18 October 2023

Rising material costs and interest rates along with a major shake-up regarding the EU's new rPVC legislation are becoming burdensome on the sector.

The European PVC industry has made significant steps to increasing recycling rates since the launch of the sustainability organisation VinylPlus just over 20 years ago. But progress in recycling is rarely easy and economic conditions and upcoming legislation will continue to challenge the sector in the future.

Construction woes

About 70pc of virgin PVC produced in Europe goes into the construction industry, European association ECVM data show, and construction applications are also the largest consumers of recycled PVC, making the current pessimism in the sector a concern for PVC recyclers.

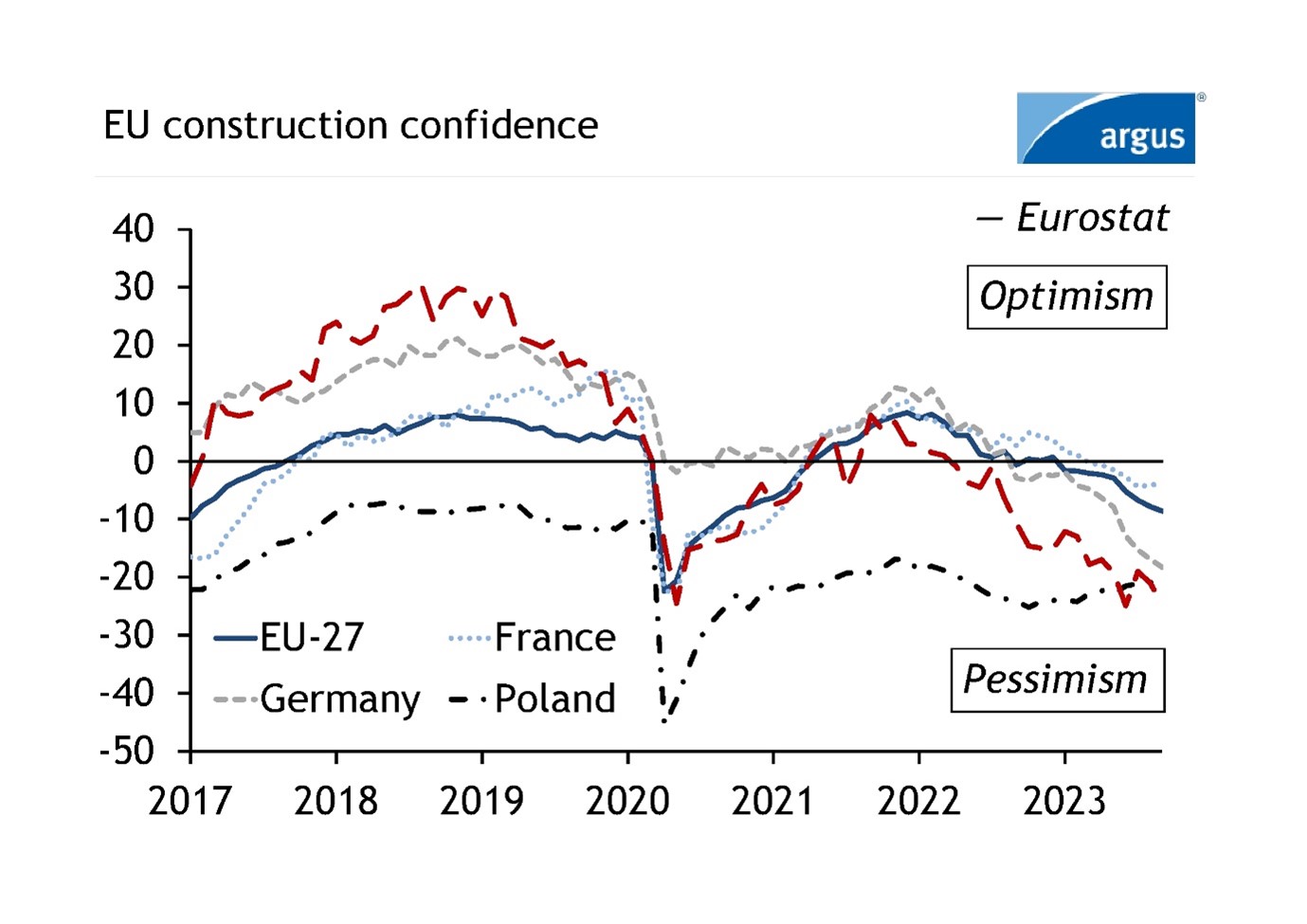

EU construction industry confidence, which rallied in 2021 and the first half of 2022, has declined steadily since and reached its lowest level since the middle of the Covid-19 pandemic, with construction firms halting new projects and delaying ongoing ones. The eurozone construction purchasing managers' index has fallen to levels that, aside from spring/summer 2020, have not been seen in a decade.

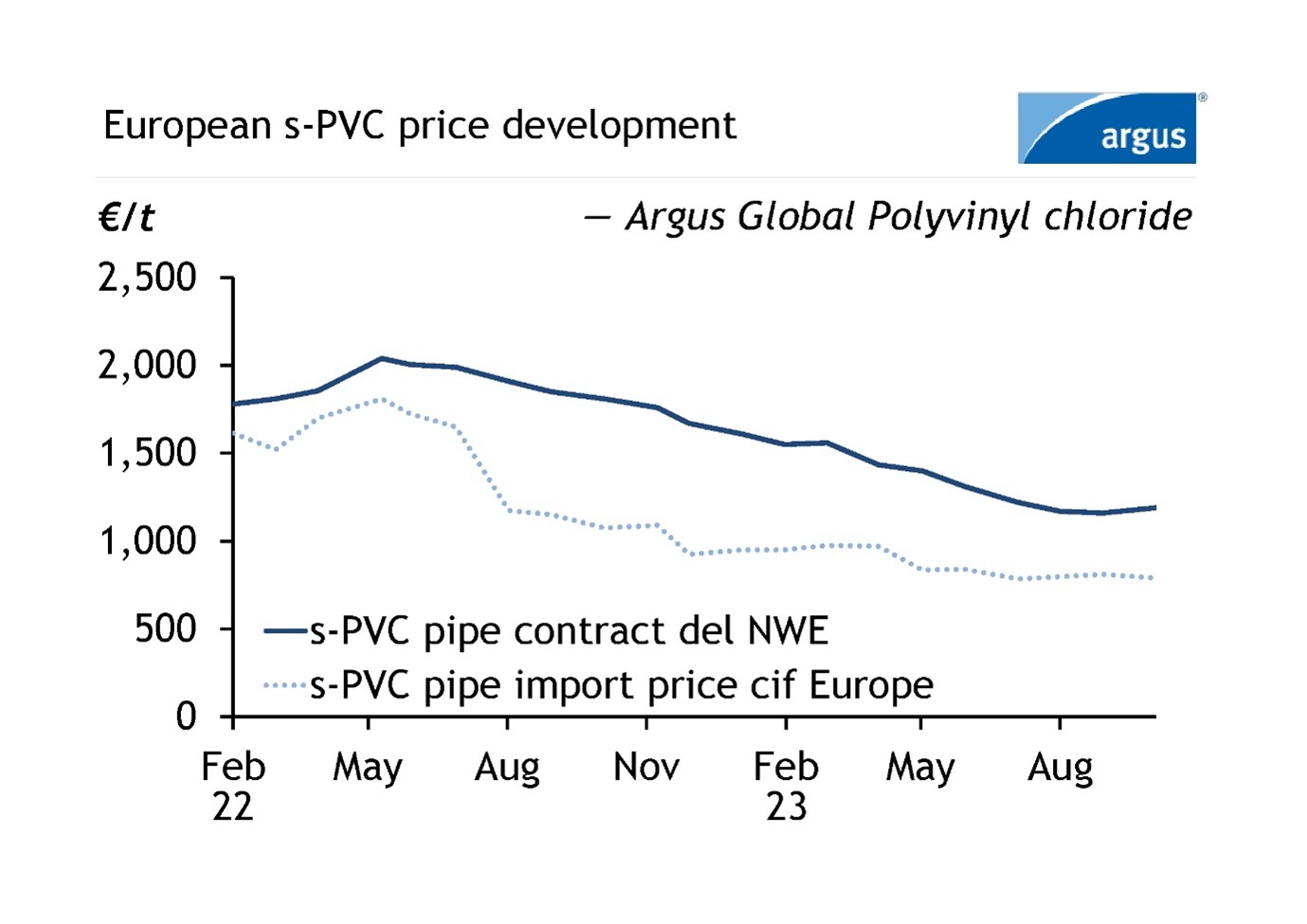

Rising material costs and interest rates weighed on the market and the lifting of Covid-19 restrictions across Europe shifted consumer spending back towards leisure and entertainment at the expense of finished goods that use PVC. It is unsurprising that recyclers see "very little demand", particularly from their customers in the pipe sector. They are also under tighter competition from virgin PVC, where prices have dropped by more than 40pc from historical highs in April 2022.

Argus' launch of rPVC prices alongside its existing coverage of the virgin PVC market will allow recyclers and buyers to track developments across the PVC industry to plan sales and purchasing strategies.

Upcoming reorganisation

The PVC recycling industry is set to undergo a significant shake-up as a result of the European Commission's new regulation addressing lead content in rPVC.

The long life of many PVC products means that articles are still entering the waste stream that predate Europe's phase-out of lead-based stabilisers. The EU ruled in May that profile, sheet and non-water pipe manufacturers can continue to use rPVC with up to 1.5pc lead content for another 10 years, as long as it is enclosed within a layer of virgin PVC. But there was a caveat — from May 2026, lead-containing rPVC from profile waste cannot be used in pipes.

The EU's intention is to prevent lead-containing rPVC from spreading between different applications. Another consequence will be the creation of a closed loop for PVC pipe waste. Pipe manufacturers currently use rPVC from pipe and profile waste and will need alternative supply.

Collection and sorting for PVC pipe waste would need to increase, European industry association Teppfa said, because "there are insufficient end-of-life PVC pipes available on the market to meet today's demand". And a price disconnect between rPVC for pipes and rPVC for profiles could develop in the EU.

Argus' rPVC assessments, covering white pellets mainly used in the profile industry and mixed-colour micronised powder that is preferred for pipe manufacturers, will allow market participants to track these developments. And we will continue to use our methodology to capture the market structure as it develops.

The data and insight used in this article comes from Argus Recycled Polymers. Request a free trial or more information here.

Author: Will Collins, Recycled Polymers Editor