Demand for German greenhouse gas (GHG) quota tickets will fall next year, even though blending mandates are scheduled to rise beyond that, because the market is already acting as if a proposed ban on the carry-over of tickets into 2020 will be passed into law.

The expected drop in demand should push ticket prices down, but this may require a significant drop in prices in order to attract buyers. German blenders are likely to become more risk-averse toward the end of 2019, faced by a lack of clarity on the legislative framework and pricing beyond 2020.

The German government is pondering prohibiting the carry-over of tickets from 2019 into 2020. Consultation into the change, which would align domestic policy with the EU Renewable Energy Directive, will close on 9 November. If passed into law, this would prevent German road fuel suppliers from using surplus 2019 compliance obligation tickets towards the domestic GHG emissions reductions mandate in 2020 of 6pc.

A number of German fuel blending companies have said they intend to cut back their compliance overhang and close 2019 with little-to-no surplus tickets, in an attempt to pre-empt weak demand and limit risk exposure ahead of the expected policy change.

Surplus tickets from 2019 will be eligible for compliance for the 2021 GHG-reductions mandate, the proposal states. But with the anticipated policy restriction, surplus tickets carried into 2020 would represent stranded capital for blenders as the tickets must be unused for a year longer than usual. And the risk of depreciation in the ticket price from 2019 to 2021 further reduces appetite for holding a long position for two consecutive years without an opportunity to exit during 2020.

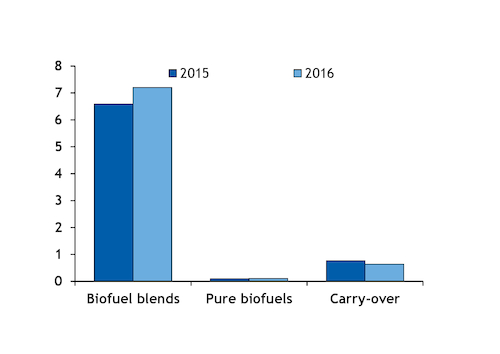

The mandated GHG savings requirements have been surpassed before (see graph), according to the German customs office in Cottbus. In 2015 a surplus of 636,000t CO2e was carried into 2016, which in turn ended with a surplus of more than 1mn t CO2e. Total quota demand was around 7.5mn t CO2e in 2015 and close to 8mn t CO2e in 2016.

The German GHG reductions mandate was pegged at 3.5pc in 2015-16. This increased to 4pc in 2017. Road-fuel consumption also increased in 2017 so this should have raised ticket demand, although Cottbus is yet to publish tickets data for 2017.

Exacerbating the supply-side surplus is the inclusion of local LPG and CNG suppliers in the ticket market from 2018. Ticket supply from these sectors — yet to be officially quantified — could offset any lost carry-over in 2019.

The weaker outlook has been counterbalanced lately, with ticket demand and prices supported by logistical disruptions for blenders. Low water levels on the Rhine have inhibited the flow of fuels barges into Germany. Fuel suppliers in the Amsterdam-Rotterdam-Antwerp (ARA) region have struggled to meet German demand through the rail network, as it lacks the capacity to replace the barge system.

This has encouraged these suppliers to eliminate the biofuels content of diesel parcels sent by train to blenders in Germany that, if possible, buy biodiesel from local inland producers — though these producers are also constrained by the Rhine levels as feedstock supply is disrupted — or instead obtain tickets to supplement their quota obligation.

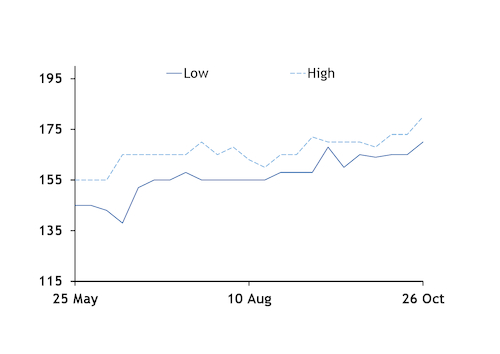

Demand for the surplus ticket supply offered by the 2017 carry-over, as well as new volumes in 2018 from LPG and CNG suppliers, has increased accordingly. Last week the ticket market was heard at €170-180/t CO2e, compared with €165-173/t CO2e the week before. Argus began assessing tickets for the 2018 compliance year, but tickets for 2017 were heard offered over €200/t CO2e during the first quarter of this year ahead of the 15 April deadline.