot indexes clearing at parity on 16 out of 20 occasions.

Portugal has net exported to Spain across February at an average of about 580MW. This is the first month that Portugal has held a net export position to Spain since March 2024, and the first time this has occurred in February since 2021. Very high wind in Portugal so far in February — also in part owing to Storm Kristin — has supported Portuguese wind generation, which is up by about 130pc on the year and by more than 80pc compared with the three-year average.

Portugal's hydro reserves currently stand at about 3.1TWh, equivalent to 94.1pc of total capacity. This is 18.7 percentage points higher than reservoir levels at the same point last year. Generation from hydro in Portugal has been low so far in February, averaging just 2.7GW, down by about a fifth from last year. Generation is likely to have to increase in the coming weeks in order to prevent overspill, or controlled releases, as was seen in Spain last year as reservoirs neared record capacity.