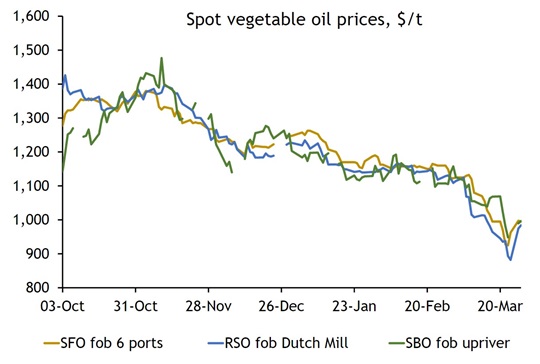

It was only a year ago when sunflower oil (SFO) truly lived up to its golden colour, costing more than double the price of Brent crude. SFO prices have almost steadily come down since March last year, with losses quickening this month, driven by looser market fundamentals, turbulence in competing vegetable oil businesses — especially rapeseed oil (RSO) — and wider macroeconomic concerns. It is still unclear whether the downward trend has ended or if prices can see further drops despite a slight rebound in SFO prices in the past few days.

SFO prices trading on a fob six ports basis fell below $1,000/t last week, largely following a massive drop in RSO prices that hit their lowest since November 2020 during bulk oilseed imports to the EU-27, with additional pressure coming from a bleak macroeconomic outlook.

The EU-27 is set up to import record volumes of rapeseed and sunflower seeds (SFS) in the 2022-23 marketing year, having already received a respective 6.19mn t and 1.98mn t of products, with Ukraine and Australia being the major suppliers. This, coupled with a near record rapeseed crop in the bloc in 2022-23, has led to an oversupply in European vegetable oil markets, heavily weighing on RSO prices.

European RSO has been mostly at a discount to SFO since December, attracting more demand from European industrial companies, after major food producing companies last year substituted SFO for RSO in their recipes because of a sharp drop in Ukrainian supplies since late-February 2022.

To absorb excess in vegetable oil supply, EU companies have ramped up SFO and RSO exports but these were still not enough to rebalance supply and demand in Europe nor to prevent prices for both products from sharp losses this month.

That said, SFO fob six ports prices rebounded sharply in the past few days, tracking gains in the wider vegetable oil complex, begging the question of whether the downward trend is already broken or if the market is just taking a breath before continuing to fall.

Spread between EU RSO and SFO fob prices

Opinions differ

Market participants have diverging views on the future of the SFO market.

European SFO prices have already bottomed out and their rebound would only continue, according to one European vegetable oil trader interviewed by Argus, owing to higher demand from food and biofuel industries, while rapeseed and SFS production are expected to remain relatively unchanged on the year in the next season. And Argentina has lost more than half of its soybean production this year because of drought, which the global vegetable oil market will feel at some point later on.

China's return to the global market should also support global demand for vegetable oils, with 2022-23 imports expected to rise by 3.5mn t on the year to replenish stocks and to satisfy a recovery in domestic consumption, according to European traders. As for India, which is now well-covered with most vegetable oils owing to a strong import pace in the past months, traders expect demand to re-emerge in April.

That said, some Indian traders are more pessimistic about the SFO price outlook, indicating that the SFO market should remain under pressure from abundant supply from the Black Sea and Europe. In addition, India is mulling a possible increase in its import duties on vegetable oils in May, which could further weigh on import prices.

Spread between EU RSO and SFO fob prices

At the same time, sellers of Ukrainian-origin SFO will try to maximise overseas sales in the coming months during uncertainty around the grain corridor's operations beyond May. The product is currently the most attractively priced commodity to ship via the corridor, given freight, demurrage and other costs, according to Indian traders.

On the other hand, SFO prices on a cif India basis fell to $950-960/t for near-term shipments in late May, almost in parity with crude palm oil and about $100/t lower than soybean oil. Similar movements in forward prices should provide support and limit the downward potential for SFO in the future, an Indian broker said.

Low SFO prices should attract some buyers from China and India, with prices expected to stabilise in a range of $850-950/t fob for Black Sea and EU origin in the near term, Sunvin Group commodity research head Anilkumar Baganitold Argus.

Author Kristin Yavorska – Market Reporter - Agriculture

This article includes data and insight from Argus’ Agriculture Service. Learn more about the Argus Agriculture package, including market intelligence, forward-looking analysis and proprietary supply/demand forecasts for the grains, oilseeds and vegoils markets.