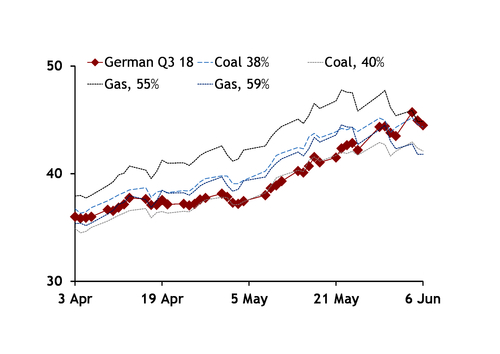

German third-quarter 2018 base-load prices have been rising in recent weeks as the market is expecting the merit order to be pushed deeper into coal and gas burning territory.

The German second-quarter 2018 contract, the then front quarter, in March had largely decoupled from firm API 2 coal swaps and NCG gas hub prices as an expected rise in hydro power generation and schedules for high nuclear availability across central west Europe had contributed to expectations that the need for German fossil-fuel generation would be limited.

Outright German coal-fired power generation did fall to 4.42TWh in May, which was the lowest level for any month so far this decade, preliminary data from German research institute Fraunhofer ISE show. Gas-fired power generation more than halved year on year to 1.41TWh in May, although power sector gas burn was lower still in May 2015 at 1.33TWh and reached a decade low for any month later that summer, in August 2015.

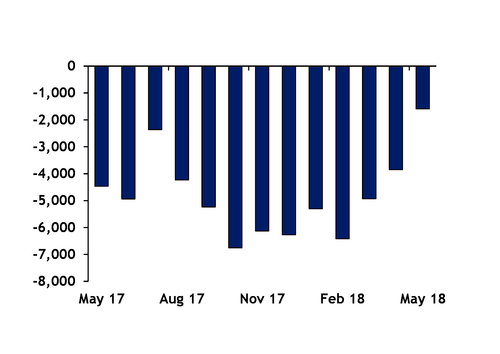

The call on German coal and gas-fired power generation fell in May even as nuclear and lignite-fired power generation was also lower on the year. Combined output from hydro, biomass wind power and solar photovoltaic (PV) installations made up 49.31pc of total power generation in Germany, which was a new all-time high. This squeezed the share of thermal output to just 50.7pc at a time when total power generation in Germany fell to just 41.35TWh, the lowest level for May since 2014. Domestic power consumption at 41.32TWh was 3.2pc higher year on year, preliminary Fraunhofer ISE figures show. But data from European transmission system operators' association Entso-e show that German commercial net exports at 1.6TWh were more than 64pc lower year on year, which helped to limit utilisation rates for coal and gas-fired units.

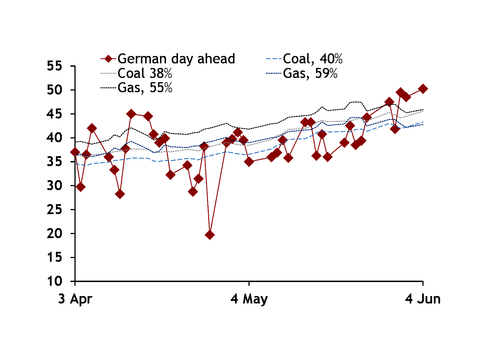

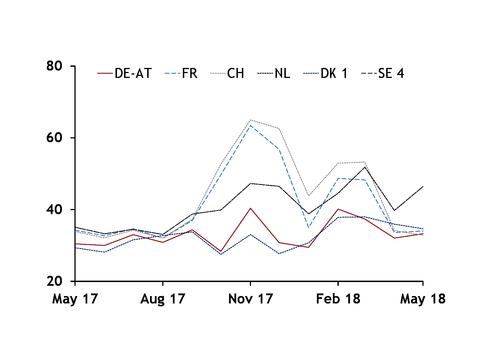

But falling demand for German exports and new record renewable energy generation, which rose largely as output from hydro power plants rose to a ten-year high, failed to weigh on average German-Austrian day-ahead auction settlements in May. The German-Austrian day-ahead settled at an average of €33.54/MWh for base load delivery on the Paris-based Epex Spot exchange, compared with €30.46/MWh in the same month a year earlier. The weighted average of hourly products in the German-Austrian intra-day market stood at €34.73/MWh, which was an increase from €31.83/MWh from May 2017. Rising costs for power sector coal and gas burn offered support to German-Austrian day-ahead and intra-day prices last month as individual hourly settlements had to step up to price levels that were sufficiently high to bring lower efficiency coal and, on less windy and sunny days, efficient gas-fired units on line, at higher start-up costs compared with these plants running base- or medium load. Average marginal costs for 46pc-efficient coal plants stood at €35.08/MWh in May, rising by around €10.50/MWh year on year, while the costs of operating a 59pc-efficient gas-fired plant rose to €41.80/MWh from €28.75/MWh a year earlier, based on Argus assessments for API 2 coal and EU ETS prompt and for NCG day-ahead prices.

The German third-quarter 2018 contract has been recovering strongly towards the end of last month and early this week to account for generally rising costs for power sector coal and gas burn as the firmer German-Austrian short-term market last month highlighted the exposure, at least in some hours, to firm European coal and gas prices, while a change in supply fundamentals in a number of markets for the remainder of this summer offered further impetus.

Hydro

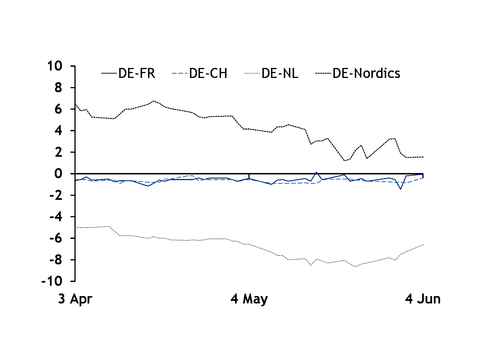

Above-average snow fall in the 2017-18 winter season and the onset of the snowmelt season in April last month propped up Swiss hydro stocks and is likely to have supported Swiss run-of-river generation. Swiss hydro stocks at the start of last week, 28 May, were 6.9 percentage points higher compared with the same period last year and reached the highest level for the period since 2009. Ample hydro power supply contributed to Switzerland switching to be a commercial net exporter to Germany — with net exports averaging 1.2GW in May — for the first time since June 2016. But snow depth near Montana, in the Swiss hydro-rich region of Valais, had fallen to 181cm as of yesterday, from 431cm at the start of this quarter, which means that inflows to reservoirs and rivers could now slow. Snow near Klosters, in the canton in Graubunden, has now almost completely melted and this compares with snow depth of 209cm on 1 April. Around 44pc of Swiss reservoir levels are located in Valais, and around 22pc in Graubunden. Snow depth on the Swiss-French border is nearing zero which could limit inflows to French reservoirs, depending on rainfall levels.

Nordic hydro stocks at the start of week 22 continued to hold a wide year-on-year surplus. But the weekly increase in Swedish reservoir levels in particular has slowed, with stocks there holding a 60pc surplus to levels a year earlier as of last week, compared with a 106pc surplus in mid-May. Germany shares an interconnector with the south Swedish SE 4 prices zone. In May, the average German-Austrian day-ahead settled at a €2.21/MWh discount over the SE 4 prices zone, compared with €0.30/MWh premium in the same month last year. And average German-Austrian prices in May settled €1.41/MWh below the DK 1 price zone with west Denmark, compared with a €0.39/MWh premium in May 2017.

Nuclear

In France, nuclear availability for June has been revised lower to an average of 45.9GW. French utility EdF had pegged nuclear availability at 49.9GW for this month at

the start of this quarter, on 2 April. Scheduled nuclear availability yesterday stood at 46.1GW for July which is 3.5GW lower than what been scheduled at the beginning of April. Swiss nuclear availability in May was near 100pc but nuclear maintenance has now started with the 1GW Gosgen reactor coming off line on 2 June. The plant is scheduled to return to service on 25 June. The 365MW Beznau 2 reactor is earmarked to be out of service on 26 June through to 9 July, while the 376MW Muhleberg reactor is to come off line for maintenance on 18 August–11 September, and the 1.2GW Leibstadt unit will be out maintenance on 17 September–13 October.

In Belgium, nuclear availability for June is now pegged at 3GW compared with 4GW at the start of this quarter. But scheduled third-quarter nuclear availability in Belgium remains largely unchanged compared with previous expectations at 4.6GW. Germany's own nuclear plant availability is scheduled to average around 8.9GW in the third quarter, which is higher than the 7.4GW average last month but slightly lower on the year because of the permanent closure of the 1.3GW Gundremmingen B reactor in December.

German wind solar

Combined wind and solar power generation in summer is statistically highest in May, based on power generation data from 2010 through to 2017. Germany has added more offshore wind capacity since last summer with a combined 5.4GW registered for the country's renewable direct marketing scheme in April through to this month, data from Germany's four transmission system operators (TSOs) show. This compares with 4.6GW-4.9GW of offshore wind capacity registered to be sold directly in the German wholesale power market in April through to September last year. All of Germany's installed offshore wind capacity is sold through the direct marketing scheme.

But even as installed offshore wind capacity has stepped higher year on year, and with Germany having added 4.9GW of onshore wind capacity since in April 2017 through to April this year, weather conditions are statically less favourable for wind power generation later in summer.

German merit order

An outlook of generally tighter central and northwest European markets have contributed to the German third-quarter 2018 power contract stepping higher to bring more coal and gas-fired power plants into profitability.

The third quarter base-load contract closed yesterday at €44.50/MWh which was around the break-even costs for 38pc-efficient coal plants at €44.59/MWh and for 55pc-efficient gas-fired units at €44.85/MWh. In mid-May, the German third quarter contract had closed at €40.10/MWh and this, was €2.10/MWh below break-even costs for 38pc efficient coal and €4.50/MWh below the break-even costs for 55pc-efficeint coal units. The NCG third-quarter 2018 contract yesterday closed at €21.97/MWh, a level at which a 59pc efficient gas unit would be competitive with a 40pc-efficient coal plant, while a 55pc-efficient gas plant could compete with a 38pc-efficient coal unit. But the coal-to-gas fuel switch range still indicates that most coal-fired units would remain at an advantage to gas plants. And given that clean spark spreads, while rising sharply in recent weeks, are positive only for gas-fired plants with an efficiency of 57-61pc, prices in the German-Austrian short-term market could remain volatile in the third quarter on days which require lower-efficiency gas units to come on line. The level of standard deviation in the German-Austrian intra-day market reached a nine-year high in May for this time of year, and so far in June stands a five-year high, partly as lower-efficiency coal and highly efficient gas plants with limited forward hedge opportunities had to recoup start up costs over fewer hours.